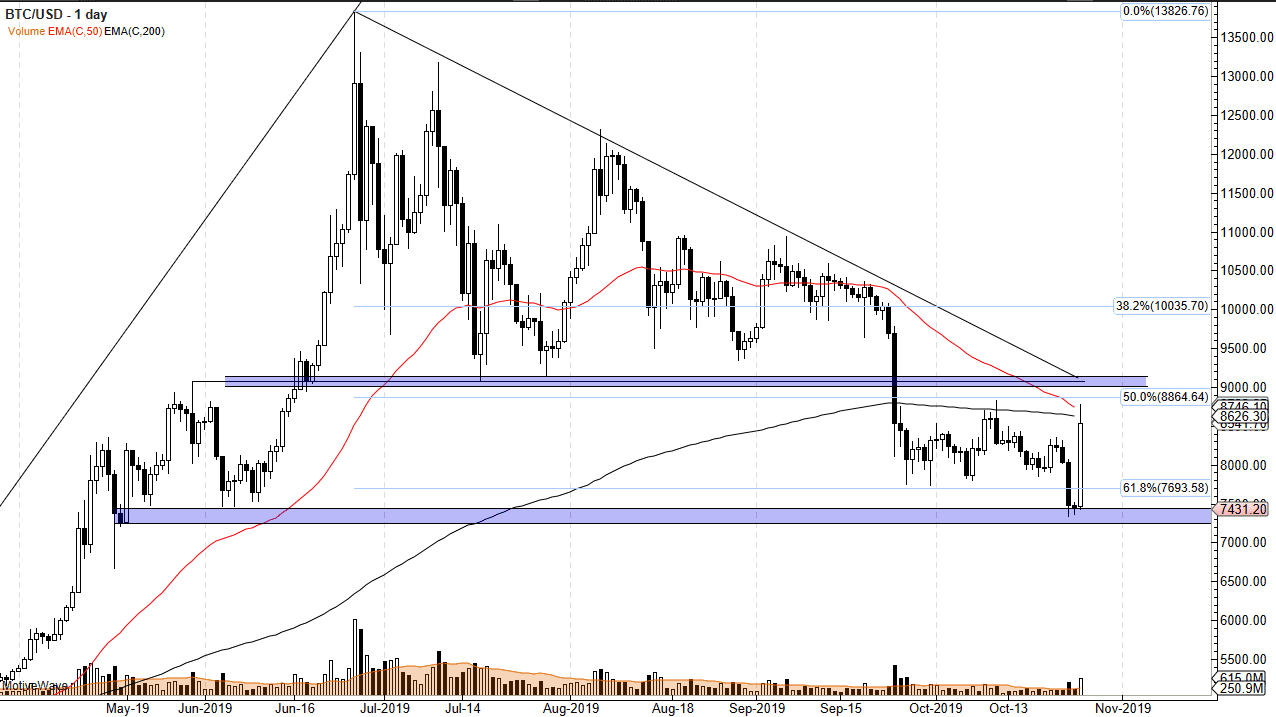

Bitcoin had a very strong session on Friday as we headed into the weekend. The market formed an extraordinarily bullish candlestick, reaching towards the 200-day EMA. This is a very interesting area because the 50-day EMA is more than likely going to cross below the 200-day EMA and that should be a very bearish sign, perhaps kicking off a so-called “death cross”, which is one of the bigger negative technical signals out there. Beyond that, there’s also resistance above at the crucial $9000 level which had previously been very supportive.

All things being equal I’m waiting for some type of exhaustive candle on the daily chart to start recommending selling again, and this is something that I was paying close attention to over the weekend. We are in a downtrend, despite the fact that we have a very bullish candlestick for the day. While it is rather impressive, the market has been rolling over for some time. I suspect it’s only a matter of time before exhaustion comes in, especially near the $9000 handle as it is a large, round, psychologically significant figure and of course the scene of the downtrend line from the descending triangle that broke down.

Based upon the measured move, we should be moving towards the $4800 level after the breakdown of the descending triangle. This doesn’t mean that we get there overnight though, so don’t be surprised at all at this balance and several others along the way. If we do see a move above the $10,000 level though, that would reverse the entire situation. Until then I suspect that it’s only a matter of time before rollover because Bitcoin couldn’t pick it speed up when the rest of the world was shunning fiat currency. Gold was rallying, and Bitcoin was going nowhere.

There is a huge concern about adoption, because Bitcoin simply isn’t being used on a regular basis. It’s a purely speculative market, based upon the idea of widespread adoption. However, until it stabilizes in value, it won’t be used on a widespread basis. In other words, the “hot money” entering into this market is the exact thing that’s going to make sure that it doesn’t last, or at least for anything more than what it is now, pure speculative action. While this isn’t necessarily a bad thing, it’s not going to be the next money that people use on a regular basis.