Risk appetite has contributed to a bullish correction in USD / JPY to reach the 107.22 resistance level, which was hit a month ago, and started trading this week stabilizing around 106.82, pending new catalysts to complete the correction. With the release of mixed US jobs report figures, the US dollar gained momentum from comments by Federal Reserve Governor Jerome Powell that the US central bank does not expect an economic recession, not in the US or at a global level. However, it monitors a number of uncertainties, including trade disputes, and will act “as appropriate to sustain the country's economic growth”.

Powell gave an optimistic view of the US economy during his appearance with Swiss National Bank President Thomas Jordan in Switzerland. Powell said the current trade policy was causing "some uncertainty" but the US consumer was doing well. Powell said: "I will not see that the economic recession is the most likely outcome for the United States or the global economy."

Prior to his comments, data from the US Labor Department showed that non-farm payrolls rose 130,000 in August after rising 159,000 in July. Economists had expected employment to rise by 158,000 compared to the 164,000 jobs originally announced last month. The unemployment rate remained steady at 3.7% in August, unchanged from July as expected. Average hourly earnings rose $ 0.11 to $ 28.11 in August after a gain of 9 cents in June and July, the report said.

After the results, economists predicted that the risks from the deterioration in world trade and manufacturing recession meant we were still looking for interest rate cuts in September and December.

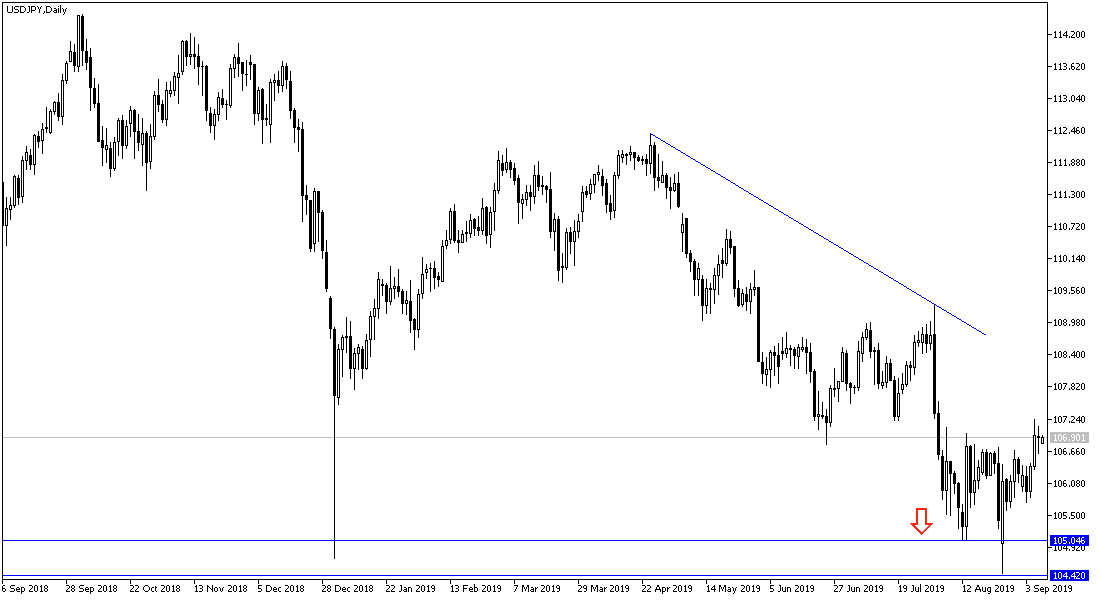

According to the technical analysis: Stabilizing of the USD / JPY above 107.00 will support the bullish outlook and strengthen the trend reversal by moving towards 107.55, 108.20 and 109.00 resistance levels respectively. In contrast, if it moves towards the 106.45, 105.80 and 105.00 support levels, the bearish trend will remain stronger as it appears on the daily and weekly charts.

On the economic data front: The yen will be affected by the announcement of the Japanese economic growth rate and the current account data. There are no significant US economic data expected today.