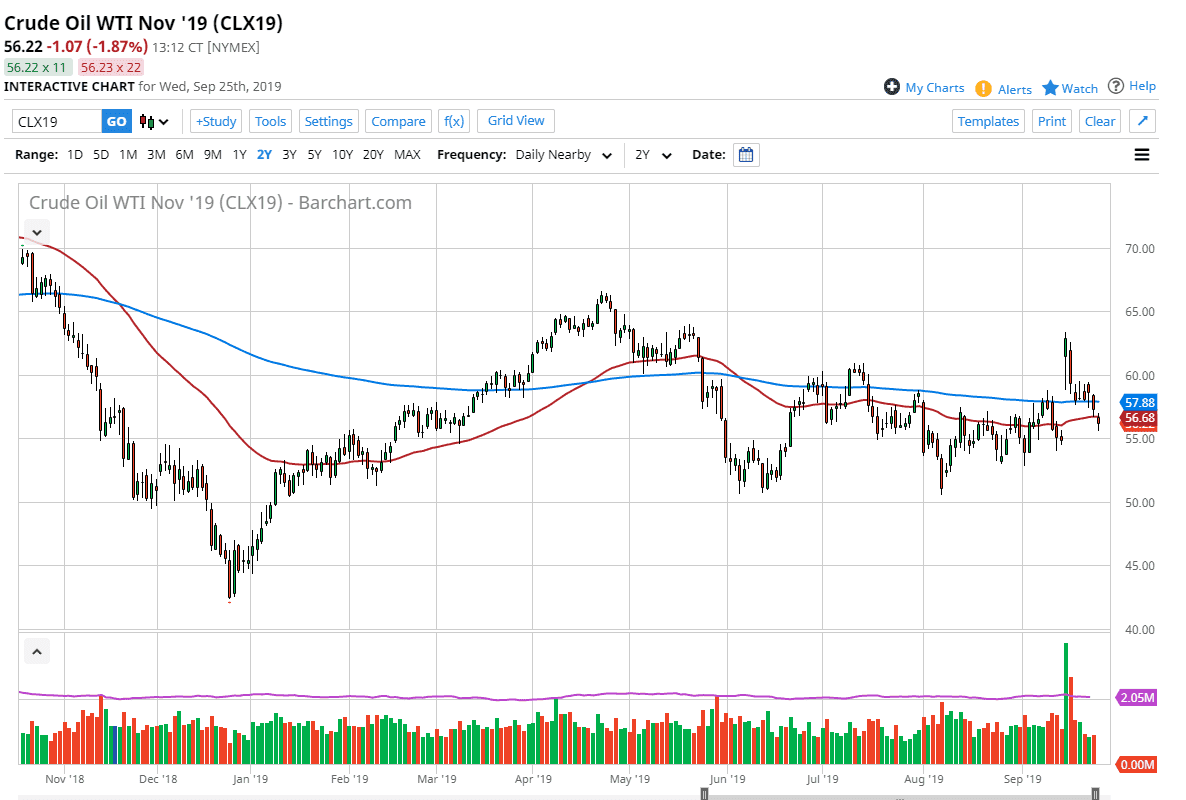

The West Texas Crude oil market gap lower to kick off the trading session on Wednesday, but then reached down to fill the gap that started with the drone attack on the Saudi oil fields. That being the case, we have now wiped that out of the fundamental picture, as it appears that the Saudi oil production will be back to normal in the next two weeks. With all of that, we have a market that is probably going to try to find a bit of minor support here due to that gap, because we are simply going sideways overall.

Crude oil markets will continue to be a bit lackluster due to the fact that there is simply not enough demand out there to soak up supply as global markets are starting to come to terms with the global slowdown economically. If that’s going to be the case, the market looks very flat and range bound as there’s no real catalyst to go one direction or the other. Overall though, we could go as low as the $50 level underneath, with the $65 level above being the absolute ceiling. That’s a $15 range for the crude oil market overall, and we are essentially in the middle of it.

Until the global economy picks up, this market isn’t going to be able to break out, because quite frankly there just won’t be enough demand. The crude oil inventory number in the United States was a build of 2.5 million barrels, which of course is negative considering that the consensus was for a drawdown of 200,000 barrels. They’re just simply is no reason for the market to explode to the upside, and therefore I think we continue to see a lot of sideways chop in this range, but with no real conviction one way or the other. Ultimately, this is a market that should continue to be very listless and nondirectional, so as we get to the outer range of either part of the consolidation I’m willing to place a trade. In this area I just don’t feel compelled now that the gap has been filled to put any serious money to work. Oil will probably continue to just chop back and forth in a relatively tight range of the next couple of days until we get some reasons to do something else. Right now I just don’t see it.