The US dollar has gone back and forth during the trading session on Tuesday as we continue to find some type of clarity when it comes to growth and the US/China trade situation. Remember, the market is very sensitive to risk appetite in general, so as risk appetite accelerates, then it should in theory drive money away from the Japanese yen. Alternately, if the markets are struggling with risk appetite, then it’s likely that we pull back to go looking towards the Japanese yen as it is considered to be the “safest currency.”

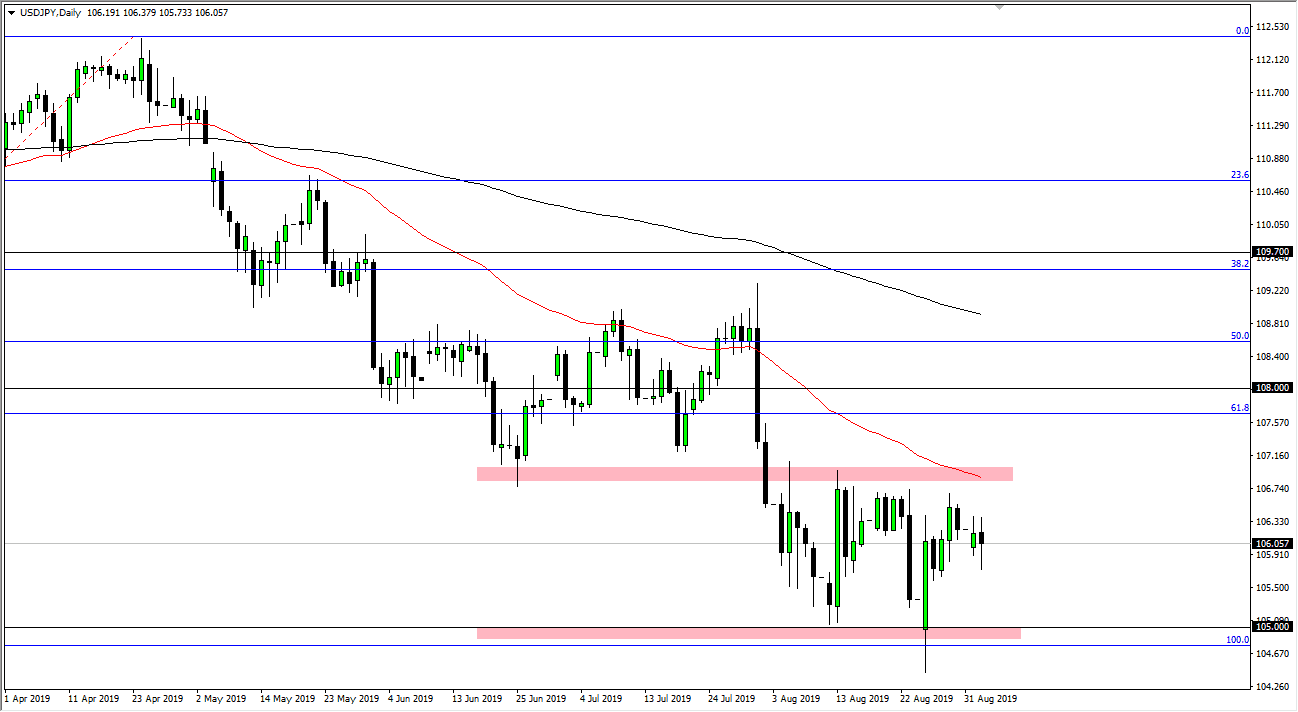

All things being equal, we are essentially in the middle of the consolidation area that I have been paying attention to, with the ¥107 level above being massive resistance, and then of course the ¥105 level underneath being support. Ultimately, this is a market that will probably continue to go back and forth just like we have seen the S&P 500 do, as the market has been trying to digest a lot of different headlines. All things being equal though, the last couple of months have looked very similar in both this market and the S&P 500, so paying attention to both of these will be important.

If the ¥107 level gets broken to the upside, slicing through the 50 day EMA, then the market could go to the ¥108 level. Alternately, if we were to break down below the ¥105 level, then we could break down even further and go looking towards the ¥102.50 level, followed by the ¥100 level after that. The ¥100 level of course will attract a lot of attention as it is a large, round, psychologically significant figure, and of course will attract the Bank of Japan. That being said, it’s very unlikely to see this happen between now and the jobs number on Friday, so with that being the case it’s likely that we simply get a lot of back-and-forth trading, and therefore range bound short-term strategies probably continue to work between the two major levels. I believe that the next couple of days will continue to be attracted to the ¥106 level as “fair value”, until we can get the jobs number that would bring in a flood of new volume into a market that has been suffering at the hands of the quiet summer trading season for several weeks now.