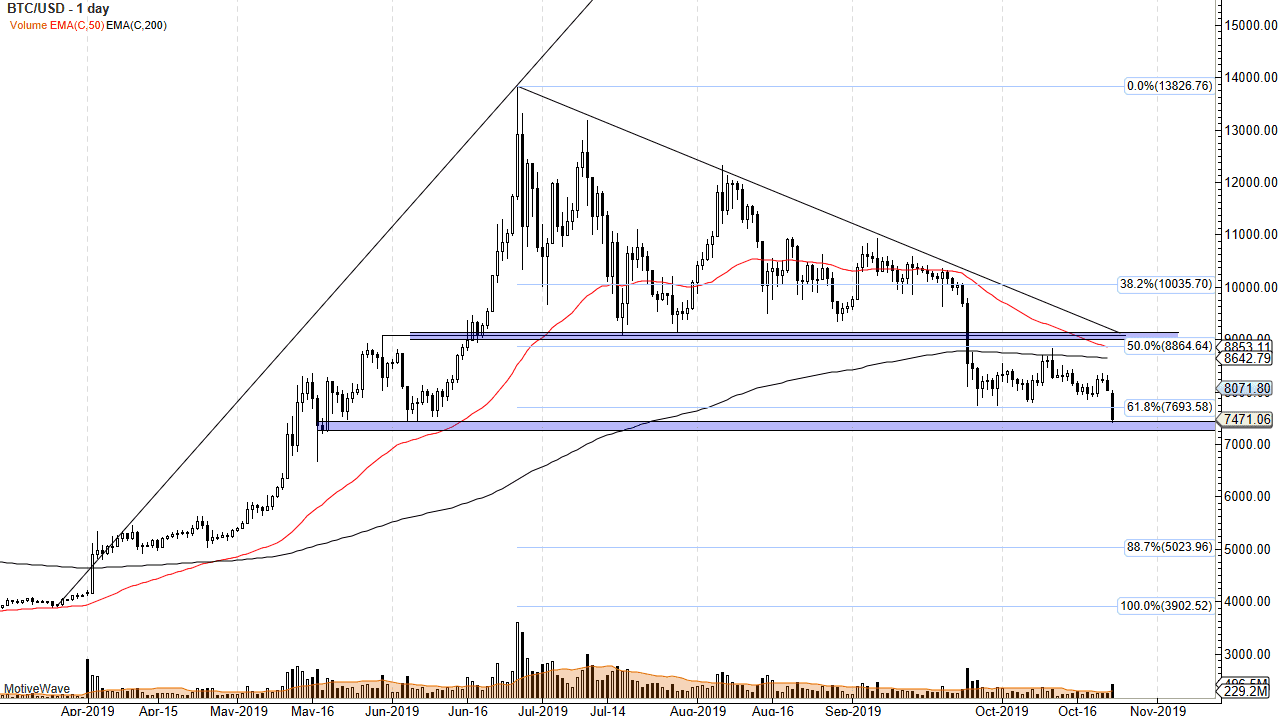

Bitcoin markets fell again during the trading session on Wednesday, as we continue to see a lot of negativity in the crypto markets. Beyond that, the recent support level based around the 61.8% Fibonacci retracement level has been broken, and it now looks as if we are ready to go much lower. Keep in mind that there had been a descending triangle that had been broken, and it does measure for a move down to the $4800 level.

Now that the market is below the 61.8% Fibonacci retracement level, it opens the door all the way down to the 100% Fibonacci retracement level, but ultimately it looks likely that we will at first trying to fulfill that descending triangle measured move. Overall, this is a market that continues to be very noisy and negative, so I like the idea of shorting this market in general as crypto has rolled over drastically. It should also be pointed out that the volume has picked up to the downside, as the Wednesday candlestick breaking through the short-term support on higher than usual volume over the last couple of weeks should send this market lower as well. It shows just how negative Bitcoin is at this point.

Looking at the moving averages, the 200-day EMA is just above the most recent consolidation area, just as the 50-day EMA is trying to break down through it. All things being equal it’s likely that the so-called “death cross” should kick off, and therefore longer-term traders will look at this as a “sell and hold the scenario. At this point, there’s nothing good on this chart, it is very likely that any time it tries to rally, Bitcoin will get sold into, as the US dollar is strong in the Forex world, and even while the central banks around the world have been cutting interest rates and going into quantitative easing, Bitcoin cannot be bothered to participate in the move away from fiat. In fact, this is a market that looks like it’s ready to start picking up downward momentum yet again. You see this repeatedly in the Bitcoin market, where there is a move followed by a couple of weeks of sideways action, followed by another impulsive move. At this point, I would be heavily short Bitcoin as it looks fundamentally broken. A lack of adoption will continue to be a major influence on this market.