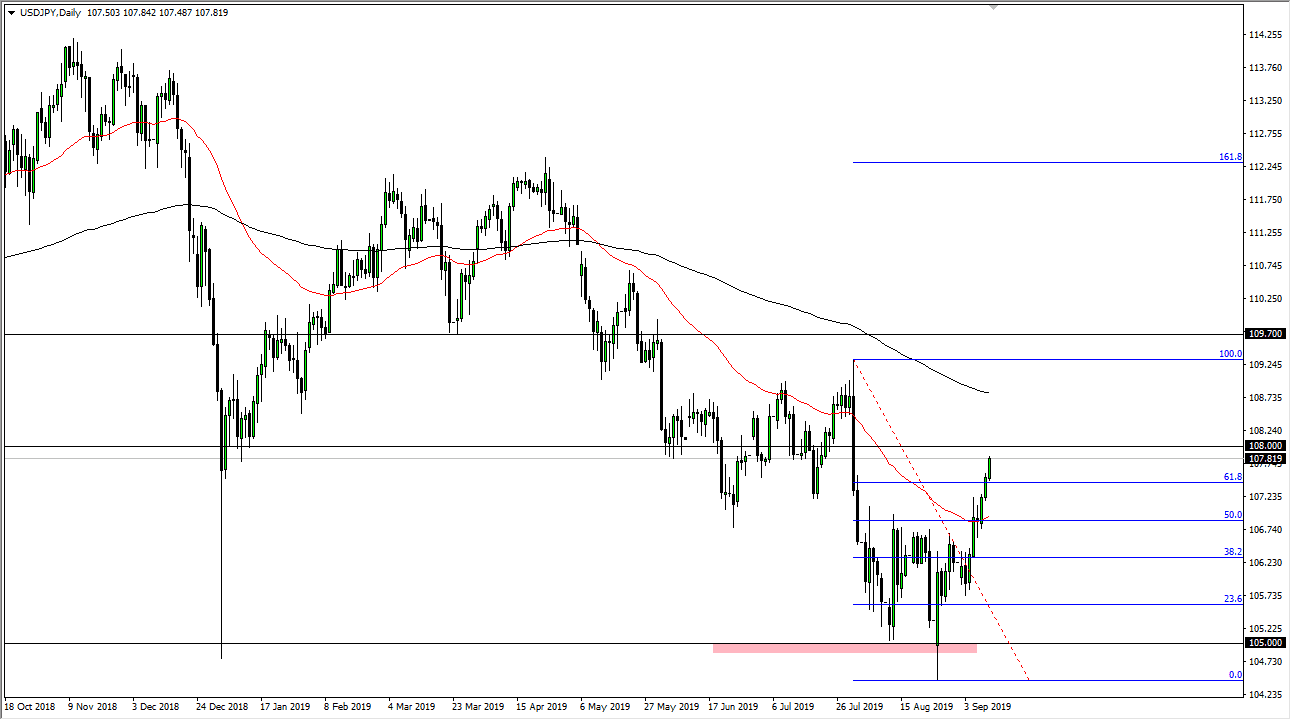

The US dollar rallied again during the trading session on Wednesday, reaching towards the ¥108 level. At this point, it’s probably only a matter before we break above that level, as we are attracted to it. That being said, one thing that you should pay attention to is that the 61.8% Fibonacci retracement level has been violated, so that typically means that we will go looking towards the 100% Fibonacci retracement level. That’s essentially why I am suggesting that we could go as high as the ¥109 level above. This is a market that is going to move with risk appetite and it should be noted that quite often there is a relatively high correlation to the S&P 500.

Late in the day on Wednesday, the S&P 500 touched the 3000 level in the futures market again, and that suggests that we are going to go higher over the longer-term. However, I would caution that it doesn’t mean we will just slice rate through it, and as I record this video I am watching the order flow chop around quite drastically. I do think we go higher, but that doesn’t mean that we go straight up in the air.

I think that what we are looking at is a scenario where the easy money has already been made, but it’s difficult to imagine a scenario where we shoot straight up in the air unless of course we get good news coming out of China. After all, the US/China trade talks are a major driver of risk appetite, which this pair is highly sensitive to. Ultimately, the 200 day EMA is starting to show itself right around the ¥109 level, so I don’t know if we make it all the way to the level, but clearly I think we are going to go looking towards the moving average.

If we were to clear the 100% Fibonacci retracement level, we could be looking at a major trend reversal but I think we need to see fundamentals changed and although things aren’t as bad as once feared, the reality is that we are still looking at an environment that is fraught with risk. I’m cautiously optimistic for the next couple of days but wouldn’t expect much as far as distance is concerned. If I was to take a “risk on” trade, it may be selling the Japanese yen against other currencies.