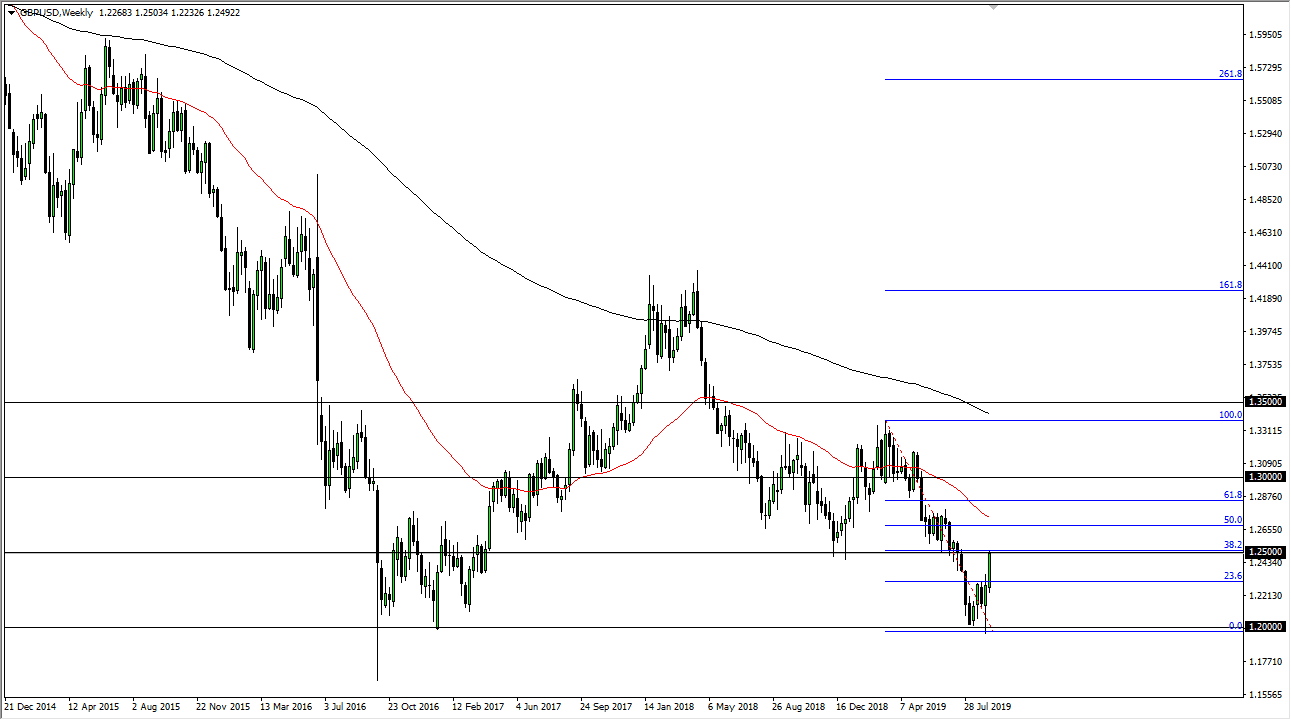

GBP/USD

The British pound initially pulled back a bit during the week against the US dollar, but then shot straight to the upside, testing the 1.25 handle. That being the case it looks like we could get a little bit more to the upside from here but I recognize there is a ton of noise between here and the 1.27 level and it’s probably only a matter of time before something ugly happens with the Brexit. I anticipate that we get a little bit more bullish pressure to the upside and then some type of breakdown that sends the market right back down. Unfortunately, this is probably going to be news based.

