AUD/JPY: Bearish Pressures Are Easing

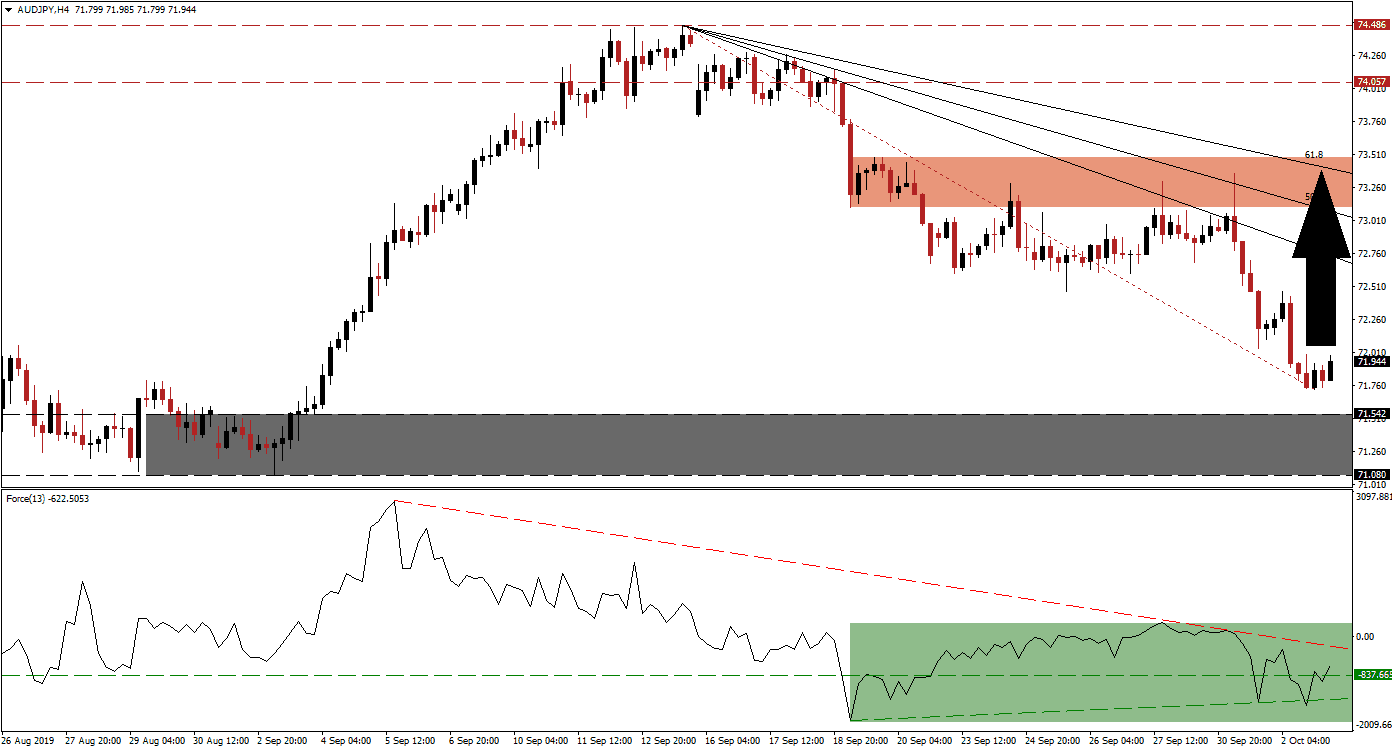

Financial markets started the fourth-quarter with a big sell-off as trade concerns flared up and US manufacturing data plunged to a decade low. This has boosted safe haven demand for assets such as gold and the Japanese Yen. The AUD/JPY accelerated to the downside after being rejected by its short-term resistance zone and moved further away from its Fibonacci Retracement Fan sequence. The contraction paused just above its support zone as bearish pressures started to ease and Australian economic data came in slightly higher than economists forecasted which was enough to halt the sell-off.

The Force Index, a next generation technical indicator, formed a long positive divergence which offered the first indication that the contraction in the AUD/JPY is prone to a price action reversal. A positive divergence materializes when an assets contracts while the technical indicator starts to advance. The Force Index advanced after the emergence of this bullish trading signal and was able to push above its horizontal resistance level, turning it into support. This is marked by the green rectangle and this technical indicator is now approaching its descending resistance level. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

While price action paused after the release of Australian economic data and started to advance, a move into its support zone should not be ruled out. This zone is located between 71.080 and 71.542 which is marked by the grey rectangle. A breakout below it is currently unexpected given the technical scenario supported by short-term fundamentals. Forex traders should monitor the Force Index closely as the AUD/JPY approaches its intra-day low of 72.042 which represents a level from where price action previously paused the sell-off before resuming it to the current intra-day low of 71.726; this level also marks the end of its newly formed Fibonacci Retracement Fan sequence which could extend lower if price action reverses.

A move by the Force Index above its descending resistance level is expected to propel price action into its descending 38.2 Fibonacci Retracement Fan Resistance Level. Bullish momentum may suffice to extend the advance into its short-term resistance zone which is located between 73.112 and 73.492 as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is currently passing through this zone and while the AUD/JPY is expected to reverse higher in the short-term, the long-term downtrend will remain intact. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/JPY Technical Trading Set-Up - Reversal Scenario

Long Entry @ 71.950

Take Profit @ 73.250

Stop Loss @ 71.550

Upside Potential: 130 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 3.25

Should the Force Index fail to push through its descending resistance level and reverse to the downside, a fresh wave of sell orders in the AUD/JPY cold follow. Given the close proximity of price action to its support zone, a breakdown is possible to drive price action further to the downside. The next short-term support zone is located between 69.945 and 70.623 which should be considered a solid long-term entry opportunity.

AUD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 71.000

Take Profit @ 70.350

Stop Loss @ 71.300

Downside Potential: 65 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.17