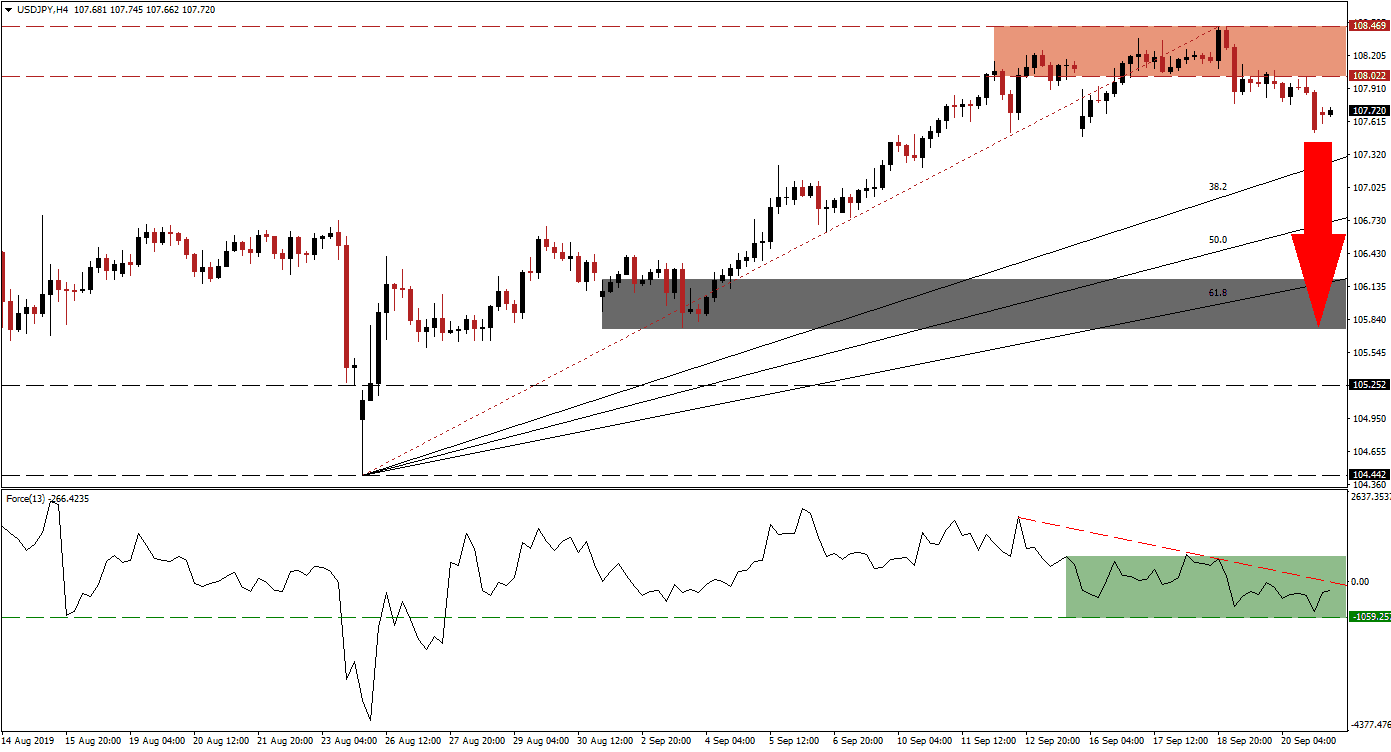

After the low level Chinese delegation cut its US trip short and cancelled planned visits to US farms, the mood surrounding a trade deal next month between the US and China to end the trade war soured. This resulted in a risk-off mood across global markets which boosted the Japanese Yen. The USD/JPY completed a breakdown during last Thursday’s trading session below its resistance zone, located between 108.022 and 108.469 which is marked by the red rectangle in the chart. Price action is now approaching its 38.2 Fibonacci Retracement Fan Support Level with a rise in bearish momentum.

The Force Index, a next generation technical indicator, formed a negative divergence prior to the breakdown as the USD/JPY recorded its most recent intra-day high while this technical indicator started to descend. A downtrend emerged and the Force Index dropped below the 0 center line which placed bears in control of price action. This is marked by the green rectangle. As this currency pair is approaching its 38.2 Fibonacci Retracement Fan Support Level, the Force Index should be closely monitored; if a breakdown materializes in the USD/JPY confirmed by a breakdown in the Force Index below the green horizontal support level, price action may accelerate down into its next support zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Another key level to watch is the intra-day low of 107.487, this level represents the low following a price gap to the downside and below its resistance zone. The gap was quickly closed and resulted in an advance which led to the intra-day high of 108.469. A move below this intra-day low is likely to result into more net sell order sin the USD/JPY as more forex traders will book floating trading profits. As traders follow trade developments between the US and China closely, the risk-off mood may prevail. The lack of clarity on future US monetary policy is additionally pressuring the US Dollar to the downside.

A breakdown below its 38.2 Fibonacci Retracement Fan Support Level, confirmed by a breakdown in the Force Index, will clear the path for the USD/JPY to extend the sell-off into its next support zone. This zone is located between 105.773 and 106.196, marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is just moving out of this zone. A move into this zone would also represent a breakdown below the entire Fibonacci Retracement Fan sequence and turn it from support to resistance. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 107.750

Take Profit @ 106.150

Stop Loss @ 108.100

Downside Potential: 160 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 4.57

Should price action recover from current levels and the Force Index push through its downtrend, the USD/JPY may recover back into its resistance zone. The fundamental scenario together with the technical picture favors more downside, but fluent developments in the US-China trade war can provide catalyst in either direction. A breakout above the resistance zone is likely to be limited to its intra-day high of 109.307 which previously initiated a bigger sell-off.

USD/JPY Technical Trading Set-Up - Reversal Scenario

Long Entry @ 108.300

Take Profit @ 109.000

Stop Loss @ 107.950

Upside Potential: 100 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.86