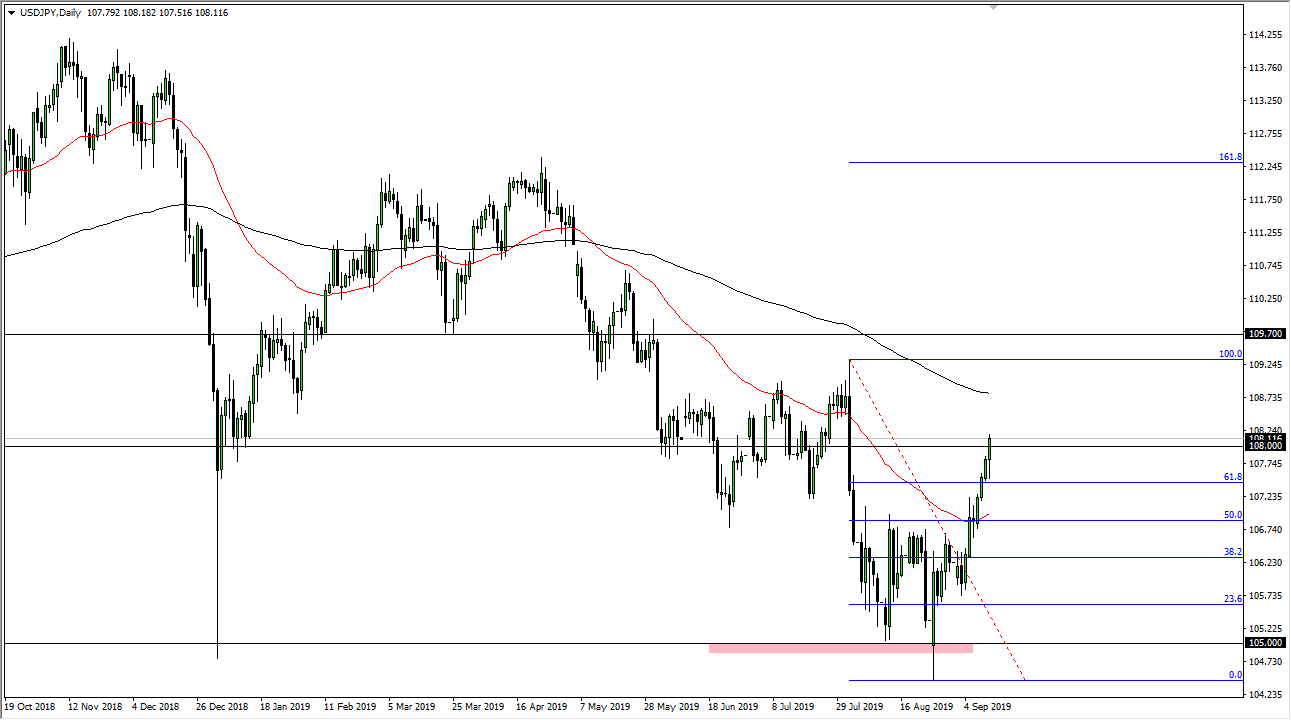

The US dollar has initially pulled back during the trading session on Thursday, reaching down towards the bottom of the Wednesday session, before bouncing and breaking above the ¥108 level. At this point, now that we are above there it’s likely that we are going to continue to go higher, perhaps trying to wipe out the massive negative candle that started the huge move to the downside. At this point, it’s very likely that the pullback should have an opportunity to offer value for people who want to go long of this market.

Beyond that, you should keep in mind that there are possibilities that the stock markets in America will continue to grind higher and that is very good for the risk appetite of this pair. The Japanese yen is considered to be a major “safety currency”, so therefore if we get some type of breakdown in the stock markets or other risk appetite assets, then the market will probably fall from here and then go down to the Japanese yen level.

This market has been a bit parabolic though, so I do think that a pullback is probably needed. The S&P 500 is starting to test the all-time highs again, and I don’t know that it can break above there without some type of pullback that gives us an opportunity to build momentum. At this point, if we do take a fresh, new high in the S&P 500, the market is likely that this pair will continue to reach towards the 200 day EMA above. If the S&P 500 rolls over then I think we go looking towards the 50 day EMA below which happens to match up quite nicely with the previous resistance barrier. At this point, I think this is a simple relief rally and it should be thought of as such. However, if we suddenly enter a major “risk on” attitude overall, then we will see this market rally. The biggest culprit of that possibly happening would of course be the US/China trade relations being solved. I doubt that happens but if we get a lot of forward progress that should help this pair continue to pick up momentum and value. Looking at this chart, the one thing you can probably count on in this pair is that we are going to get a lot of volatility and choppiness going forward.