Investors continue to take risk appetite and the strengthening of the US currency amid recent optimism over the trade dispute between the US and China, contributed to the gains of the USD/JPY pair, pushing it to the 108.16 resistance level in early trading on Thursday. It was steady around 107.97 at the time of writing, and ahead of the release of important US inflation figures, which will set the Fed's monetary policy outlook at its meeting next week. The positive start of the US-China trade talks, which will begin in a few days, increased investor confidence and weakened the Japanese yen, one of the most important safe havens for investors in times of uncertainty in financial markets.

US inflation figures – consumer and producers prices, and retail sales - will provide investors with insight into what the US central bank will do when they meets next week to determine its monetary policy. Expectations are high that the bank may cut interest rates once or twice before the end of the year and next week's meeting could be one of them. But what Jerome Powell said at the end of last week makes that unlikely. Powell stressed that the US economy is far from recession and the risks facing the US economy are the trade wars led by the Trump administration.

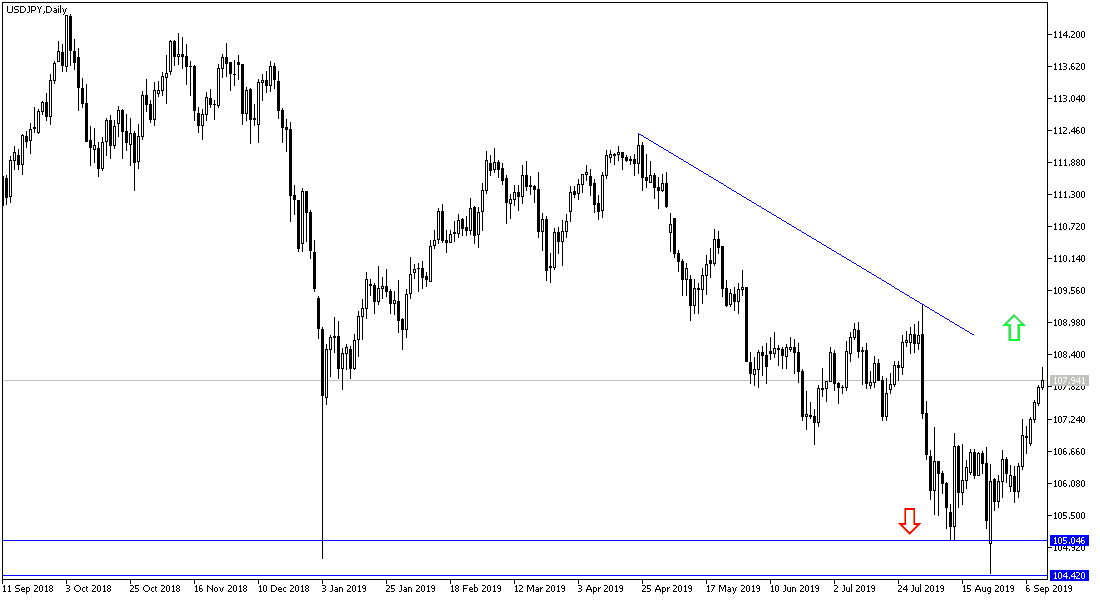

According to the technical analysis of the pair: As we had previously expected, the success of USD / JPY in stabilizing above 108.00 resistance will support the upward correction strength and may lead the pair to the next resistance levels at 108.65 and 109.20 and psychological top at 110.00 respectively. This will happen if investors continue to take risks and there is no retaliatory action between Trump and China over trade. On the downside, the pair may re-move towards support levels at 107.20, 106.55 and 105.90 respectively if it fails to move towards the mentioned resistance levels.

On the economic data front, the economic calendar today includes the release of Japan's producer price index and the country's three-way industrial activity index. The most important thing today is the release of US inflation figures with the release of the consumer price index, the most important measure of inflation and then the weekly jobless claims.