Bitcoin markets have done very little over the last couple of weeks, as they tend to grind sideways at times. At this point, it’s obvious that there is a need for some type of catalyst for Bitcoin to start moving. The Bitcoin market is essentially flat for the last two weeks, dancing around the 200 day EMA which of course is a crucial technical indicator for longer-term trading. As we are sitting here, it’s very likely that we are going to continue to see a lot of a back-and-forth short-term trading at best.

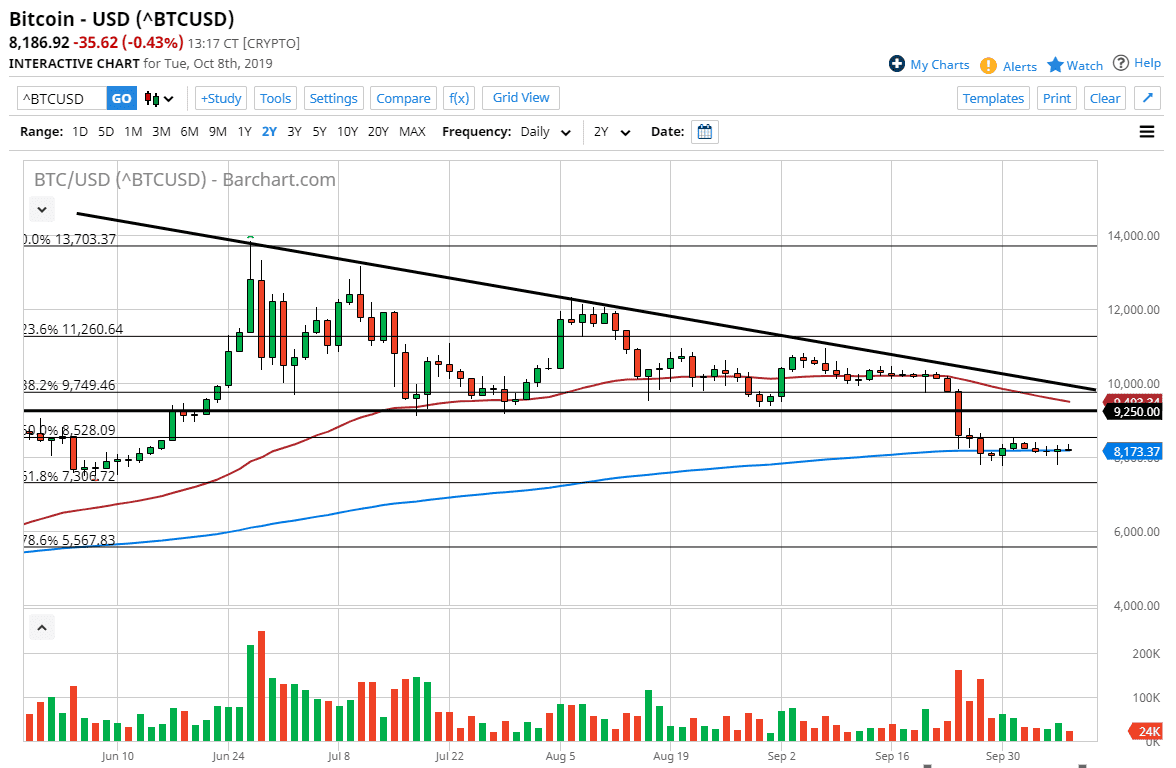

That being said, the market has recently broken below the bottom of a major descending triangle, which signals that we could very well go much lower. Based upon the measurement of the descending triangle, we could go as low as the $4800 level underneath. It doesn’t mean that we need to get there in the short term, but longer-term that would be the outlook for this market. After all, the Bitcoin market has done very little while precious metals have been all over the place reacting to Central Bank meddling when it comes to monetary policy, and of course send the fiat currencies lower. However, Bitcoin has not reacted positively to that major fundamental reason.

To the upside, the $9250 level was the bottom of that descending triangle, so even if we do get a rally from this area, it’s likely that we would see a lot of exhaustion in that area. The 50 day EMA is close to that level as well, so any rally at this point would have to be looked at with suspicion until we can break out above there. That being said, the bottom of the descending triangle has not been tested to make sure it offers resistance, so that could be the initial move. That being said, there’s also the possibility that the market turns around and break down below the hammer from the Monday session, which would break this market down and have it going much lower. Once the market clears the $8000 level to the downside, it could kick off the next leg lower. Currently, it does not look like buying is a possibility, as we would need some type of major catalyst to change the entire attitude. Overall, this is a market that should be sold any chance you get to do so going forward.