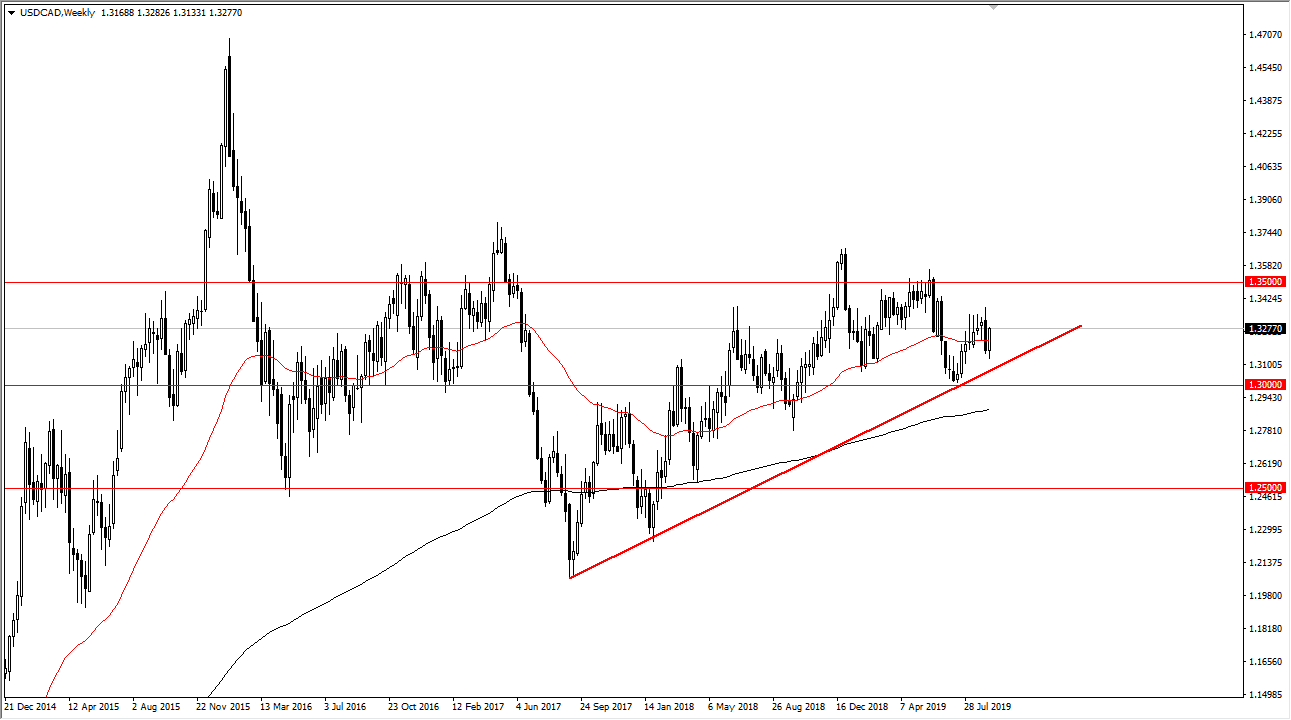

USD/CAD

The US dollar has rallied against the Canadian dollar during the week as oil markets got absolutely pummeled. This makes quite a bit of sense I think it will continue to be the way going forward as the market is so sensitive to the crude oil markets. We have been following a nice uptrend line and it looks like we will probably head towards the 1.35 level. That being said though, it’s going to be very choppy so I think short-term pullbacks should be buying opportunities as long as oil markets continue to struggle.

