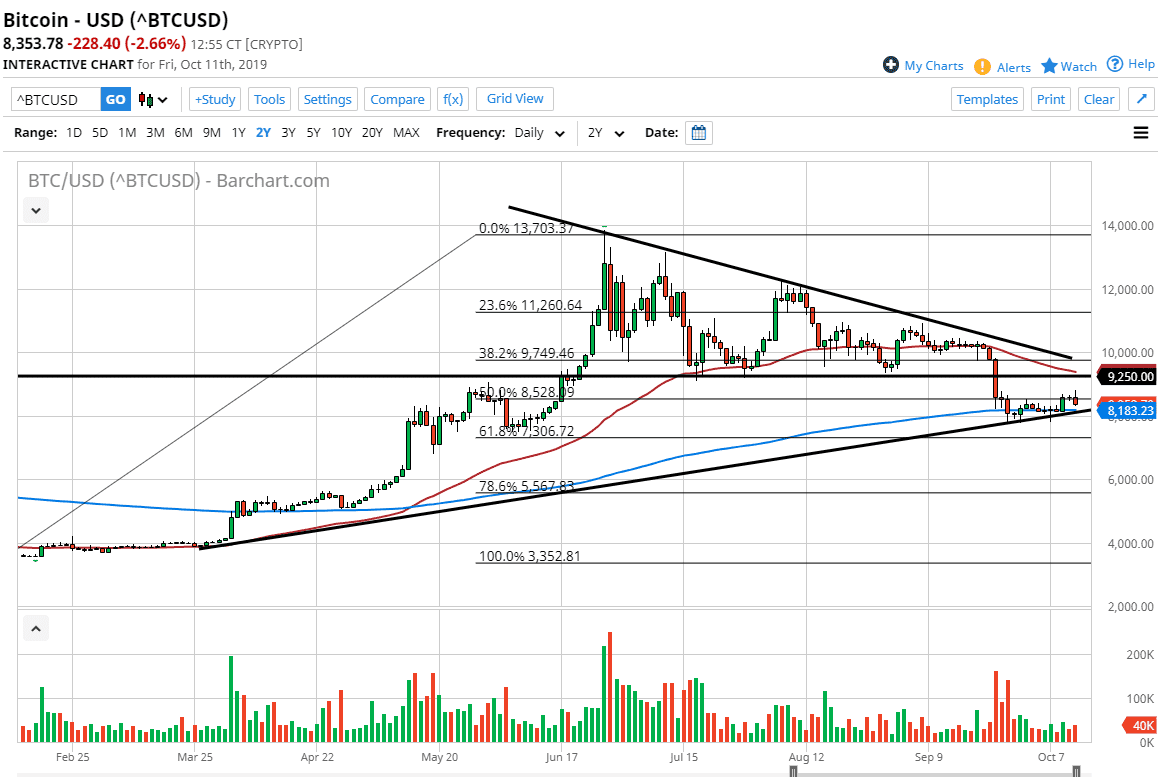

The Bitcoin market try to rally during the trading session on Friday but gave up the gains and rollover back towards the 200 day EMA yet again. The uptrend line underneath offer support, but quite frankly at this point Bitcoin does not look very healthy at all. With that being said, the 200 day EMA and the significant trend line both should offer plenty of support. If that trend line gets broken, I anticipate that the Bitcoin market will unwind quite rapidly.

Ultimately, this is a market that should continue to be fundamentally strong yet isn’t. After all, central banks around the world continue to loosen monetary policy, crashing fiat currencies. However, Bitcoin hasn’t bothered rallying based upon this so it’s obvious that the fundamentals in Bitcoin are starting to change. Perhaps people are starting to pay more attention to the fact that it is not being adopted very widely, or perhaps they are paying attention to the fact that the bullish case for Bitcoin is that it is going to be money. It can’t be money if you can’t find some type of stability in it. After all, one of the biggest complaints about fiat currency is that it loses value over time. Bitcoin has the ability to lose or gain 10% in a single day. There’s no way that can be used in commerce on any massive adoption.

Beyond all of this, the ascending triangle has been broken and it did measure for a move down to $4800. I don’t think that would be much of a surprise after the market simply has not participated in what should have been very good fundamentals for it. With this, I’d be waiting to see if we can break down below the $8000 level but if we do I would fully anticipate that the market breaks down rather quickly at that point. Rallies at this point are to be faded, at least until the 50 day EMA gets broken to the upside, if not the $10,000 level which are very close to each other. I don’t see that happening, at least not without some type of major catalyst, so I still believe that this market drops before it rallies anytime soon. Whether or not we hold of $4800 might be a completely different conversation, but at this point that’s as far as I’m willing to push to the downside.