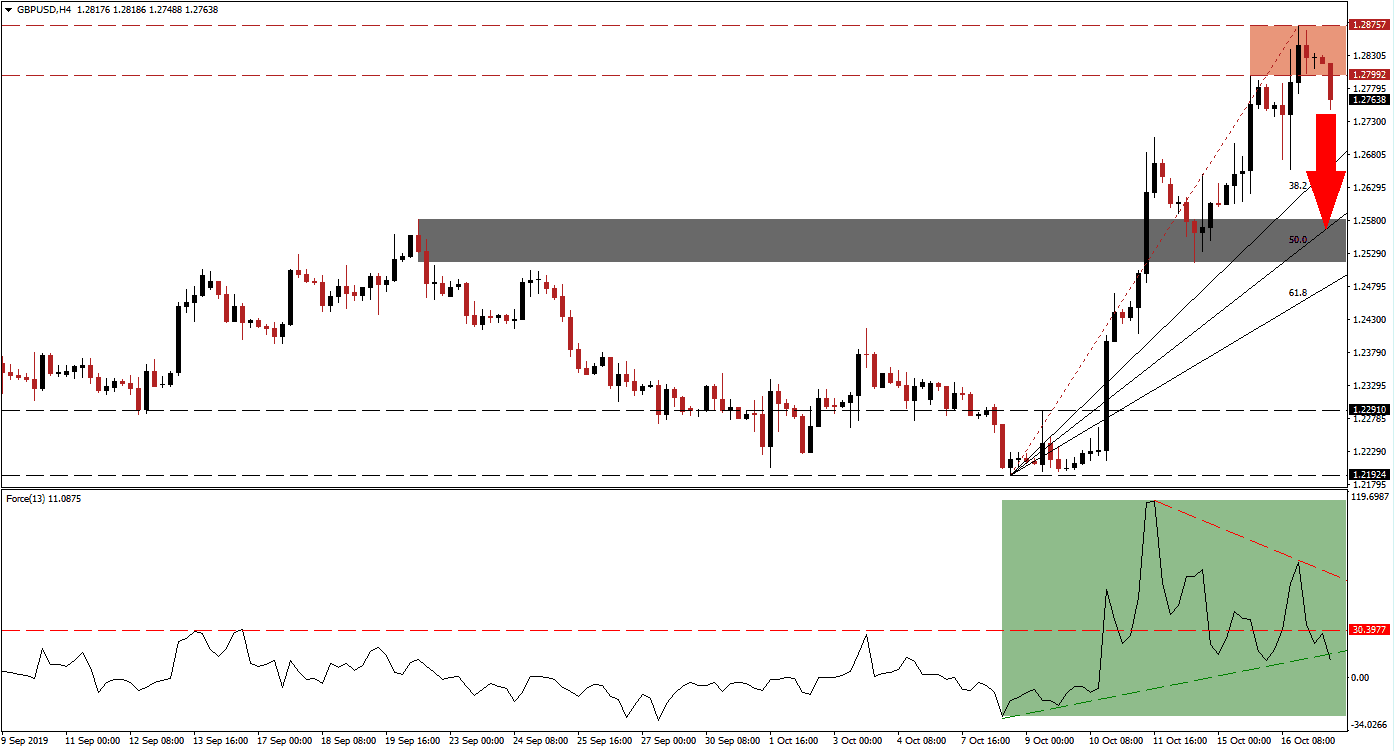

New hurdles have emerged when it comes to a Brexit deal, but sources claim it is very close. The EU Summit begins today and markets are on edge with expectations for a deal by the end of the summit tomorrow slim, but possible. The British Pound surged to multi-month highs as optimism rose sharply this week. The GBP/USD pushed to a new intra-day high of 1.28757 earlier this morning which takes its current advance to almost 700 pips since the rally started from an intra-day low of 1.21924. As the start of the summit approaches, price action completed a breakdown below its resistance zone and bearish momentum is on the rise.

The Force Index, a next generation technical indicator, is flashing a sell signal as a negative divergence formed. This happens when price action advances while the underlying technical indicator contracts. Enforcing the sell signal is the breakdown in the Force Index below its horizontal support level which turned it into resistance and bearish momentum further forced a breakdown below its ascending support level. This is marked by the green rectangle and represents another major bearish development; while this technical indicator remains in positive territory, a push below the 0 center line is expected to follow and place bears in full control of the GBP/USD. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

A steep Fibonacci Retracement Fan sequence emerged as a result of the quick, strong advance which is now vulnerable to a breakdown. Forex traders should monitor the intra-day high of 1.27062 which marks the previous peak of the rally which was reversed to an intra-day low of 1.25157, the bottom range of its next short-term support zone. Following the breakdown below its resistance zone, located between 1.27992 and 1.28757 as marked by the red rectangle, a partial retracement of the advance is likely to follow. This is expected to keep the long-term uptrend healthy and intact, unless a Brexit delay will be the result of the two-day EU summit.

Given the strong rally, a short-term period of profit taking should be expected, especially since the uncertainty surrounding a Brexit deal remains elevated. The next short-term support zone is located between 1.25157 and 1.25812 as marked by the grey rectangle, the 50.0 Fibonacci Retracement Fan Support Level has just pushed above this zone while the 61.8 Fibonacci Retracement Fan Support Level is approaching the bottom range of it. A breakdown below this support zone is currently unlikely as the US is faced with its own range of economic issues with the latest red flag yesterday’s disappointing retail sales data. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

GBP/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.27550

Take Profit @ 1.25750

Stop Loss @ 1.28200

Downside Potential: 200 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 3.08

Even the announcement of a Brexit deal needs to pass UK Parliament and while optimism remains high and number crunching ongoing, it is premature to consider it a done deal. As a result of the sharp rally, the technical picture points towards a short-term corrective phase inside the long-term uptrend. The next resistance zone, following a sustained breakout confirmed by the Force Index, awaits the GBP/USD between 1.29872 and 1.30472; the previous pause in the sell-off of this currency pair.

GBP/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.28850

Take Profit @ 1.30450

Stop Loss @ 1.28150

Upside Potential: 160 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.29