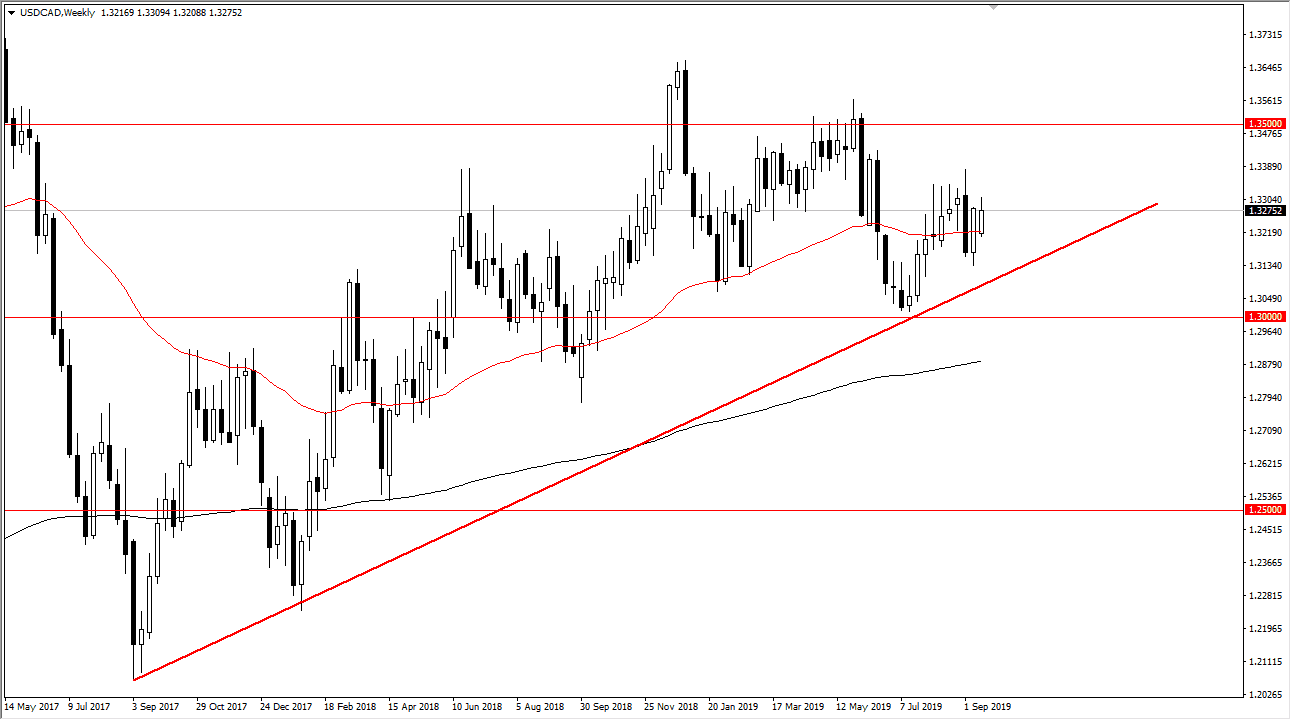

USD/CAD

The US dollar rallied during the week against the Canadian dollar as we continue to see the oil markets to be very erratic. More than likely, oil will continue to fall to fill the gap, so it’s very likely we will continue to see bullish pressure in this market. That being said, expect a lot of noise near the 1.34 handle, but if we can get above there it’s likely that the market goes towards the 1.35 handle. Ultimately, there is an uptrend line underneath that should continue to support this market.

