Ahead of the release of the first inflation indicators in the United States, the price of the USD / JPY is stabilizing bullishly around the 107.84 resistance level at the time of writing, its highest in five weeks. The pair’s recent gains were supported by increased risk appetite amid a breakthrough in the trade dispute between the United States and China. Careful waiting and anticipation has mastered the situation for that war that threatens the future of US economic growth. The return of the threatening and intimidating tone between the two parties will negatively affect the pair's gains and restore fears to investors that the new round of negotiations will be doomed to failure as in previous times.

Along with optimism between the United States and China, the US dollar has gained momentum from comments by Federal Reserve Governor Jerome Powell that the US economy is far from recession and that the Trump-led trade wars are the biggest threat to the economy. His remarks after the announcement of the mixed results of the official US jobs report noted the increase in the average hourly wage and the steady unemployment rate, but lower than expected gains for jobs in the non-agricultural sector, and in general the US labor market remains strong and the US central bank is relying on that to tighten monetary policy.

Investors will be watching the release of US inflation figures this week to predict monetary policy decisions of the US Federal Reserve next week.

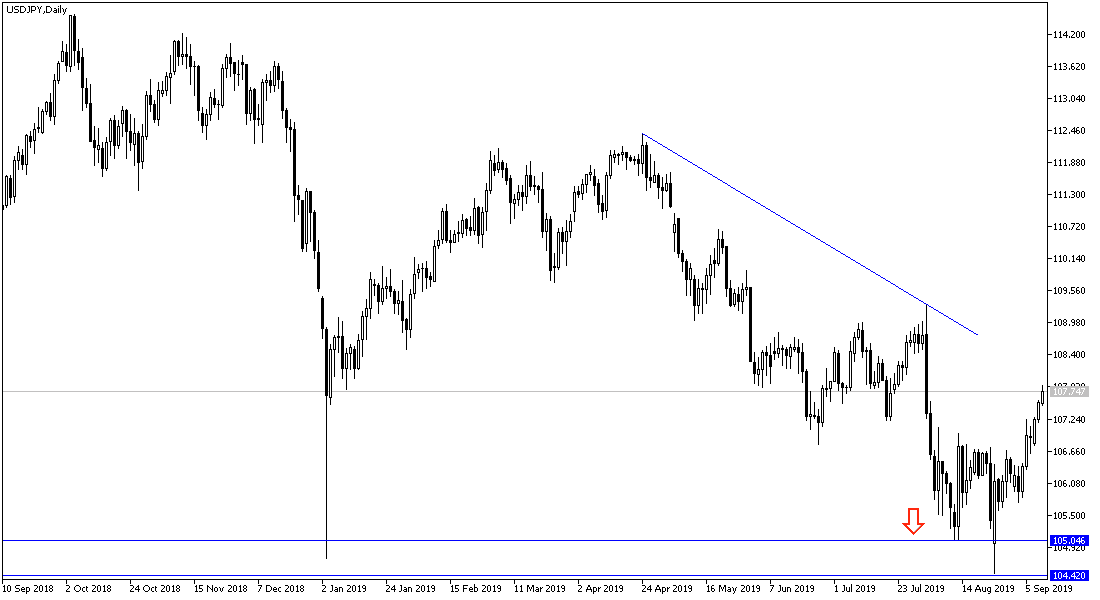

According to the technical analysis of the pair: USD / JPY is on its way towards the 108.00 resistance level, which supports the uptrend strength, breaking through that will support the immediate move towards resistance levels at 108.65 and 109.20 and 110.00 psychological top, which will happen as long as the investors continue to take risks, and there were no negative development of the world trade war. The pair may re-move towards support levels at 107.20, 106.55 and 105.90 respectively, if global trade and geopolitical tensions increase again, the Japanese yen is one of the most important safe havens for investors.

On the economic data front, the economic calendar today will focus on the release of the US PPI, one of the tools for measuring US inflation, after which the weekly crude oil inventory figures will be released.