Bitcoin has exploded to the upside of the weekend in thin trading as the Chinese President suggested that crypto currency was in fact a viable alternative for transactions. However, it should be kept in mind that this is rhetoric in more of a “anti-US dollar” type of situation. Going forward, the question is whether or not Bitcoin can continue the upward pressure.

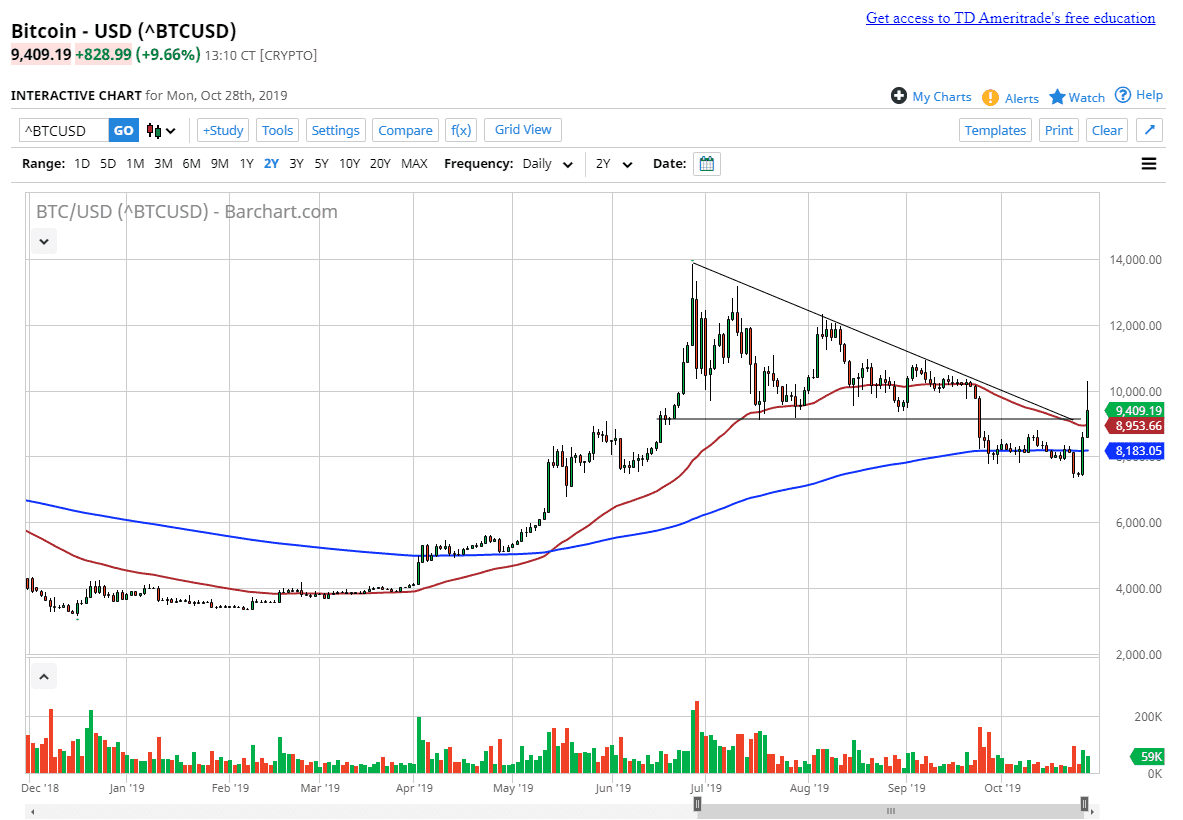

While it certainly has looked bullish over the last 48 hours, the reality is that the $10,000 level is still offering significant resistance, and we have given back quite a bit of the gains. By doing so, it looks like the $10,000 level will in fact be as resistant as I thought it could be, as I have recently stated that if we could close above $10,000, then it is something to pay attention to. While it was explosive in nature, I would draw your attention to the top of the candlestick, which coincides perfectly with the breakdown that led to lower pricing. What this tells me is that there was not enough volume to break through the selling previously, and then I would draw your attention to the volume bars at the bottom of the chart which are most certainly bigger than the several days before, but also much smaller than the breakdown. In other words, I believe that this will probably be faded.

However, one of the things about Bitcoin is that it can suddenly shift its attitude and take off in one direction or another. Because of this, if we do break above the highs of the trading session on Monday and then I have to suggest that the buyers are in fact in control again and the market could go looking towards the $12,000 level. On the other hand, if we close below the 50 day EMA which is painted in red on the chart, it should send this market back down to the $8000 level. One thing is for sure, now that the volume has returned, it will be interesting to see how this plays out. So far, it looks as if we may be struggling to continue to go higher. At the very least I think that there is a pullback coming, but it is at a major inflection point. The last 48 hours of course have been very good, but Monday has seen the market relax a bit. The next day or two should be crucial.