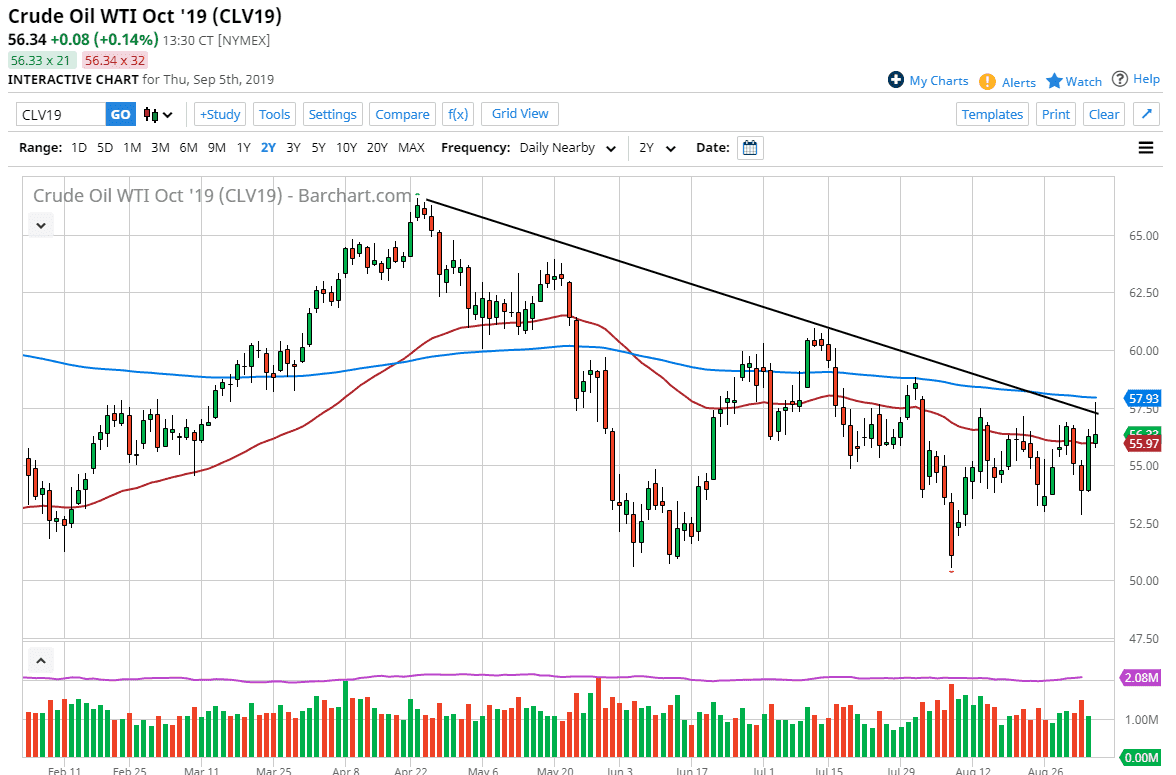

The West Texas Intermediate Crude Oil market has struggled to hang onto gains during the trading session on Thursday, as we got a better than anticipated inventory figure, but have also failed at the downtrend line that has been so prevalent in this market. Beyond that, we also have the 200 day EMA which is sitting near the $58 level. By failing there, we ended up turning around and forming a massive shooting star. The shooting star is an extraordinarily negative sign and will send a lot of people looking to short this market.

However, this is a market that is about to deal with the jobs figure and that of course could give us an opportunity to see whether or not demand will pick up or not. The reality is that it probably isn’t going to unless of course the jobs number in the United States has some type of blow out. All things being equal I think it’s likely that the market will continue to be attracted to the 50 day EMA as that’s where we are basically closing right now. The crude oil markets are currently dealing with quite a bit of trouble out there when it comes to global growth, and that of course is a major problem.

Speaking of that global growth, we did get a little bit of a boost due to the fact that the Americans and the Chinese are starting to talk again but ultimately nothing has been decided and it’s very unlikely to happen anytime soon. Because of this I think we are probably setting up for some type of pullback, which could send this market back down towards the $54 level.

The alternate scenario of course is that we break above the top of the shooting star and perhaps even more importantly the 200 day EMA. I don’t consider that a major break out until we get at least a daily close above there, so it’s probably going to be quite difficult to happen. I believe at this point the downward pressure still will be rather crushing, and probably continue to see the market go back and forth between the $57.50 level, and the $53 level underneath. Expect a lot of noise, but ultimately we are still very range bound and I don’t see that changing in the short term. I obviously will keep you up-to-date here at Daily Forex.