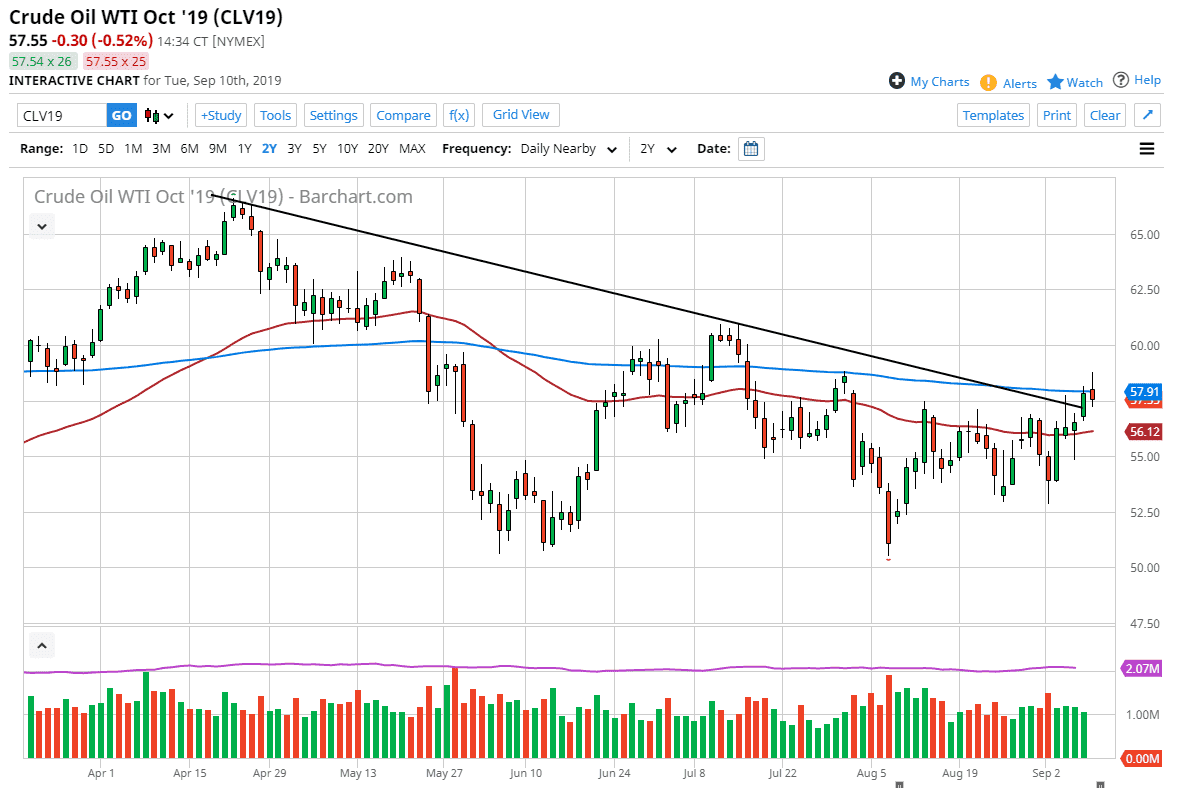

The West Texas Intermediate Crude market rallied significantly initially during the trading session on Tuesday, but has found the lot of resistance above the 200 day EMA. That is a long term technical barrier, and it does look like we could pull back a bit from here. That being said, we did break the downtrend line previously, and it suggests that we are ready to go higher.

After all, we are worried about the Iranians and the fact that OPEC is cutting production. With that, it’s likely that we could continue to go higher, especially if the US dollar gets hammered. All things being equal though, we have broken through major resistance and even though the 200 day EMA has offered resistance, it will be interesting to see if we can break above the top of the candle stick for the trading session on Tuesday. If and when we do, that would be a very explosive sign that we are going to go towards the $60 level above. Pullbacks from here should find support at the 50 day EMA, and if we were to turn around and break through there it’s likely that we would break down significantly as it would be a complete reversal of bullish pressure.

I think the one thing you can count on is an extraordinarily violent and volatile market, and it’s going to be difficult to imagine being able to hang onto trades for more than a few minutes at a time. The volatility has been a bit overdone, and unfortunately I think it’s only going to get worse. At this point, it’s very likely that we will continue to see choppy and difficult conditions going forward.

Crude oil is probably a market that’s best left alone at the moment, because it seems to be doing nothing but chomping most traders up that I know. In fact, several prop shops that I keep in contact with during the trading session are trying to get there traders out of the market completely. All things being equal, we have formed a nice reversal pattern, but the road higher is going to be very difficult and troublesome. If you do feel that you need to trade this market, I would do so with a very small positions as the volatility is likely to cause massive swings in your profit and loss statement.