The bitcoin markets did very little during the trading session on Thursday, hanging about the $8500 level. What’s particularly interesting about this is that we had seen a bullish candle stick the day before, and simply have just sat still since then. A lot of that bullish candle stick was based upon the idea of an exchange suggesting that institutional interest has doubled. This is a bit interesting considering that institutional investment is exactly what Bitcoin isn’t supposed to be.

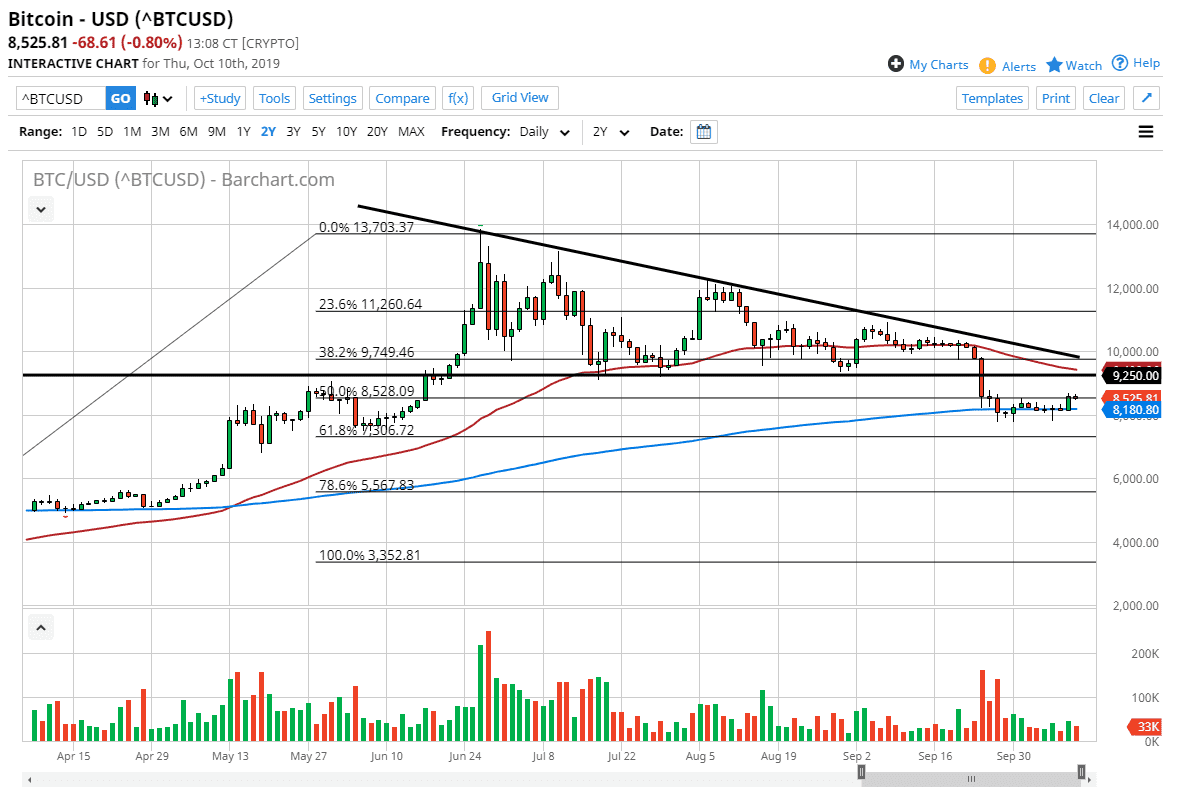

Regardless of any of that, we have recently broken through a major descending triangle. The bottom of that descending triangle was found at the $9250 level, and there was a huge flush at that point. We crashed into the 200 day EMA and simply sat there for a couple of weeks as bitcoin can do. The bullish candle has happened during the Wednesday session, and then Thursday was another quiet day. When I look at the longer-term chart, the 50 day EMA is getting close to the $9250 level, and therefore it suggests that there should be plenty of sellers in general at that area as the previous support should now fight “market memory” an offer a significant amount of resistance.

Ultimately though, if we were to break back down below the 200 day EMA and close below there, that would be a very negative sign. At that point it opens up a potential move based upon the descending triangle of down to the $4800 level. All things being equal I like the idea of fading rallies as they occur, as the market has obviously lost a lot of interest in Bitcoin, and in the environment that we find ourselves and with central banks loosening monetary policy, there’s absolutely no reason to think that Bitcoin should be falling. The fact that it didn’t do anything during that time tells me that Bitcoin is starting to lose it shine.

This doesn’t mean that we can’t rally, but rallies at this point are to be looked at as selling opportunities as the trend has most decidedly started to shift over the last couple of months. That being said though, if we were to break above the $10,000 level, then it could reassert the uptrend but right now that doesn’t look to be very likely to happen based upon what we have seen over the last several months.