Gold markets went back and forth during the trading session on Friday, showing signs of exhaustion as we have possibly gone too far into short-term of a timeframe. That being the case though, the gold market is still very strong and it’s likely that we will see buyers coming back into the marketplace.

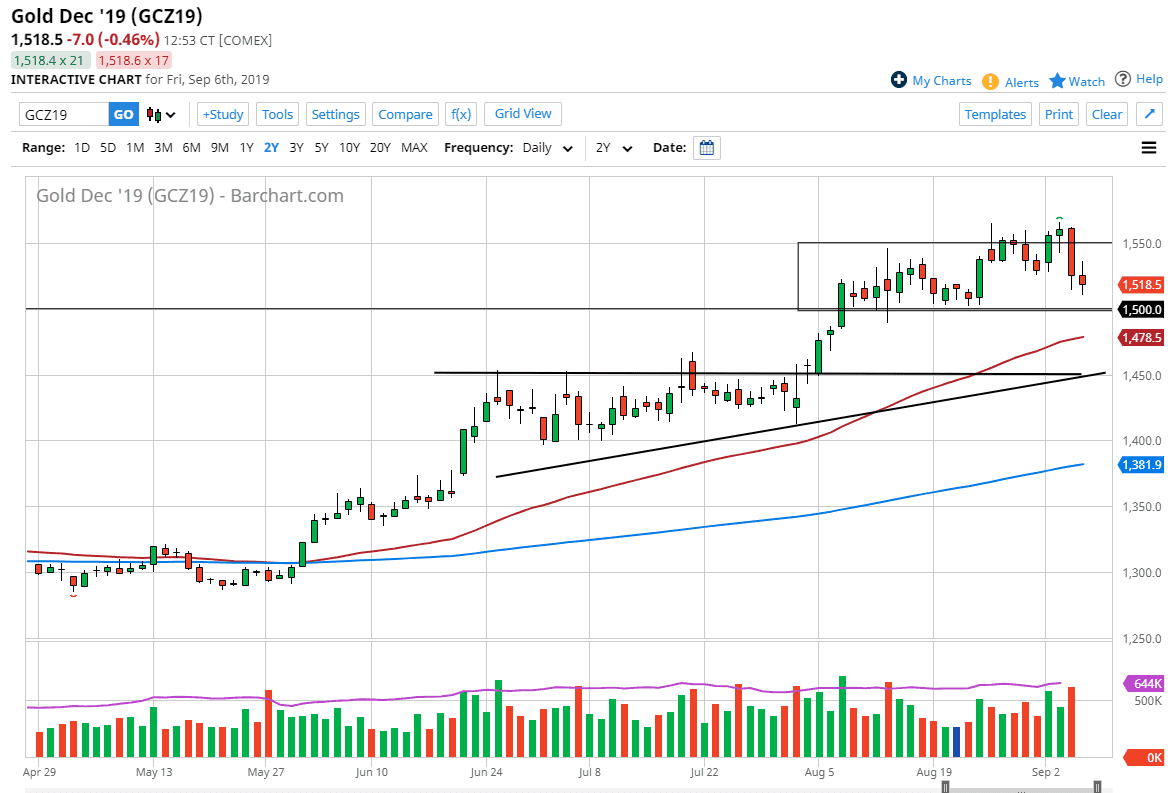

The $1500 level underneath should be somewhat supportive, and therefore it wouldn’t be surprising at all to see this market bounce. However, if we break down through there then the next support level might be the 50 day EMA, and then perhaps even the $1450 level. That is a level that was the top of an ascending triangle that I have marked on the chart, and of course will attract a lot of attention as it has not been retested recently. Looking at this chart, the market is in a strong uptrend, but then again the Gold markets may have been rallying without any type of check along the way.

There are plenty of traders out there that will be looking to get involved that have missed this move, so the support is almost a given. The candle stick on the weekly chart is a little bit more like a shooting star, so I think this pullback that’s coming is being telegraphed. That doesn’t mean that I would be a seller, it means that if you are patient enough you should be able to pick up gold “on the cheap”, which is essentially what trading is all about, buying things when they are on the cheap side, and selling them once they get relatively expensive. Gold is going to be no different and there are plenty of reasons to think that we continue to go higher.

The central banks around the world continue to loosen monetary policy, which is bullish for the gold market, and the buying of bonds doesn’t hurt the idea of precious metals going higher as well. With all of this loose monetary policy, people will continue to look for value in a market that is representative of the “hard money policy” that most traders would love to see. For the longer-term, I believe that the market is probably going to go looking towards the $1600 level, the $1800 level after that, and then the $2000 level after that. I do believe we get to the $2000 level, but it’s going to take quite a bit of time.