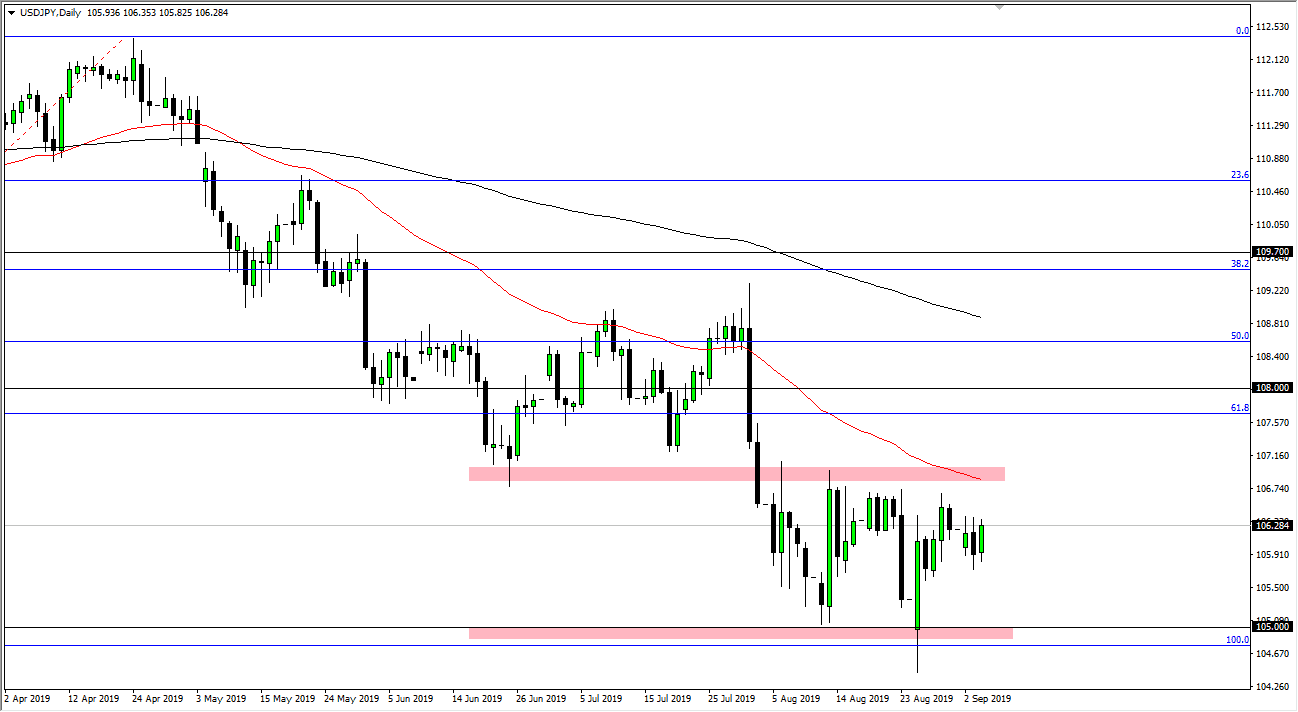

The US dollar has rallied slightly during the trading session on Wednesday but has stayed within the relatively tight range that we had been in for some time. That being the case it’s likely that the market is going to stay within consolidation and therefore it’s not worth fighting at this point. Add to the fact that the jobs figure comes out on Friday, and then you have a recipe for sitting still and doing very little. With that, I think that we are more than likely going to have to employee short-term range bound systems and take advantage of the obvious support and resistance that comes into play in this area.

As far as resistance is concerned the ¥107 level is rather resistive. I think rallies at this point will continue to run into a significant amount of pressure. That pressure for me will be very difficult to break above, especially considering that the 50 day EMA is sitting right there as well. With that, I think it’s only a matter time before we sell off on rallies, unless of course we get a sudden huge “risk on” type of situation as this pair is so sensitive to global risk appetite.

That being said, the ¥105 level underneath continues to be massive support level and it’s going to be difficult for this market to break down through there but if it were to do so it would be extraordinarily negative. I believe at this point it’s likely that the market breaking through that level unwinds down to the ¥102.50 level, possibly even the ¥100 level. In that scenario I think that would probably accompany something rather nasty in the markets, perhaps some type of massive selloff in the stock market or a shock jobs report this Friday.

I think at this point it’s likely that we simply go back and forth in the short term, so I think it’s probably best to go looking for a decent intraday set up that nets 10 or 12 pips, and simply rinse and repeat. This is a market that is winding itself up for a bigger move but that won’t come without some type of shock headline or at the very least that jobs report that the entire world is now waiting on. Expect choppy and short-term trading between now and 8:30 AM Friday morning in New York.