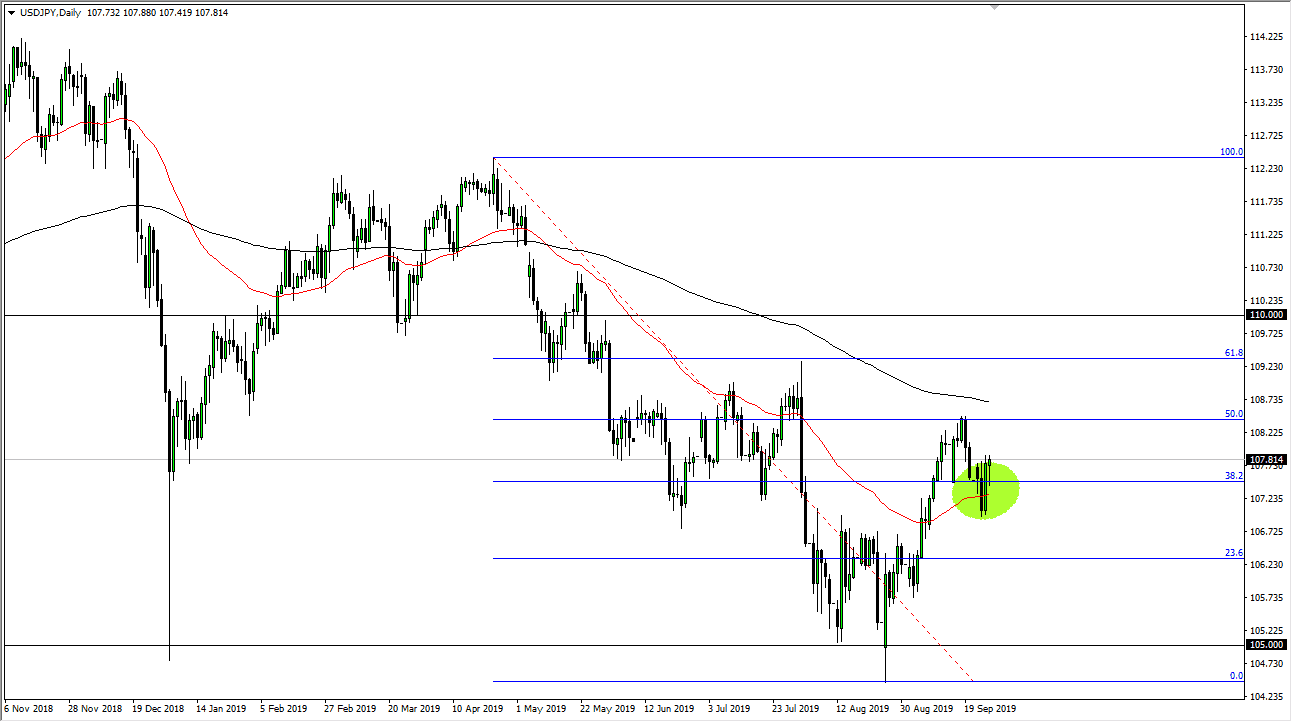

The US dollar initially fell during the trading session on Thursday but then turned around to show signs of life again. At this point, the market looks as if it is trying to go towards the 50% Fibonacci retracement level above, which is where we pull back from. Just above there, the 200 day EMA sits, so it’s very likely that we would see selling there as well. This is a pair that is highly sensitive to risk appetite so that will have to be monitored in order to get a feel as to where the market is going to go next.

It has been a very nice consolidation and recovery over the last couple of days, and it should be pointed out that the Tuesday and Wednesday candle stick if combined makes a bit of a hammer, which is followed by a hammer on the Thursday session, suggesting that perhaps the 50 day EMA is going to try to hold as support. However, the 200 day EMA will be tough to crack above, and we would probably need to see some really good “risk on” type of situation to get that going for any significant amount of time.

The 61.8% Fibonacci retracement level is where we had seen the market break down significantly previously, so I think that’s going to be difficult to get above as well. I think there are enough things out there that could work against the value of the pair given enough time that it’s probably a short-term pop just waiting to happen, which of course is waiting for selling pressure after that. The alternate scenario of course is that we turn around and break down below the lows of the Wednesday session, and then it’s likely we go down to the ¥106.50 level, and then possibly even the ¥105 level after that. Either way, this is going to be a very choppy and destructive type of market for those who were over levered. If you can keep your leverage low, then it’s very likely you will be able to navigate this pair, because it’s going to be very easy to get sudden jolts in one direction or the other based upon a Tweet, headline, or other such attention seeking nonsense that we seem to get out of the political class worldwide these days.