For eight trading sessions in a row, the good performance of the USD/JPY pair continued, and last week's close tested the 108.25 resistance, the highest level in six months, before testing 107.50 support in early trading today. This was with the release of negative figures for Chinese industrial production, and is now stable around 107.83 at the time of writing. The pair will remain around its recent gains until the monetary policy of both the Bank of Japan and the Federal Reserve is announced this week. Recent gains supported by risk appetite amid recent breakthrough between the United States and China. This time the two sides took steps to calm the atmosphere ahead of their trade talks in Washington and amid Trump's hints that even a temporary deal with China could be reached.

The strong yen, which reached a three-year high in late August, put the Bank of Japan in a difficult position. However, over the past three weeks, the yen has been the weakest currency in the world, losing 2.5% against the dollar. The yen's setback, along with rising bond yields, may force the Japanese central bank to stick to its policy until it sees the impact of the sales tax hike on October 1.

Although the Bank of Japan has made asset purchases dependent on economic data, the yen has been the only major currency to have appreciated against the US dollar since the end of 2017 by 4.2%. Strong currencies usually have low interest rates (such as Japan and Switzerland), while weak currencies should offer higher interest rates to offset currency risk.

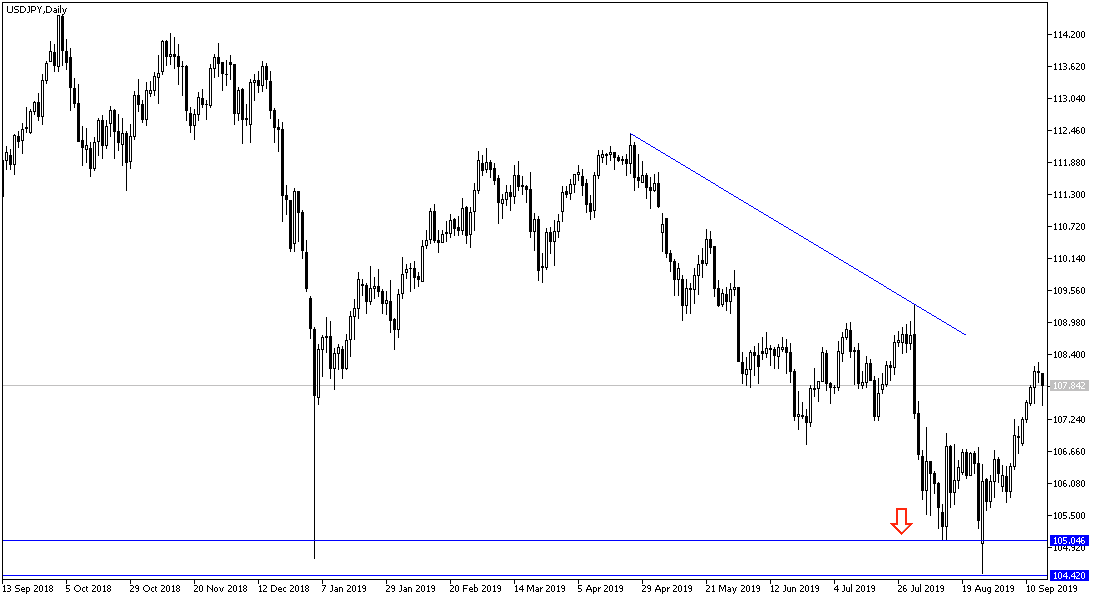

According to the technical analysis of the pair: as indicated on the daily chart below, the USD / JPY bullish correction journey needs a test of the 110.00 psychological level to confirm the strength of this correction. Should it return to test the support levels at 107.40, 106.85 and 106.00, the pair's current hopes for a correction will collapse.

On the economic data front, the JPY will react to the release of Chinese economic data today as it is one of the most important safe havens. No significant economic data is expected from either the US or Japan today.