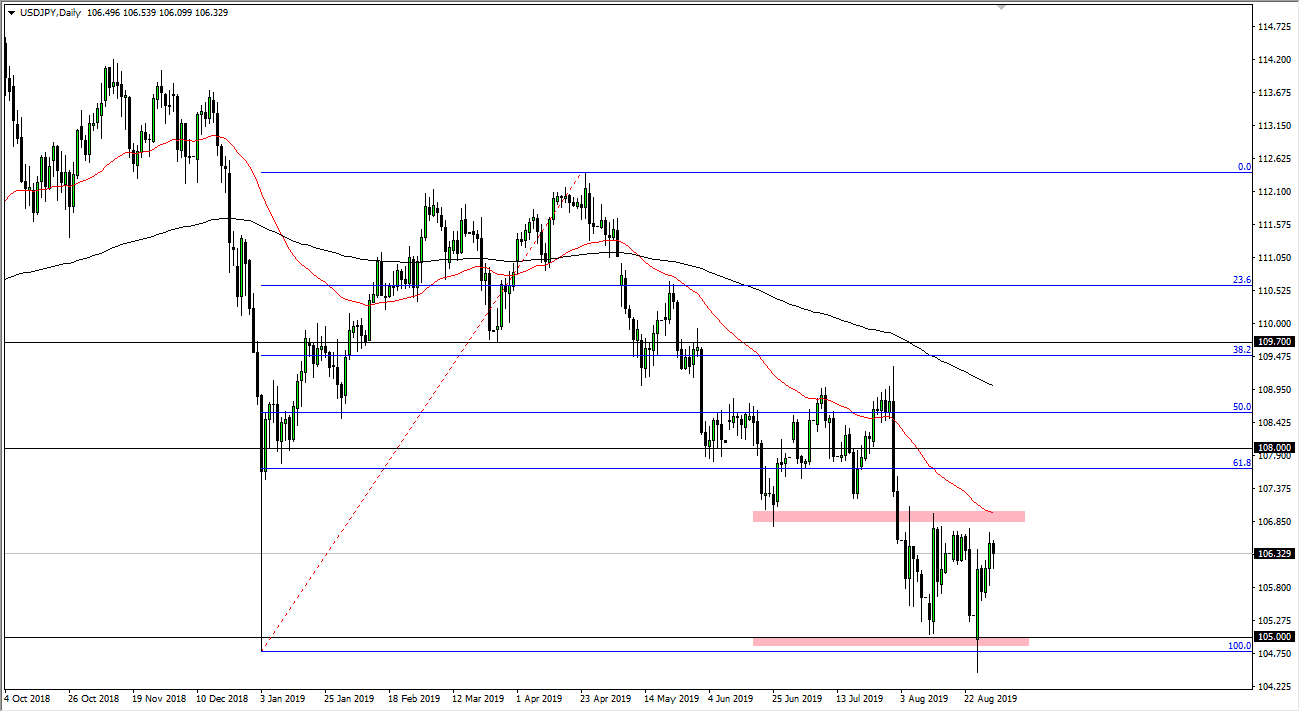

The US dollar has been back and forth against the Japanese yen for some time now, and I think that will continue to be the case as we head towards Labor Day in the United States on Monday. I think at this point the market will be very thin so I’m not expecting much during the day. Having said that, there are a whole list of things that could happen to change the entire marketplace over the weekend, with the Chinese and American tariffs being at the forefront of the possibilities. At this point in time though, it looks as if the 50 day EMA above at the ¥107 level should cause quite a bit of resistance.

I like the idea of the market going back and forth and giving us an opportunity to play this market from a short-term standpoint, perhaps trying to grind down towards the ¥105 level. That level is a massive support level, so I think that if we were to break down below there, it would be a complete collapse in the risk appetite of the world currency markets. That would not be a huge surprise, I think at this point we are probably going to continue to see a lot of volatility, especially considering that we are essentially one Tweet away from chaos.

I think overall we will continue to see a lot of range bound trading but I think Monday is probably going to be more lackluster than anything, save fireworks over the weekend. Remember, Labor Day is a huge holiday in the United States, so it will of course have a massive influence on what happens next. I think that ultimately this is a market that continues to find more sellers than buyers, and at this point I would be a bit surprised if we broke above the ¥107 level on a daily chart. If we do, then I think the market goes to the ¥108 level next. To the downside, if we were to break down below that ¥105 level, then the market very likely will go down to the ¥102.50 level, possibly even the ¥100 level where I would anticipate a lot of attention paid by the Bank of Japan, possibly prompting intervention and at the very least prompting a verbal intervention by central bank members in Tokyo as the strength in the Japanese yen will continue to cause issues.