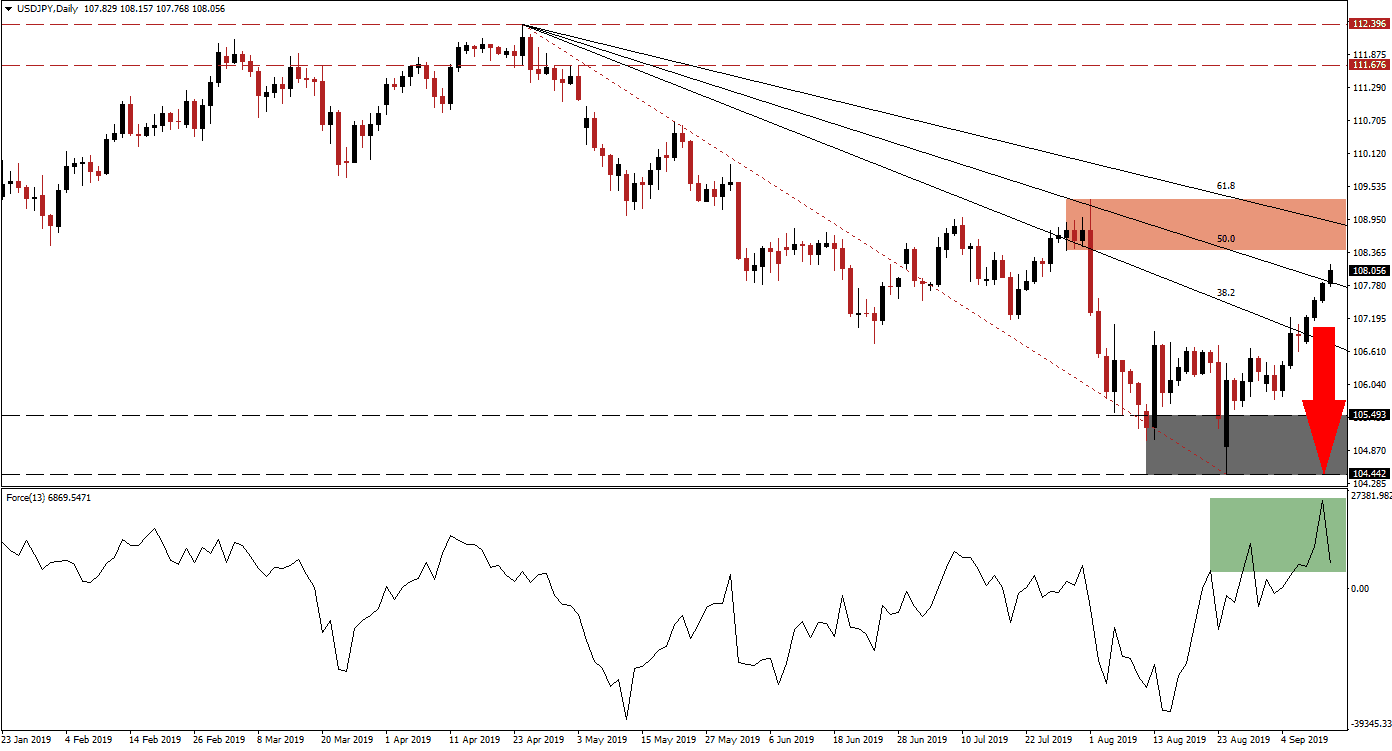

The Japanese Yen, a safe haven asset, has been under selling pressure over the past two trading weeks as forex traders started to rotate out of risk-off assets. In addition, the Bank of Japan has warned market participants that it will not allow the Japanese currency to strengthen out of control and that interventions should be accounted for. The USD/JPY accelerated to the upside after recording an intra-day low of 104.442 and bullish momentum resulted in a breakout above its support zone. Positive developments in the US-China trade war, such as the exemption of certain US goods from tariffs by China and the delay on Chinese tariffs by the US, have further increased the risk-on sentiment. This resulted in more selling pressure in the Japanese Yen and lifted the USD/JPY above its 38.2 as well as 50.0 Fibonacci Retracement Fan Resistance Level.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, started to flash an early warning signal that the uptrend in this currency pair could be nearing its end. As the USD/JPY extended its gains, the Force Index started to retreat from its high. This is marked by the green rectangle in the chart. This coincides with price action approaching the 61.8 Fibonacci Retracement Fan Resistance Level as well as another resistance zone, marked by the red rectangle, which is likely to pressure the USD/JPY. The decrease in the Force Index suggests that bullish momentum won’t be strong enough to pressure for a breakout and continuation of the current rally. The resistance zone to monitor is located between 108.413 and its previous intra-day high of 109.307.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

An extended contraction in the Force Index below the 0 center line is further expected to invite new net sell orders in the USD/JPY. The loss in bullish momentum as price action is approaching the resistance zone, coupled with the strong rally over the past two weeks which spanned roughly 400 pips, makes this currency pair vulnerable to a price action reversal. This can be partially attributed to profit taking. Economic data should also be carefully monitored as it could provide the trigger for the next move in either direction. Japanese data released this morning showed further weakness in machine orders for July, but at a smaller than expected pace, while they increased on a year-over-year basis.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

Forex traders should be prepared for a sell-off in the USD/JPY as the 61.8 Fibonacci Retracement Fan Resistance Level is bringing plenty of resistance together with the resistance zone. While current US-China trade war commentary has been more positive, it is unlikely that talks will yield an end to the trade war as differences and mistrust remain elevated. A correction down to the 104.442 to 105.493 support zone, which is marked by the grey rectangle, is expected to unfold as the Force Index extends its move to the downside.

What is a Support Zone?

A support zone is a price range where bearish momentum is receding and bullish momentum is advancing. They can identify areas where price action has a chance to reverse to the upside and a support zone offers a more reliable technical snapshot than a single price point such as an intra-day low.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 108.100

Take Profit @ 104.750

Stop Loss @ 109.400

Downside Potential: 335 pips

Upside Risk: 130 pips

Risk/Reward Ratio: 2.58

The breakdown scenario remains the dominant outcome for the USD/JPY given the technical breakdown in price action and the rise in bearish indicators. While the USD/JPY has limited room to the upside, until it will enter its resistance zone and the gap to the 61.8 Fibonacci Retracement Fan Resistance Level will narrow, the loss in bullish momentum may prevent this currency pair to push much further to the upside. A breakout above the twin resistance level is not expected, unless a fundamental event can catapult price action higher. Next week’s US Fed meeting where another 25 basis point interest rate cut is expected further limits upside potential.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

USD/JPY Technical Trading Set-Up - Limited Breakout Potential

Long Entry @ 109.500

Take Profit @ 110.650

Stop Loss @ 108.950

Upside Potential: 115 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 2.09