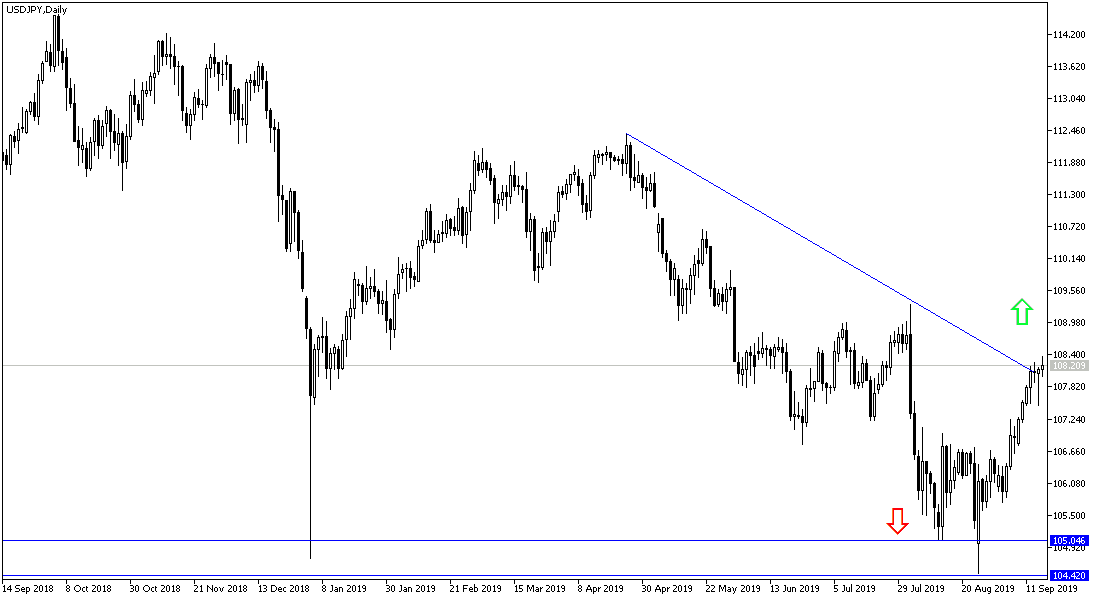

Investors ignored safe havens despite the situation in the Middle East, which portends a war threatening the world's most important oil region. Therefore, USD / JPY continued to correct upwards to 108.36 resistance at the time of writing, its highest in six weeks. All US dollar pairs will be on hold until the US central bank announces its monetary policy decisions on Wednesday amid strong expectations that the central bank will cut interest rates by a quarter point to counter the risks to the US economy. If the bank disappoints the expectations, the US dollar may remain strong. At the same time, the return of global trade and geopolitical tensions will be a catalyst for the Japanese yen to return to its gains as it is one of the most important safe havens.

On the level of world trade war. The situation with Japan is different, with reports suggesting that the US and Japan may sign a joint statement exempting Japan from any US tariffs or duties on imported cars. It is still believed that Trump and Abe are on track to sign a trade agreement next week on the sidelines of the UN General Assembly summit. Japan is expected to grant the United States similar terms on agriculture, which was offered by Japan to others through a trans-Pacific partnership and a free trade agreement with the EU.

According to the technical analysis of the pair: A steady upward momentum for the USD / JPY performance for the second consecutive week, and it is expected to confirm the strength of this new trend if it succeeds in testing the 110.00 psychological resistance level. The current bullish momentum may be negatively affected if the pair moves towards support levels 107.85 and 107.00 respectively. We may see movement in a limited range until the monetary policies from the Federal Reserve and the Bank of Japan are announced.

On the economic data front: Today's economic calendar has no important Japanese economic data. From the US, industrial production, capacity utilization rate and NAHB housing index will be released.