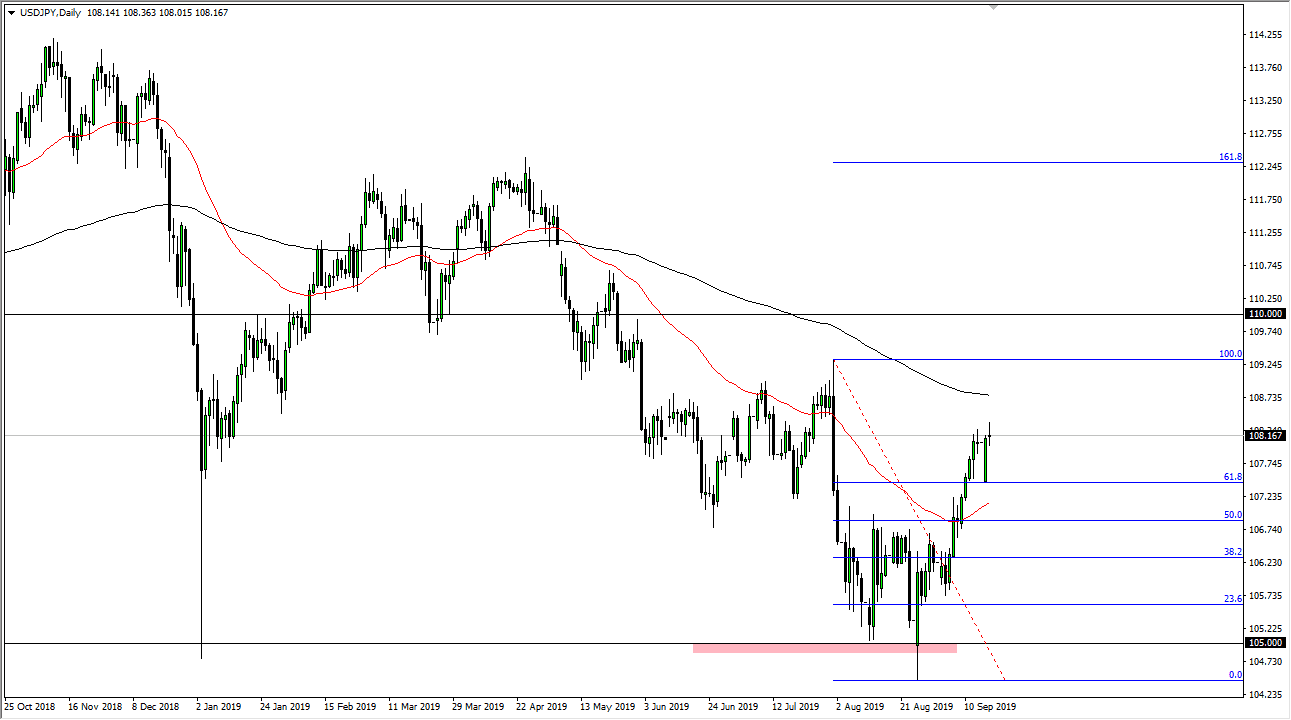

The US dollar went back and forth during the trading session on Tuesday, as we are hanging about the ¥108 level. That’s an area that should continue to be interesting, because we have filled the gap from the opening of the week, and now we are just sitting there waiting to see what happens next, as the Federal Reserve has an interest rate decision coming, and of course the press conference as well. This being the case, the market is likely to have a massive move rather soon, perhaps shortly after the press conference.

The Federal Reserve is likely to cut rates, so in theory that could boost the stock markets and that could in theory boots this pair. However, the 200 day EMA above is resistance as well, closer to the ¥109 level. Any signs of exhaustion in that area probably sends this market back down, but if we do break above the 200 day EMA it’s possible that the market could go towards the ¥110 level.

To the downside, I believe that the market could drop down to the ¥107 level. The market could fall if the US dollar strengthens in general, due to the Federal Reserve being less dovish than a lot of people had wished. With that being the case it’s very likely that we will see market participants push lower. I think at this point it’s very likely that the market will continue to be choppy and noisy, but all things being equal we should have a significant move by the end of the trading session. In fact, it’s probably best to trade this market after the close on Wednesday, as it gives us an opportunity to pull some type of scenario where we can figure out the longer-term trend. This market has been a bit parabolic as of late, so it’s possible that we could have a bit of a hesitation before we take off in one direction or the other. The daily close will be crucial, so at this point I will be watching the market and reporting back to you at the end of the trading session on Wednesday to read as to where we go next. Remember that this pair is highly sensitive to risk appetite, and it seems like there are a lot of potential pitfalls out there when it comes to trading.