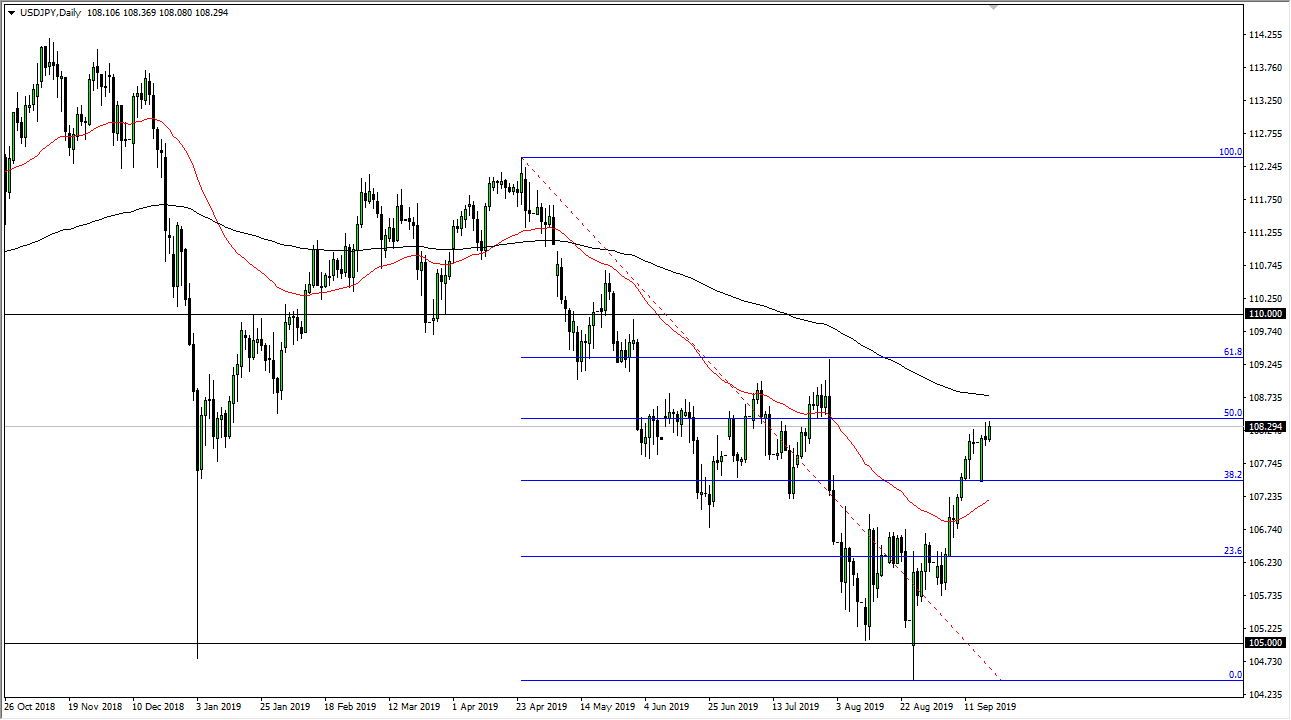

The US dollar has rallied again during the trading session on Wednesday, as the Federal Reserve was a little less dovish than people had anticipated. This isn’t necessarily the scene of a strengthening risk appetite, which is one of the things that could send this market. The 50% Fibonacci retracement level is offering a bit of resistance, so it’s possible that we could see selling given enough time. Signs of exhaustion will be taken advantage of, especially near the 200 day EMA.

Signs of failure should send this market back down, once the stock markets complain and throw a tantrum about the Federal Reserve not stepping on the gas when it comes to the economy. If that’s going to be the case, then this pair will certainly fall. When it does it will start looking towards the ¥107 level, an area that should cause a certain amount of support as it was previous resistance.

The alternate scenario of course would be to break above the 61.8% Fibonacci retracement level, perhaps reaching towards the ¥110 level. A break above there could send this market much higher, perhaps towards the 100% Fibonacci retracement level which is closer to the ¥112.50 level. That doesn’t seem as likely though, because we have seen so much in the way of negativity in this market, mainly because the world continues to offer a lot of “risk off” type of situations, so it does seem like it’s only a matter of time before the Japanese yen would be being picked up.

The breakdown candle stick that we are approaching the top of course would be very crucial, so we need to see whether or not the market rolls over. At the first signs of serious exhaustion I would be a seller. At this point, a daily close above that 200 day EMA has the entire marketplace rethinking the entire situation. All things been equal though, keep in mind that this market is very sensitive to risk appetite but in the short term it looks like it is trying to rally due to the fact that the US dollar is strengthening against most currencies. That being the case, the market is very likely to be a bit erratic, but eventually the Japanese yen will probably pick up quite a bit of interest as well. Keep your position size small and be patient.