AUD/USD: Bullish momentum is on the rise

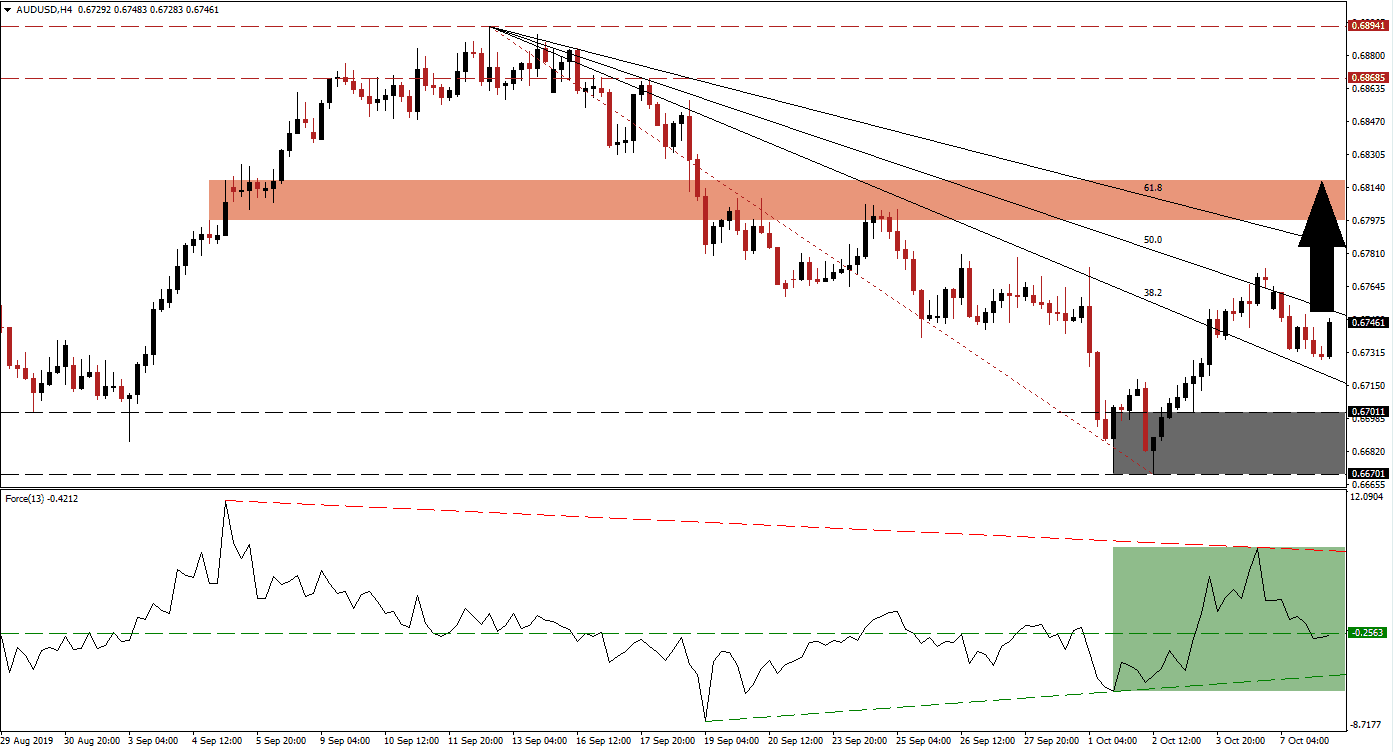

Optimism ahead of high-level US-China trade talks rose during the Asian trading session and overshadowed mixed economic results out of Australia as well as weaker data out China. Australian business confidence decreased to 0, business conditions increased slightly to 2 while the Chinese Services PMI slipped to 51.3. The AUD/USD advanced, but remains trapped between its 38.2 Fibonacci Retracement Fan Support Level and its 50.0 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next generation technical indicator, advanced together with price action as the AUD/USD completed a breakout above its support zone and started to push higher. After this currency pair briefly pierced its 50.0 Fibonacci Retracement Fan Resistance Level before taking a pause, the Force Index contracted while maintaining its bullish bias. This technical indicator remains above its ascending support level and is currently trading just below its horizontal support level as marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Bullish momentum is on the rise after the AUD/USD completed a breakout above its support zone which is located between 0.66701 and 0.67011 as marked by the grey rectangle. The current pause following the breakout above its 38.2 Fibonacci Retracement Fan Resistance Level, turning it into support, is normal and this currency pair is now expected to extend its advance. A move in the Force Index to the upside is likely to lead price action to a push above its descending 50.0 Fibonacci Retracement Fan Resistance Level from where the rally can extend into its next short-term resistance zone.

Forex traders should monitor the intra-day high of 0.67730 which marks the current peak in breakout sequence of the AUD/USD. The next short-term resistance zone is located between 0.67972 and 0.68173 which is marked by the red rectangle. A breakout above this level would require a fundamental catalyst, such as a positive outcome of the US-China trade talks which is highly unlikely. Given the high expectations going into the talks, a disappointing outcome should be considered; especially given the latest rhetoric out of the US. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

AUD/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.67450

Take Profit @ 0.68150

Stop Loss @ 0.67250

Upside Potential: 70 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 3.50

As the trade talks approach, volatility is expected to rise and if the Force Index slides further into negative territory, a price action reversal may follow. The Australian Dollar is the top Chinese Yuan proxy currency and traders may opt to take profits should the technical picture deteriorate. This could push price action back into its support zone which should be considered a great long-term buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.67100

Take Profit @ 0.66750

Stop Loss @ 0.67250

Downside Potential: 35 pips

Upside Risk: 15 pips

Risk/Reward Ratio: 2.33