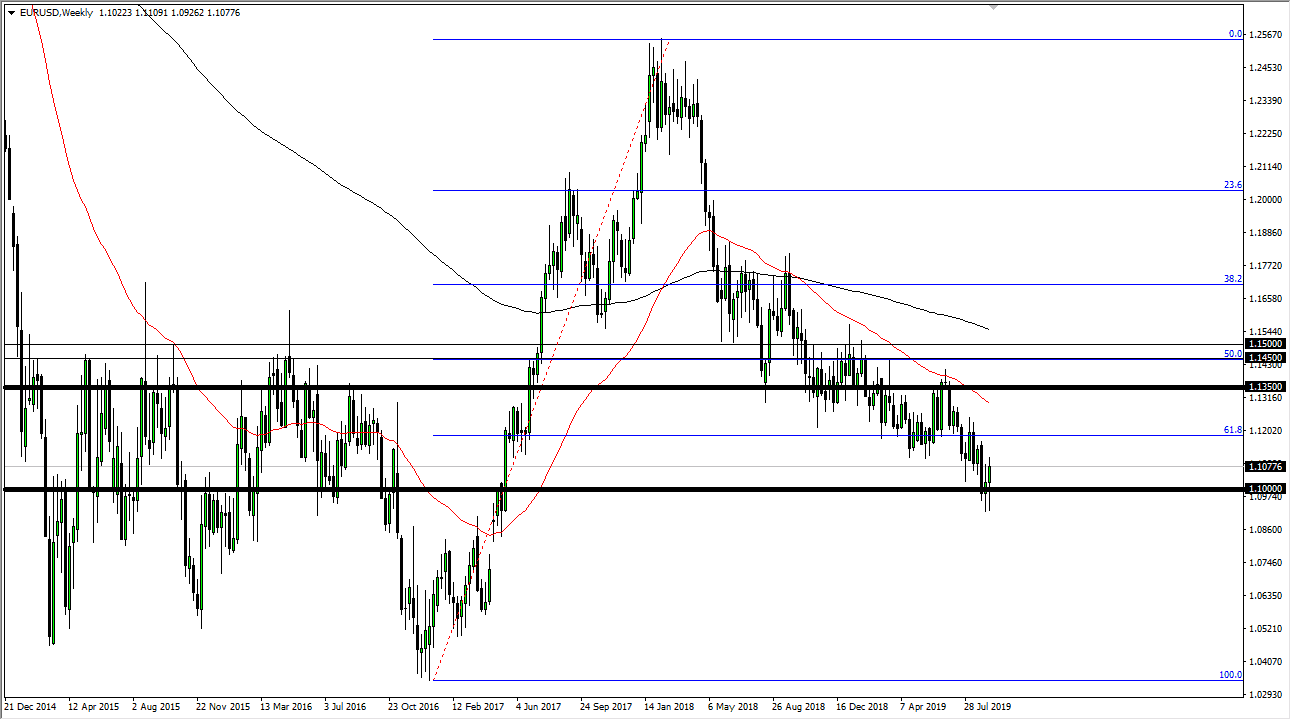

EUR/USD

The Euro had a wild week as the ECB met and released its interest rate announcement. It looks as if the markets were a bit underwhelmed by the quantitative easing, so the Euro gained. All things been equal though, I think what we are going to see sellers step in rather soon, as the 1.11 EUR level is offering a bit of resistance. I would not be surprised at all to see this market break back below the 1.10 level to continue the move lower.

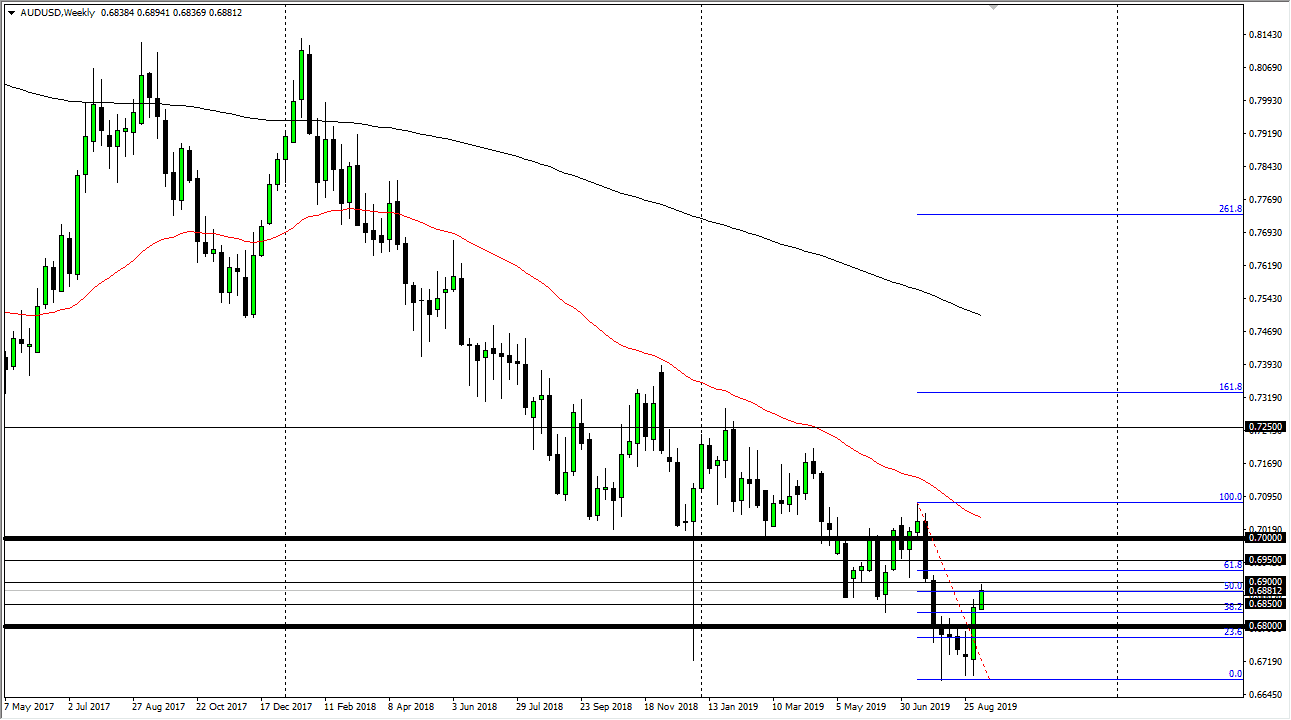

AUD/USD

The Australian dollar rallied a bit during the week but continues to struggle at the 50% Fibonacci retracement level from the recent fall. At this point, it’s likely that we will continue to see quite a bit of volatility, as this market is sensitive to the US/China trade situations. That continues to be a bit of a moving target, so expect choppiness but I still think there is difficulty navigating this pair. I prefer to fade rallies.