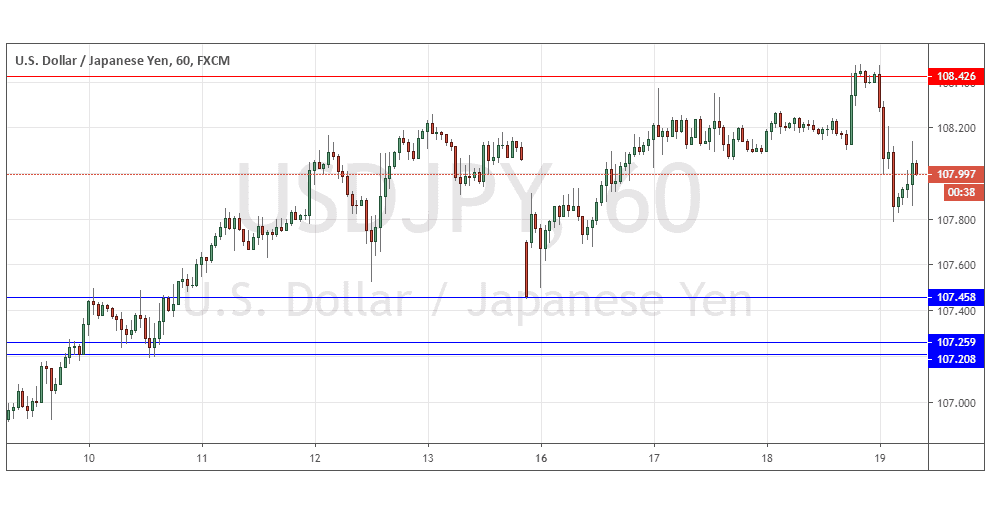

USDJPY: Strong resistance at 108.43 holds

Yesterday’s signals were not triggered, as the bearish price action took place a little way above the resistance level at 108.43.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be taken between 8am New York time Thursday and 5pm Tokyo time Friday.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 108.43, 108.71, or 109.00.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 107.46, 107.26, or 107.21.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that this pair was likely to react sharply to the FOMC releases due later. I saw the best potential here as a spike up to a key resistance level followed by a fast, bearish reversal short trade entry, the closer to 109.00 the better, following the FOMC releases.

This was a good call as although there was no post-FOMC spike, the price moved down quite sharply from the 108.43 area. The move is now stabilizing, and we have the same broad technical picture: weakly bullish, but bearish from the zone between 108.43 to about 109.00.

I would keep looking for short trades from areas above 108.43 as the medium-term upwards trend still seems to be valid, but not strong enough to break above this pivotal zone of long-term resistance.

I would be happy to take a bearish bias later on this currency pair following any bearish reversal at a key resistance level. There is nothing of high importance due today concerning the JPY. Regarding the USD, there will be a release of Philly Fed Manufacturing Index data at 1:30pm London time.

There is nothing of high importance due today concerning the JPY. Regarding the USD, there will be a release of Philly Fed Manufacturing Index data at 1:30pm London time.