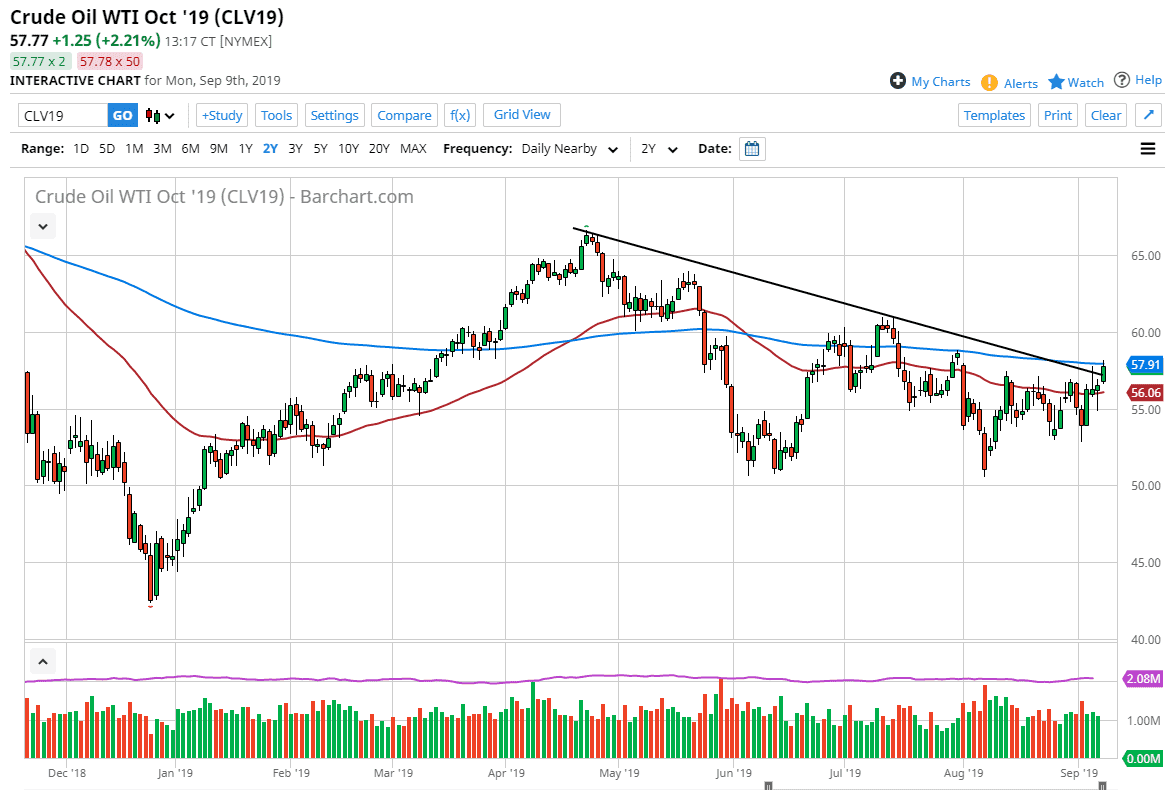

The WTI Crude Oil market broke higher during the trading session on Monday, slicing through the downtrend line that we have seen, and now we are reaching towards the 200 day EMA. At this point, it’s very likely that we will continue to see a little bit of upward pressure, but it’s also necessarily true that the 200 day EMA could offer enough resistance to cause a bit of a pullback. I think what this looks like is volatility just waiting to happen. Because of this, I think that the market participants will continue to have to deal with enormous choppiness.

The global demand picture is something to worry about, but at the same time we have a lot of issues with the Iranians which will have people very cautious about the oil supply and tensions in the Straits of Hormuz. Ultimately, this is a market that is trying to break out to the upside so it’ll be interesting to see if it can hold up. I do like the idea of buying dips though, because I think at this point there is enough order flow just below to keep this market somewhat afloat.

The $60 level above would be the initial target, but as we should continue to see a lot of respect for the large, round, psychologically significant numbers as per usual, and therefore a break above there would probably lead to a more longer-term move. To the downside, the $55 level is the bottom of this overall consolidation but with the reaction that we’ve seen over the last several days, it’s likely that we will continue to see more buying pressure than anything else. That doesn’t mean it’s going to be easy, but it is looking more and more like the buyers are starting to run the position. I think we have a mixed market right now, and that will continue to add to the uncertainty out there.

With all of that being said it’s probably best to keep position size relatively small, because we can get the sudden jumps in one direction or the other, although I do favor the upside at least in the short term. Beyond that, we also have a lot of confusion when it comes to where the US dollar is going, and that of course can have an influence on this market.