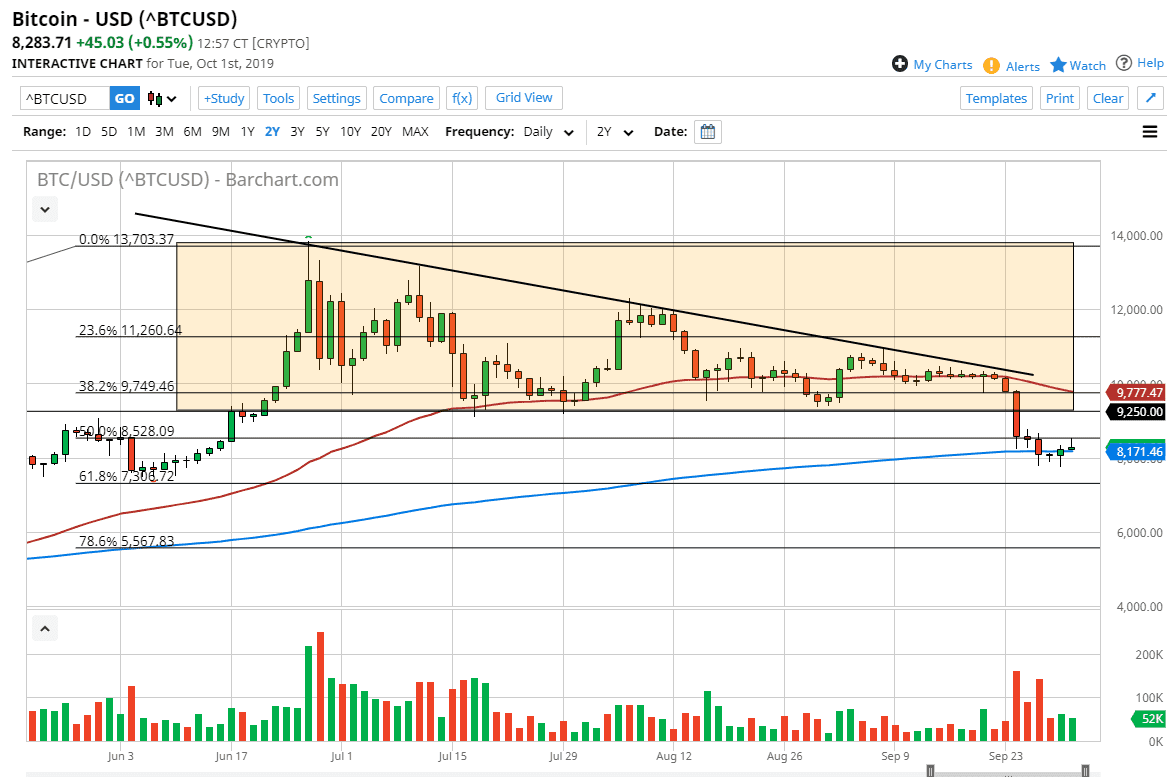

Bitcoin markets initially rallied during the trading session on Tuesday, but then rolled right back over at the top of the short term range that the market had been in. By forming the shooting star at the $8500 level, it looks as if the market is going to struggle to continue going higher. After all, we have made a major break down recently, so it does suggest that we are probably going to continue to drop. However, there are a couple of different reasons to suspect that it’s possible support come into play.

All things being equal, it’s very likely that the market participants will continue to find reasons to sell, because we had recently broken down below the bottom of a massive descending triangle. With that, it should be noted that the last couple of times Bitcoin broke down significantly, it started with this exact same pattern. While history doesn’t necessarily repeat itself, it does typically rhyme and this break down below the $9250 level would have sent off the lot of alarm bells. At this point, the market also has a major downtrend line that offered bearish pressure, and of course the 50 day EMA will as well. Signs of exhaustion continue to attract a lot of attention, and it’s difficult to imagine a scenario where it sticks for the longer-term at this point.

Having said that, the 200 day EMA of course has attracted a lot of attention, and if we were to break down below the bottom of the candle stick for the Monday session, it’s likely that the market would go lower and precipitously so. The measured move from the descending triangle should send the market below the $5000 level. Obviously, a breakdown below that candle stick would be a confirmation of the 200 day EMA being broken down. At this point, the market looks very susceptible to selling pressure, and it’s unlikely that Bitcoin takes off to the upside now, considering how it has struggled while gold has taken off to the upside. With central banks around the world cutting rates and doing forms of quantitative easing, it’s likely that the Bitcoin market should take off, but yet it hasn’t. That being said, it’s likely that the market has simply ran out of steam. Beyond that, monetary flow out of China has slowed down so that of course has worked against Bitcoin as well.