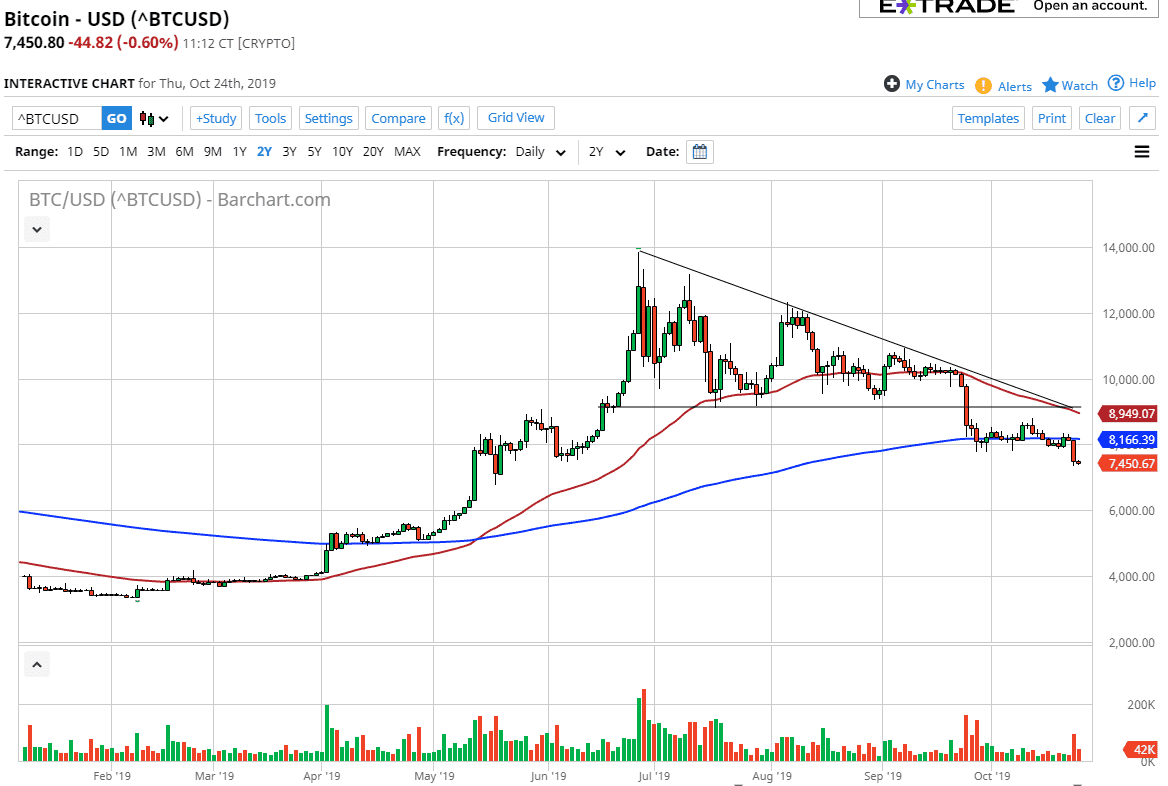

Bitcoin markets have done very little during the trading session on Thursday, as we hover around the $7450 level, and at the bottom of the huge red candle that made up the Wednesday session. We are obviously very soft at this point and it’s likely that although there will probably be some value hunting out there, the reality is that rallies will be sold into going forward. The 200-day EMA just above of course offers a lot of resistance, and therefore signs of exhaustion will be taken advantage of. In fact, there’s really no scenario where buying Bitcoin makes any sense at this point, because we have broken through a massive set of support barriers.

As you can see on the chart, there was a descending triangle that kicked off the move lower, and measures for a potential move down to the $4800 level. We still have some time to go, but it doesn’t necessarily mean that we are going to go straight down, and therefore I think that if you continue to look for opportunities to short, you should take advantage of it. Not only is the 200-day EMA going to offer resistance but the 50-day EMA above there should also offer resistance as a starting to turn lower also. In fact, we are probably going to see the so-called “death cross” in the short term, and as soon as that happens longer-term systems traders will be short of Bitcoin as well. All things being equal, Bitcoin looks like complete death, and it looks likely to go much lower.

If the market were to turn around and break above the $10,000 level, then it will be extraordinarily turn around and obviously the buyers will have recaptured the attitude of the market. That seems to be unlikely, so ultimately, I prefer to look at this from the short side still. Every time we have seen a spike in volume, it has been for a bearish candle. That’s something that you should pay attention to, because it shows exactly how this market feels about Bitcoin. Beyond that, alternate crypto currencies are getting slaughtered at the same time, so crypto looks like something that needs to be shorted and not bought. A lack of adaption and stability continues to plague Bitcoin for any long-term viability. At this point, Bitcoin is going to go lower. I suspect this will last for several weeks, if not months.