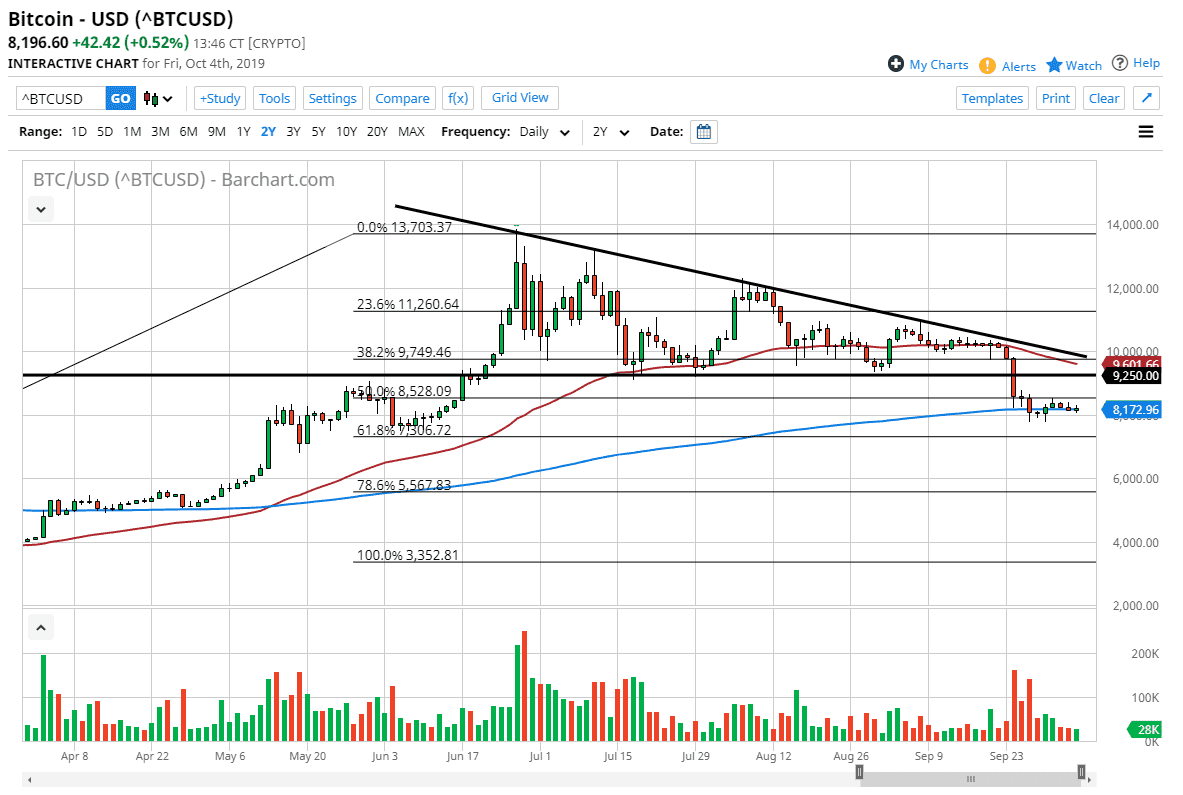

Bitcoin continues to do very little, as the Friday session was quiet as well. The market is essentially sitting at the 200 day EMA as it has done all week. This can’t go on forever, but bitcoin does tend to go very quiet for long periods of time. We have recently seen a major break down, so therefore my base case scenario is that we fall from here, as the descending triangle that was broken still measures for a move down to roughly $4800.

This doesn’t mean that it has to happen quickly or even right away. We could also bounce from here, which would be quite normal in the round of technical analysis as a retest of the $9250 level for resistance is quite common as well. That was the bottom of the descending triangle so therefore one would have to think there is a significant amount of order flow in that area. Ultimately, we could just simply break down from here and if we break the lows of the week, it’s likely that the market will then continue down towards its projected target over the longer-term.

One of the biggest problems that I have with Bitcoin right now is that while central banks around the world continue to ease monetary policy, money is not shifting into the crypto space. It’s not just Bitcoin, it’s most cryptocurrencies that have been suffering when they should in theory be rallying. As central banks continue to print money, that has been one of the biggest arguments to own crypto over the last several years. It turns out that nobody was paying attention to that fundamental reason, so I think we can take that off of the board at this point.

Now that we have broken down through this descending triangle, I suspect that a lot of short-sellers will jump into this market. We did have a bit of a bump early in the year due to Chinese nationals trying to get money out of the country, but that seems to be over and now there’s not much to prop up Bitcoin. Beyond that, adoption isn’t exactly strong in higher economies, and of course the biggest problem is that the market is so volatile that it can’t be used as a reliable means of financial transaction. Think of it this way: you can sell something for $2000 worth of Bitcoin but have that same amount of bitcoin be worth $1400 in just a few days. It simply makes it useless as a currency. This isn’t to say there will be speculation, but that’s all Bitcoin is at this point.