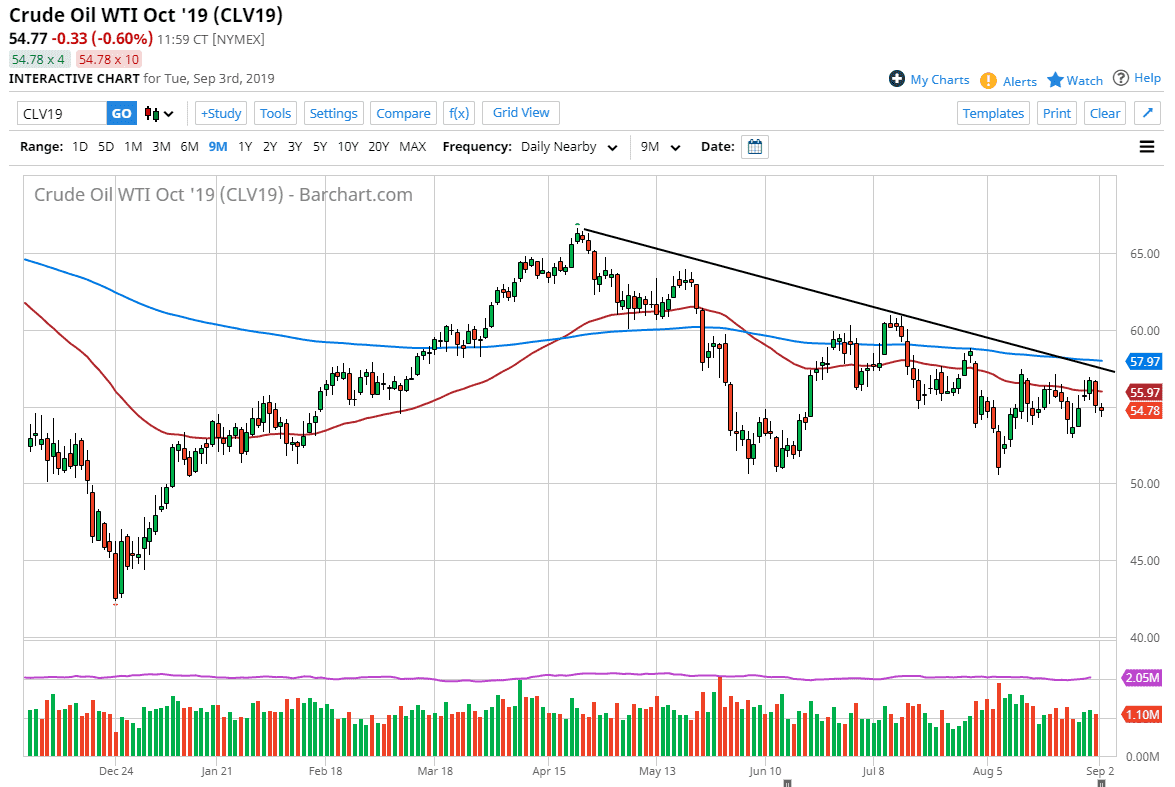

The West Texas Intermediate Crude Oil market has fallen a bit during the trading session on Monday, but it was Labor Day in the United States so you need to keep that in mind. Regardless though, we did break through the $55 level and that of course is a negative sign. That was an area where we had formed a gap from, but that gap has not only been filled but broken.

Any rally at this point will more than likely start short-sellers looking for an opportunity to get involved. After all, the Brent market has broken through a symmetrical triangle, and although the WTI market hasn’t, the reality is that it’s only a matter of time before we see one market follow the other. With that being the case I suspect that the WTI market will go lower given enough time and therefore I’m looking for shorting opportunities.

Above current trading is the 50 day EMA, and then of course the downtrend line as well. Both of those should end up being a selling opportunity. Ultimately, I think that the market will reach down to the $51 level, and therefore test the major support level that extends all the way down to the $50 level. At this point, if we were to break down through there, the market should then go much lower, perhaps down to the $45 level. All things being equal, I think at the very least we will probably go looking towards the $51 level.

The alternate scenario would of course be a break above the downtrend line and perhaps even the 200 day EMA. If we can get above there, then the market will test the $60 level. I find that very difficult though, because the demand around the world is going to continue to drop, as global growth is going to continue to be a major issue. Beyond that, there are plenty of drillers and the United States willing to flood the market and then of course the Russians look very unlikely to cut crude oil output, thereby adding to the oversupply issue. At this point, I think that you continue to fade this market, as it will more than likely continue to drop overall. If we were to break down below the $50 level it would probably be tied to some type of major financial problem which you will see in other markets such as a stock market.