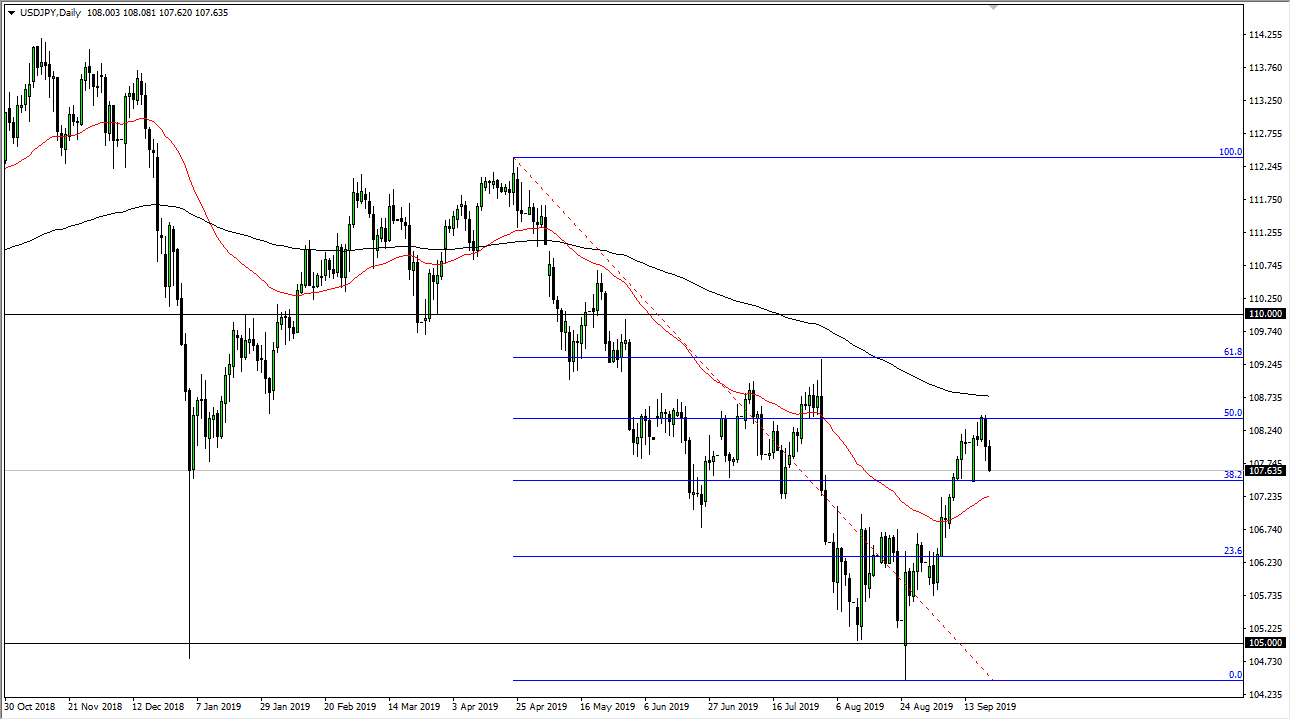

The US dollar has rolled over again against the Japanese yen during the Friday trading session as concerns around the world continue to drive money back towards the Japanese yen. We have recently tested the 200 day EMA but it is clear that we have failed there. With that being the case it makes sense that the market would pull back from that level, not only due to the 200 day EMA, but the fact that the 50% Fibonacci retracement level was sitting right there as well.

As a general rule, I see the 50% Fibonacci retracement level offering this kind of “perfect resistance” as a very negative sign and it seems as if the pair will continue to drive lower, perhaps reaching down towards the lows again, although it will probably take some time to get there. Keep in mind that this pair is highly sensitive to risk appetite and let’s be honest here: there is plenty of trouble out there just waiting to happen. With that being the case I believe that the market will go looking towards the bottom again, but it may take several weeks to get there. Beyond all of that, the recent rally has been a bit parabolic, so it makes sense that we had to give back some of it anyway.

That pullback could send this market towards the ¥107 level, which is an area that will attract a lot of attention because it is a large figure, but more importantly it’s an area that we had seen significant resistance at previously. That dictates that there should be a certain amount of “market memory” in that area, which will show itself as support. Breaking below there then it opens of course the idea of going down to the ¥105 level again which will again attract a lot of attention.

There are a lot of geopolitical and economic concerns out there, so it does make sense that this pair continues to go lower. With that being said, I don’t necessarily have an interest in trying to buy this market anyway. It will be more of a grind lower in a choppy presentation of momentum, but it should not be forgot that we are closing towards the very bottom of the session, which normally lends itself to see a significant amount of follow-through as it shows real conviction to the downside.