Mid-level trade talks between the US and China are on their way in Washington today which will be followed by high-level negotiations tomorrow. Market participants have essentially ruled out any deal, but expectations for tariff delays are still high. Latest moves out of the US, such as the State Department’s visa restrictions on several government and Communist Party members as well as the black-listing of more Chinese companies, makes any deal unlikely. Despite the negative tone, the AUD/NZD caught a bid at its support zone from where bearish pressures are easing.

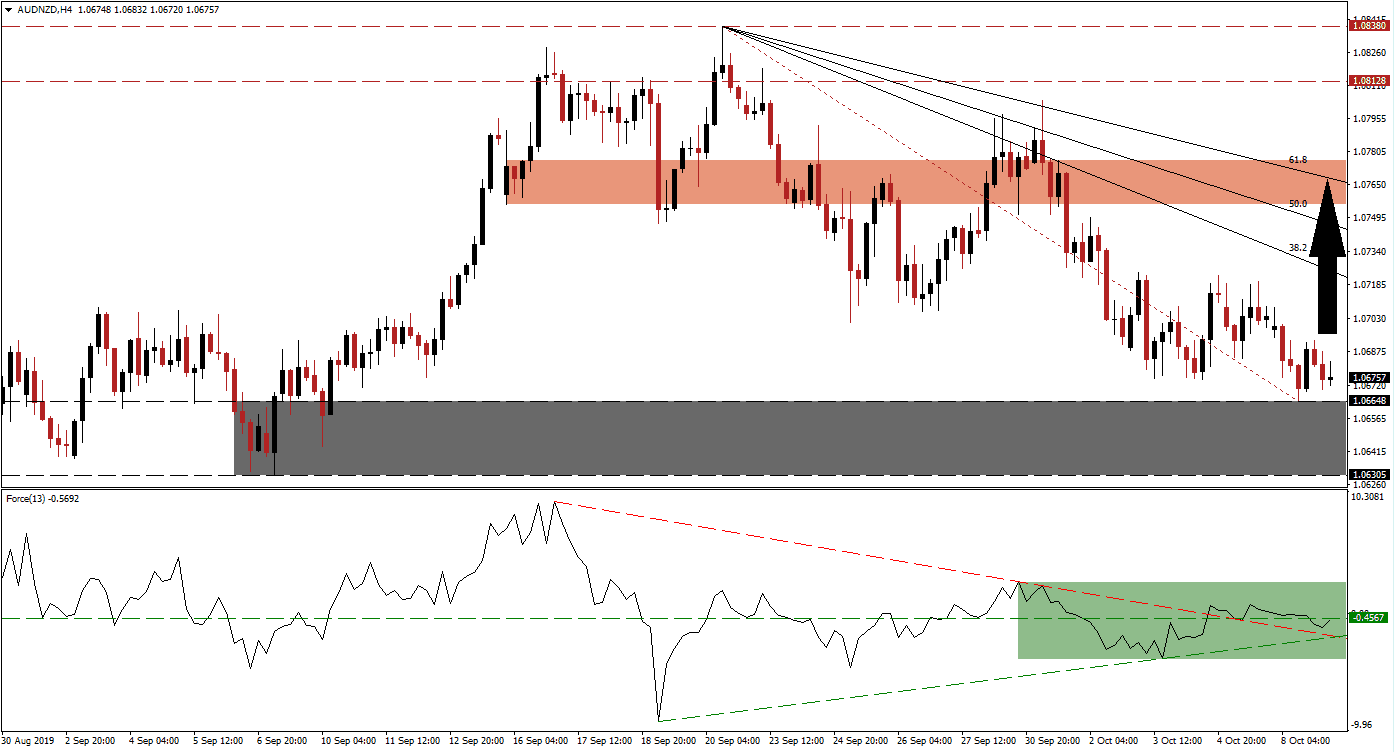

The Force Index, a next generation technical indicator, has formed a positive divergence as this currency pair recorded a higher intra-day low of 1.06648 which marks the top range of its resistance zone. This also resulted in the re-drawing of the Fibonacci Retracement Fan sequence. A positive divergence is a bullish trading signal and forms when price action contract as the underlying technical indicator advances. The Force Index additional pushed above its descending resistance level, turning it into support, and is now in the process of eclipsing its horizontal support level; this is marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bearish pressures started to ease after the AUD/NZD reached its support zone which is located between 1.06305 and 1.06648 as marked by the grey rectangle. Forex traders should now monitor the Force Index as sustained move above its horizontal support level is expected to lead price action back into its 38.2 Fibonacci Retracement Fan Resistance Level. A breakout above the intra-day high of 1.06929, the current high of the bounce off of its support zone, is further expected to increase bullish momentum and result in the addition of new net buy orders.

A price action reversal, partially fueled by a short-covering rally, can take the AUD/NZD through its 38.2 as well as above its 50.0 Fibonacci Retracement Fan Resistance Levels and back into it short-term resistance zone. This zone is located between 1.07556 and 1.07763 as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is currently passing through this zone. This would keep the longer-term downtrend intact and a fundamental catalyst would be required in order to result in a breakout above it. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/NZD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 1.06750

Take Profit @ 1.07650

Stop Loss @ 1.06400

Upside Potential: 90 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.57

Should the outcome of trade negotiations come in much worse than the already low expectations, the AUD/NZD could temporarily pierce below its support zone. The Australian Dollar is the top Chinese Yuan proxy currency and therefore volatility should be accounted for. Australia and New Zealand both depend on the Chinese economy, but given the size of the Australian economy it can weather the slowdown better than its smaller neighbour. This favors a stronger AUD/NZD from a fundamental perspective. The next support zone is located between 1.05309 and 1.05673 which should be viewed as a great buying opportunity.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.06150

Take Profit @ 1.05450

Stop Loss @ 1.06450

Downside Potential: 70 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.33