For the fourth day in a row, USD / JPY continues to correct lower to the 107.30 support level after failing to trade above the 108.47 resistance level last week. Investors' appetite for safe havens, including the Japanese yen, which has a negative interest rate and easing monetary policy, has increased recently with expectations that the round of US-China trade talks could fail as in previous rounds, threatening to increase trade war between the world's two largest economies. Which supports the recession of the world economy. USD / JPY is steady around 107.55 at the time of writing ahead the announcement of the US Consumer Confidence.

The yen's gains could increase if global trade and geopolitical tensions increase.

Risk appetite is currently low after weak PMI data in Germany and Europe raised concerns about the scope of the global manufacturing slowdown. Prospects for trade talks between the United States and China remain cautious after President Trump said he wanted a "full deal" rather than a temporary deal. At the same time, the week of the UN summit in New York suggests that world leaders will be more open to diplomacy and tact - something that could be negative for the yen.

Following the release of inflation figures in Tokyo, the next major release will be the minutes of the Bank of Japan's monetary policy meeting for August. It provides insight into what the Bank's board members are thinking about the economy and the Bank of Japan's future policy. If there are signs that it may be in favor of further monetary easing, this will be negative for the Japanese yen while strengthening its strength as a safe haven in case of uncertainty.

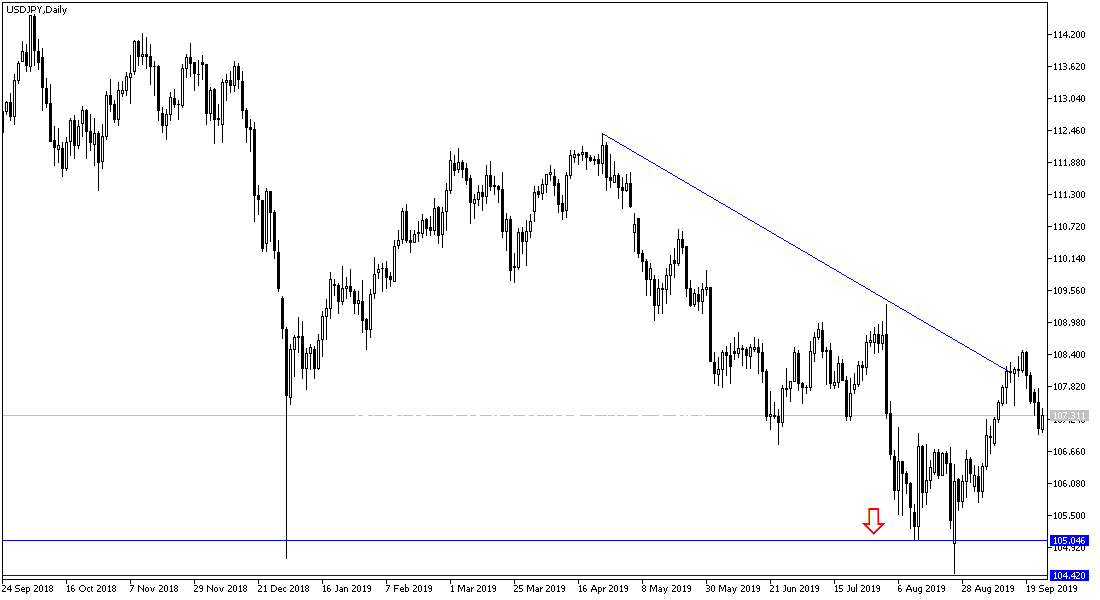

According to the technical analysis of the pair: The recent move of the USD / JPY will motivate investors to consider buying the pair again, and the levels that will be the most appropriate for this to happen well be at 107.35, 106.80 and 106.00 respectively. If it returns to test 108.20 and 109.00, the correction will resume again and target the psychological top 110.00. This may happen with the easing of global trade and geopolitical concerns and the solution to the mysterious Brexit file.

On the economic data front: Today's economic calendar will focus on the release of US consumer confidence and the Richmond Manufacturing Index data.