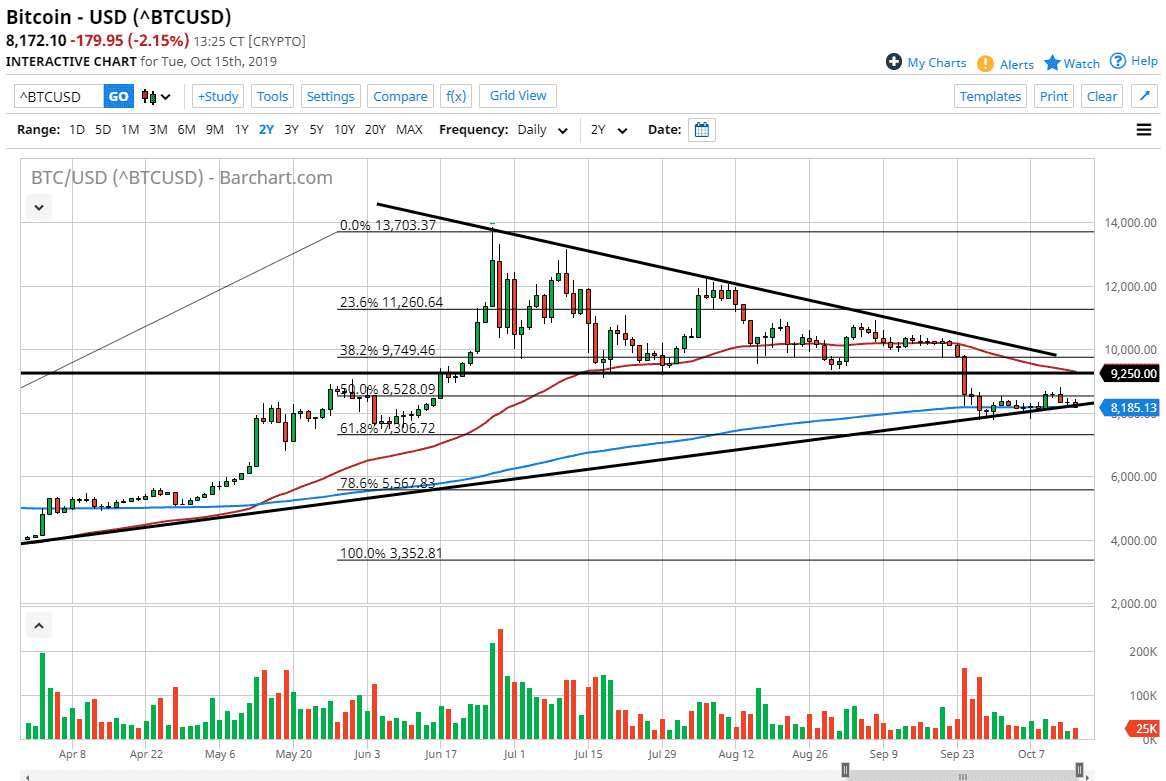

Bitcoin initially tried to rally during the day on Tuesday but then broke down a bit again. We continue to dance around the 200 day EMA which of course will cause quite a bit of noise as it is a longer-term trend signal. Beyond that, we are testing the uptrend line of the larger time frames that I have marked on the chart, and I do think that it’s only a matter time before we break down as we simply can’t lift off. In fact, I have been talking about this for a couple of weeks, and it now looks as if the time is come to make a decision for the sellers.

Looking at the recent action, we have broken the low of a descending triangle, as marked on the chart. Once the market break down below the $9250 level, the market was set up to have a significant amount of momentum to the downside. Based upon the descending triangle, the market should go looking towards the $4800 level, something that gives us plenty of time to still profit from the negativity. In fact, if we can break down below the $8000 level, that will kick off that move.

If we do rally from here I expect the $9250 level to continue to offer resistance, and that will be especially true now that the 50 day EMA is currently parked at that level. Ultimately, if we rally it all I think it’s only a matter time before the sellers come back in and starts to short this market. I think that would be a nice selling opportunity, but ultimately if we did turn around and break above the $10,000 level, then it’s likely that we could continue to go to the upside. That would be a significant change in attitude and could send this market much higher. I do not expect that though.

All things being equal, bitcoin had its opportunity to rally but it didn’t bother. Central banks around the world continue to loosen monetary policy, bitcoin sits still. Now that it is starting to drift lower, it doesn’t take much imagination to see that it will continue to fall. In fact, the $4800 level is a very reasonable target but that doesn’t mean that we are going to get there right away. If bitcoin cannot rally in this environment, I’m not exactly sure when it can.