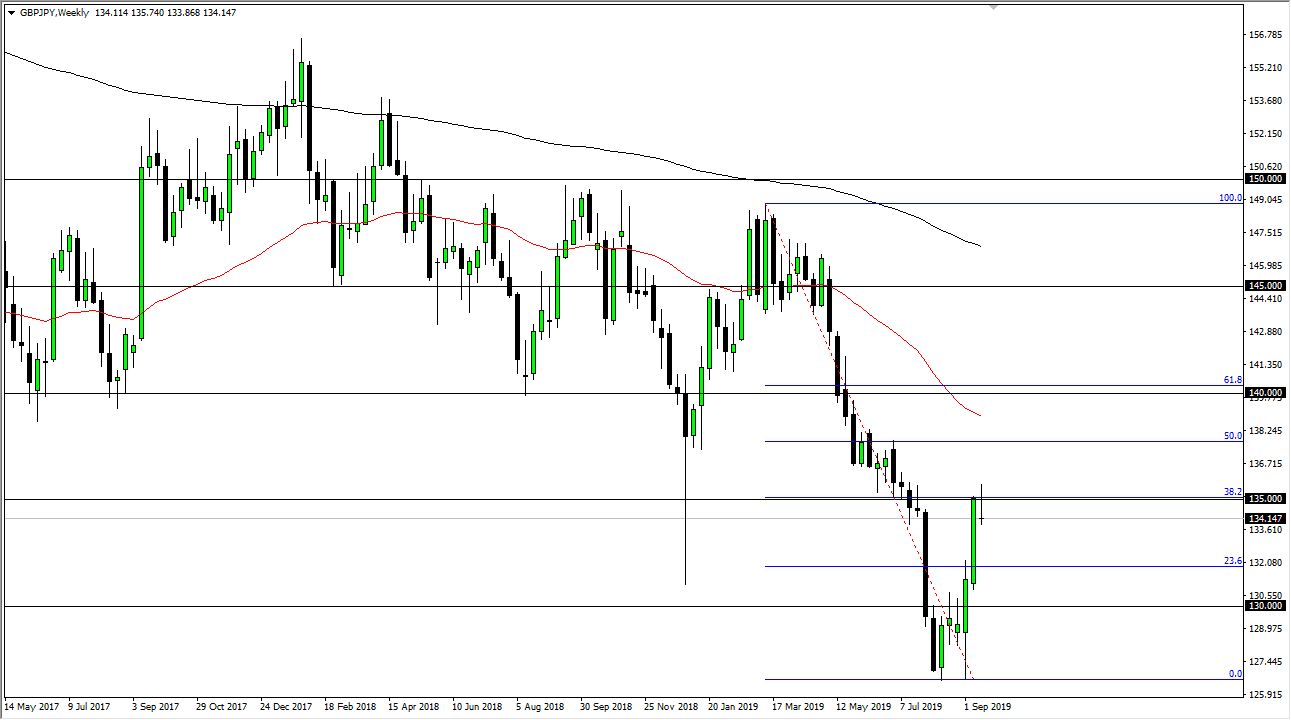

GBP/JPY

The British pound gapped lower against the Japanese yen due to the Saudi drone attacks throwing fear enter the marketplace on Monday. However, we turned around to fill that gap, only to turn right back around again to form a shooting star. This is right at the 38.2% Fibonacci retracement level, so therefore it’s very likely that we fall from here and I would anticipate seeing this market drop at the first signs of trouble in the financial markets or some type of “risk off” scenario.

