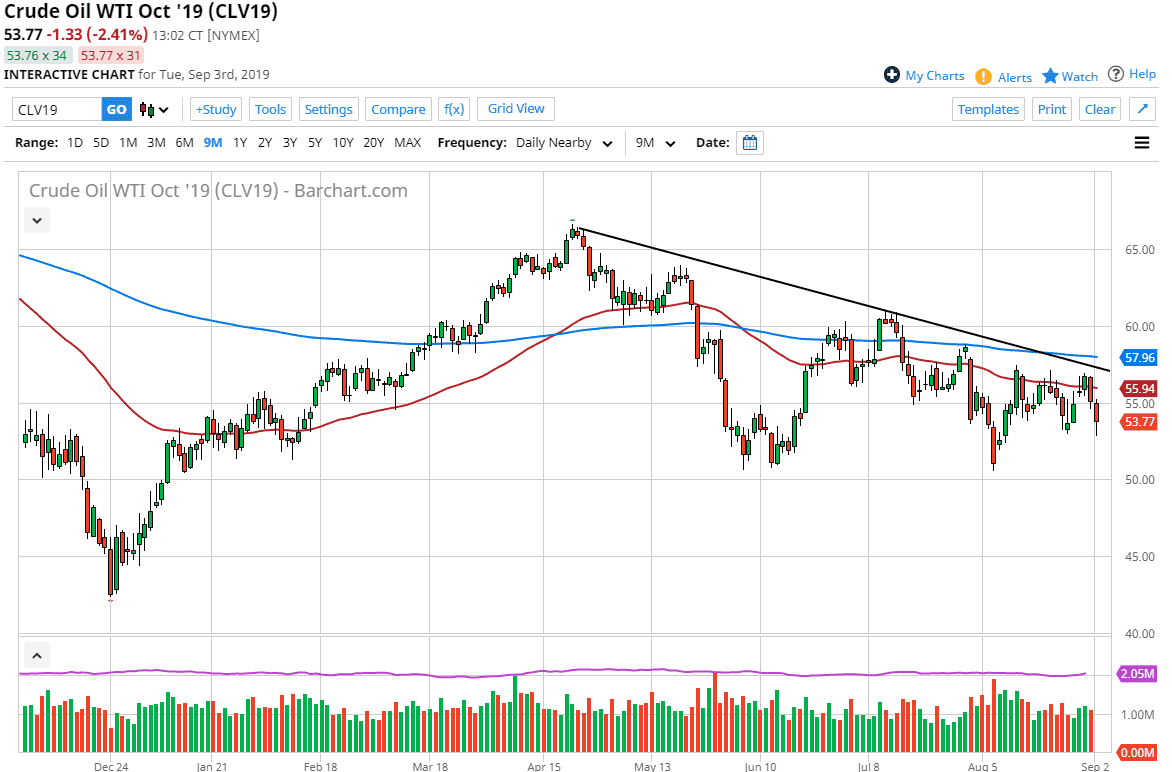

The West Texas Intermediate Crude Oil market has fallen a bit during the trading session again on Tuesday but we have bounced a bit from the lows. At this point, the 50 day EMA is causing a significant amount of resistance, sitting a few dollars above current pricing. At this point, it’s very likely that we will continue to go lower, but we may get a short-term bounce to test that 50 day EMA yet again. After all, there is a huge oversupply of crude oil and we have a whole slew of problems out there that could continue to drive prices lower.

The US/China trade talks continue to sour, as we have seen more tariffs slapped on each country over the course of the weekend. With that being the case, it’s likely that we will continue to see a lot of negative pressure on crude oil as the demand for petroleum should drop from that reason alone. Beyond that, we have the global slowdown coming, so that will drive down the perceived demand for crude oil as shipping and transportation will continue to fail.

Looking at the technical analysis, the 50 day EMA should continue to offer plenty of resistance, but we also have the downtrend line and the 200 day EMA above there that will continue to put downward pressure in this market. Ultimately, this is a market that will more than likely find exhaustion to be a major problem. At this point, I will be on the sidelines waiting for a selling opportunity as we do more than likely bounce in the short term. That bounce should be looked at as yet another attempt to save the market but I think we are eventually going to go down towards the $51 level, perhaps even down to the $50 level. If we were to break down through that level, it’s very likely that we will continue to go down to the $45 level. I think at this point we are trying to form a massive descending wedge, and as long as we are in the pattern it’s very unlikely to see the market change its overall attitude. However, if we were to break above the 200 day EMA which is pictured in blue, that could send the market to the $60 level, possibly even the $62.50 level.