Bitcoin markets rallied a bit initially during the trading session on Thursday but found enough resistance near the highs of the last couple of days to roll over yet again. We continue to dance around the 200 day EMA which of course will attract a lot of attention from a longer-term standpoint, but what is more important to pay attention to is that the market seems to be very comfortable dancing around this level.

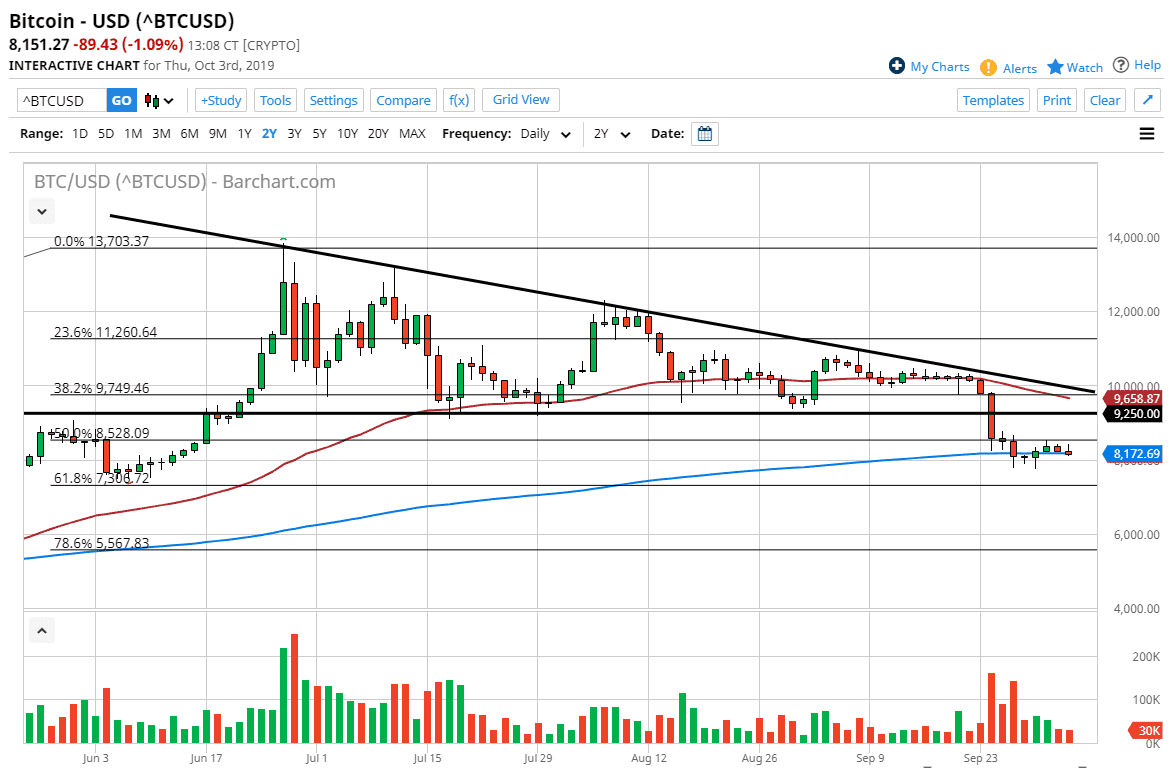

Typically, the market will bounce rather significantly from the 200 day EMA, but the fact that it hasn’t tells me that there isn’t exactly a lot of fear when it comes to hanging about at this lower level. This tells me that the market is likely to continue drifting lower and quite frankly the price action over the last three days does as well. The candle stick for the trading session on Thursday is very bearish looking and it also looks as if the market is starting to rollover in general. Add to that price action to the idea of breaking down below the descending triangle marked on the chart above, and you have what I believe is a relatively bearish market.

As I have been saying here at Daily Forex, the fact that Bitcoin did not rally while other assets did due to central bank softness speaks volumes. Remember, the Bitcoin market should be working overtime to rally against central banks around the world cutting rates and doing more quantitative easing. It’s supposed to be the anti-fiat market and all markets, and it simply been dead over the last couple of months. Because of this, the market looks very likely to continue going lower, as the descending triangle measured for a move to go much lower, perhaps as low as $4800 or so based upon the height.

That being said, if we do rally from here the $9250 level should be rather resistive, as it was significant support previously. The 50 day EMA is just above there as well and that of course could cause a significant amount of resistance also. I should point out even though I bearish of Bitcoin, I don’t necessarily think it is going to be a market that is going to melt down, I just think that a lot of the excitement of owning the asset has left the building. In this environment, I like the idea of shorting this market on short-term time frames.