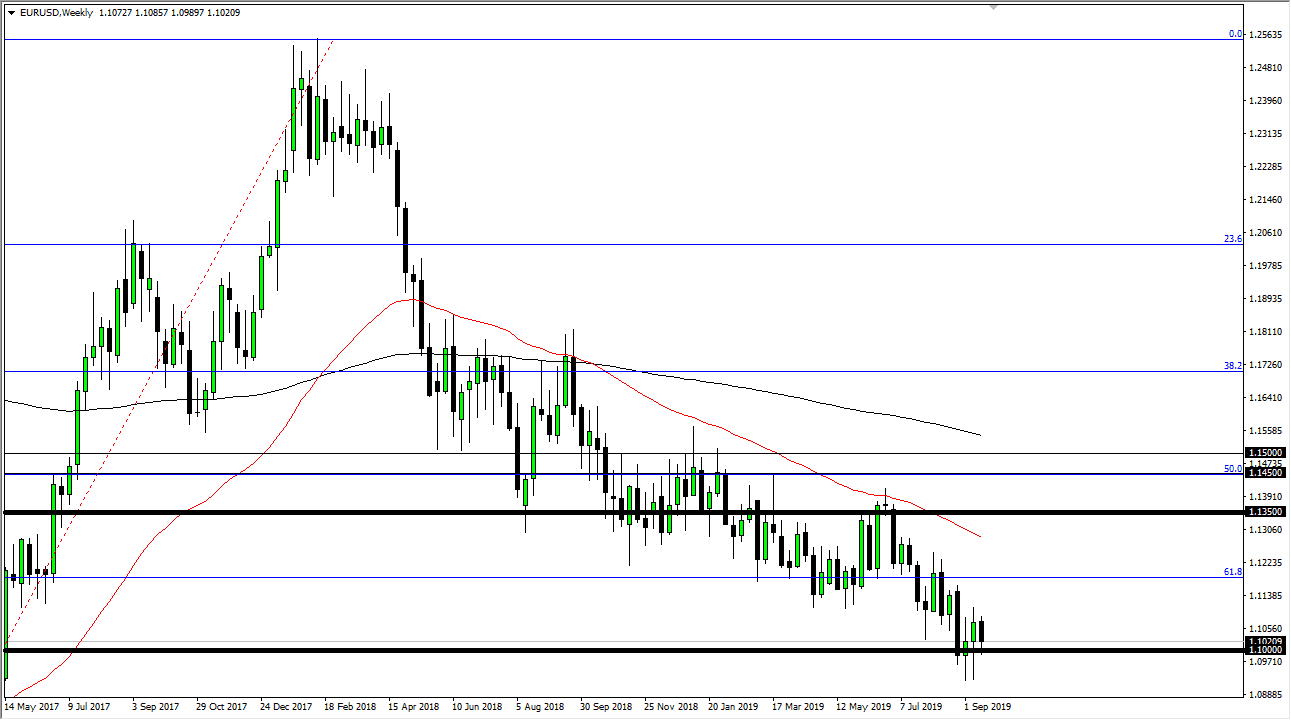

EUR/USD

The Euro continues to go back and forth and chop around but with an overall negative attitude. I think that rallies at this point are not to be trusted, and short-term traders will continue to short every time they get an opportunity to do so. The 1.10 level also offers a lot of psychological support and liquidity but given enough time we should continue to see this market drift lower as it has over the last 18 months. Eventually, I anticipate that the market is going to go down to the 1.09 level underneath.

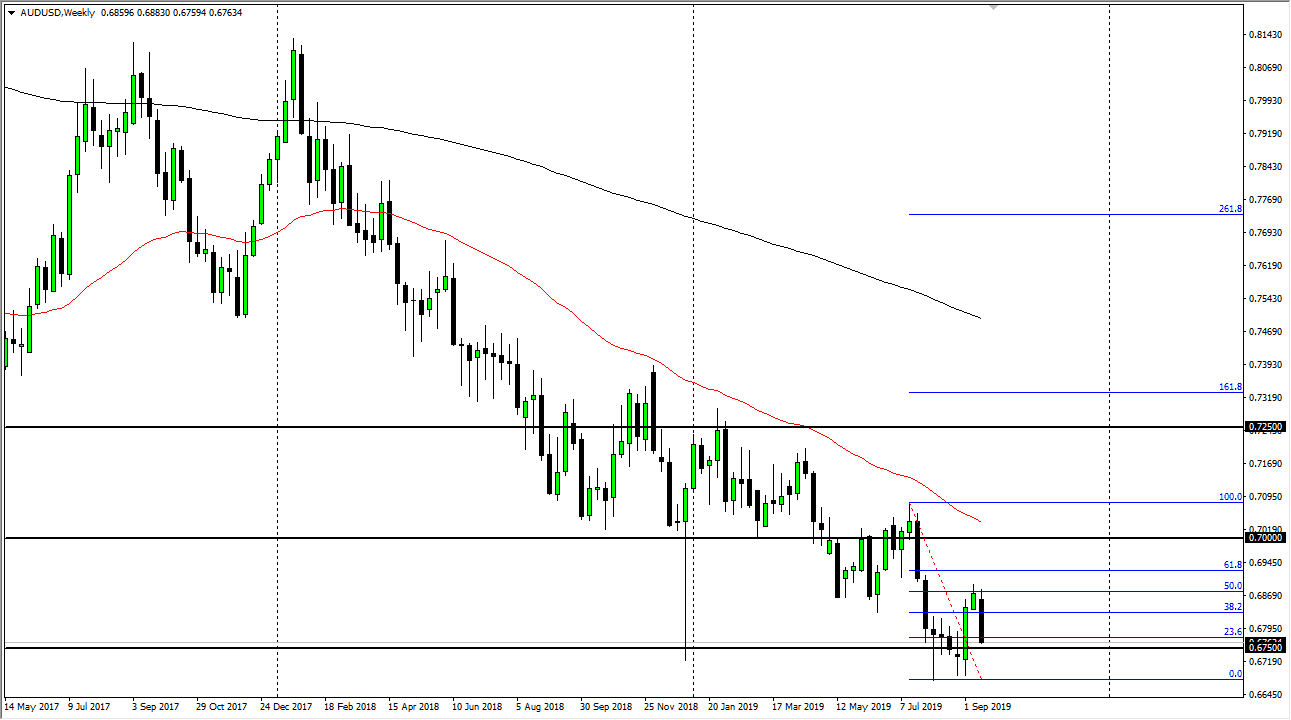

AUD/USD

The Australian dollar fell during most of the week, as we continue to see more negativity coming out of the US/China situation overall. Quite frankly, this pair continues to move right along with that and it’s likely that the RBA is going to cut rather soon. All things being equal we should continue to go lower and perhaps break to a fresh, new low in route to the 0.65 USD level.