After four bearish sessions, as the USD / JPY failed to break the 108.47 resistance last week, it was normal for the bears to dominate the pair's performance with a sell-off towards the 106.95 support. With the return of confidence in the dollar, the pair started to rise towards the 107.88 resistance during yesterday's session. Keep in mind that the persistence of global trade and geopolitical tensions will continue to be a catalyst for investors to hold on to safe havens, notably the Japanese yen. As expected, the United States and Japan reached a trade agreement on the sidelines of the UN General Assembly summit. The first phase will be worth 40 billion dollars. In contrast, a similar deal with China remains elusive as financial markets and investors doubt that the current round of talks between the world's two largest economies will succeed in reaching an agreement, which means renewed retaliatory measures.

Investors abandoned safe havens after US President Trump made the remarks on the sidelines of the UN General Assembly summit, saying that the trade agreement with China is currently closer than ever. At the same time, he signed a wide-ranging trade agreement with Japan. This contributed to strong gains in US stock indices and strengthened the US dollar. Trump faces political crisis ahead of US elections in 2020. He may be held accountable or isolated if convicted.

For economic news. The US Commerce Department released a report showing that US new home sales rebounded strongly in August after a sharp decline the previous month. New home sales rose 7.1 percent to an annual rate of 713,000 homes in August after falling 8.6 percent to an average of 666,000 in July. Economists had expected new home sales to jump 3.9 percent to 660,000 from the 635,000 reported last month.

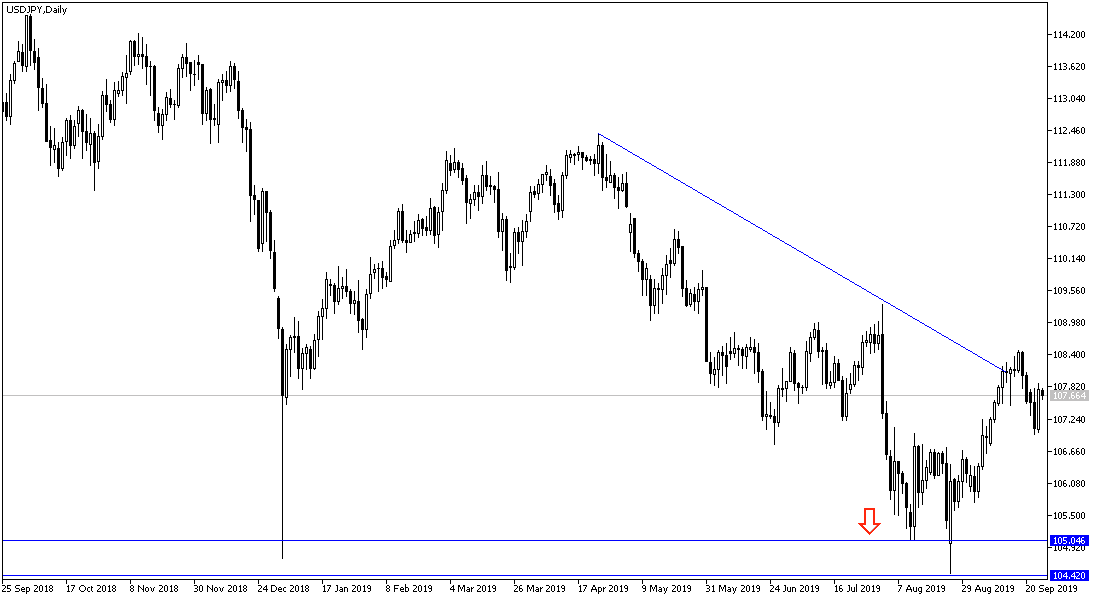

According to the technical analysis of the pair: The return of the stability of USD/JPY above the 108.00 resistance will stimulate the upward correction again, and in the event of a failure to overcome that level, we will have new selling deals on the pair, where the strength of the long-term downtrend will be confirmed. We still confirm that the move towards the 110.00 psychological resistance is the key to the bullishness, otherwise the pair will remain bearish again. Currently the most important support levels are 107.45, 106.80 and 105.90 respectively.

On the economic data front: The economic calendar will focus on the US data, most notably GDP growth, jobless claims, pending home sales, and comments by Federal Reserve Governor Jerome Powell.