The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Wednesday as traders bought everything they can get their hands on. It was a very odd day around the world, because there was nothing to kick any of this off. That being said, something has to give and I would anticipate that longer-term trends come back into favor. If that’s going to be the case, then this market will more than likely pull back from current levels and go looking for lower prices.

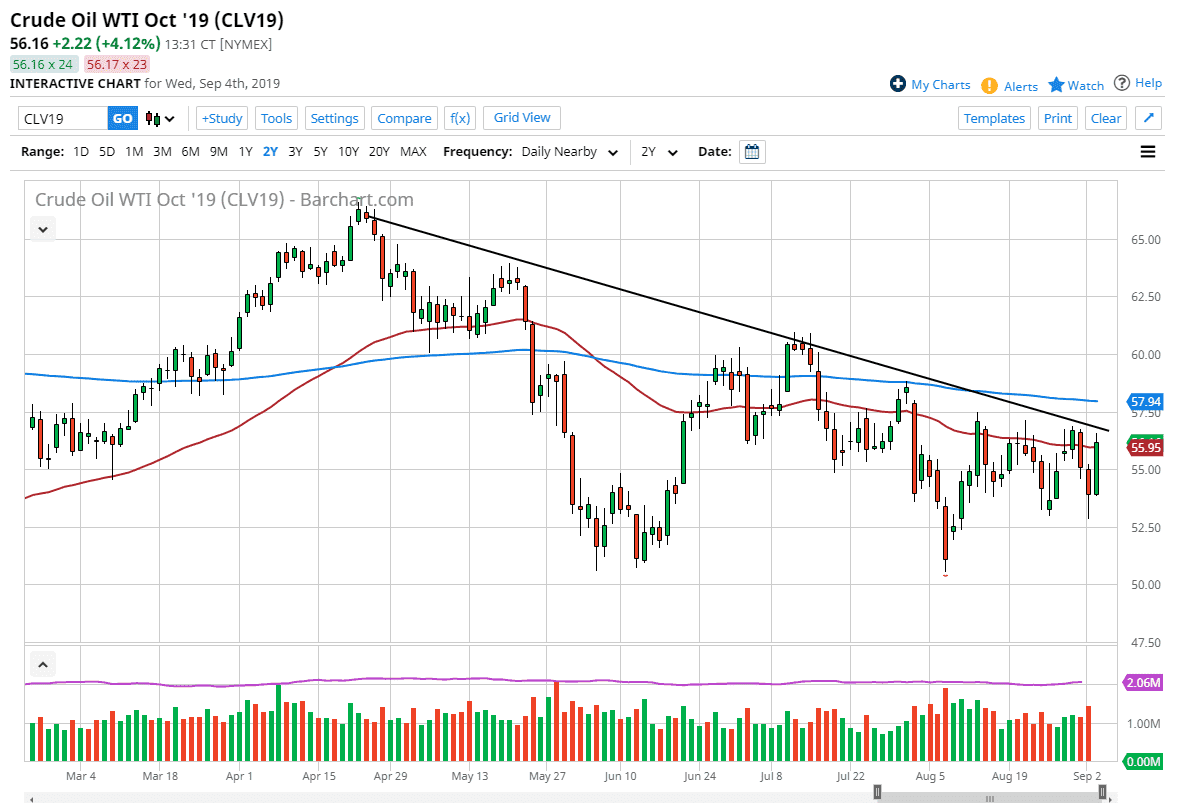

Just above, we have the downtrend line and the 50 day EMA both coming into the picture. Beyond that we also have the 200 day EMA and of course we have the backdrop of a very negative geopolitical circumstance around the world. In that environment, crude oil should not do well as demand for petroleum and energy overall should continue to fall. I think that it’s only a matter of time before we get a roll over, perhaps reaching back down towards the bottom of the range for the day, closer to the $53.50 level.

Beyond that, we also get the volatile jobs number coming out on Friday and therefore it’s a bit difficult to imagine that traders are going to want to take on a lot of risk between now and then. With that being the case, I would fully anticipate that we pull back if nothing else to consolidate what we have already done. The market should continue to be rather choppy and erratic but these days that’s completely normal. With algorithms slapping the market back and forth, you need to keep your position size small and your stops relatively wide.

If we were to break the blue 200 day EMA, which is at roughly $50, then you can have a discussion about the market going even higher and towards the $60 level. Until then, you have to look at rallies with suspicion as we are so close to so much major resistance. Ultimately, I think that this market probably continues to find plenty of reasons to chop around but I think in the short term are going to see a reversion to the mean which essentially means going back to the $55 level below. After the jobs number, we may have a bit more clarity but right now it certainly looks as if we’re going to struggle for it.