Bitcoin markets did very little during trading on Monday, but in all fairness it was Columbus Day in the United States. This could have had a certain amount of influence on volume, but volume has been a bit anemic in the cryptocurrency markets for some time. At this point, it’s likely that volume probably wouldn’t help anyway, because there’s no reason for Bitcoin to take off at this point considering that in theory it should have quite some time ago.

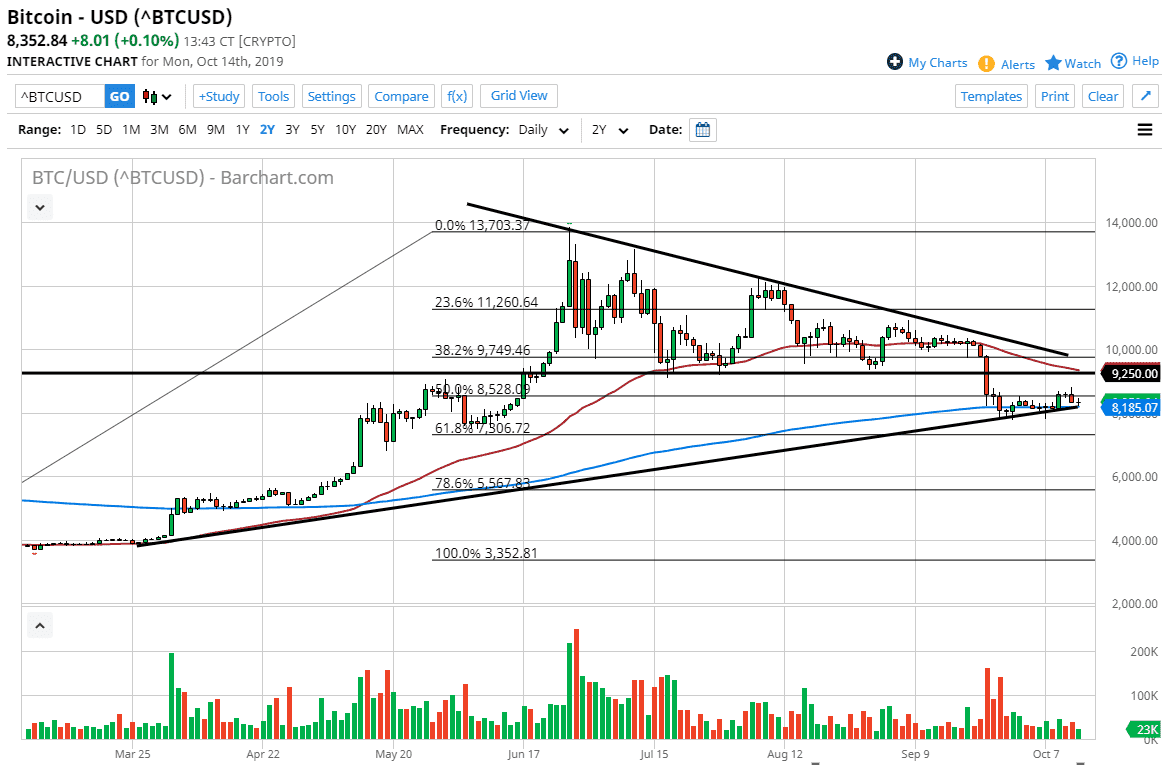

Looking at the chart, we have been walking across the top of a trend line from several months ago. Beyond that, the 200 day EMA is also crucial, and it is something that we should pay attention to as longer-term traders will use it as a way to determine the trend. Beyond that, the EMA is somewhat flat, so it looks as if the longer-term trend is starting to lose some steam as well. Beyond that, it should be noted that the market, although not breaking down - simply hasn’t picked up any momentum as well, something that this market thrives on.

As the central banks around the world continue to cut interest rates and liquefy the markets, that loose monetary policy should continue to drive money into alternate assets and away from fiat currency. This is where bitcoin has failed: it has failed to capitalize on that very fact. In fact, that is a bit scary to say the least, as if Bitcoin cannot take advantage of this situation, then it’s very unlikely that the Bitcoin market is going to take off in the opposite scenario as well. This is exactly where Bitcoin should be gaining, but the fact that it isn’t speaks volume.

To the upside, even if we do rally the 50 day EMA now approaches the $9250 level, which was the bottom of the descending triangle that kicked off the selling pressure. That should cause a turnaround, so at the first signs of exhaustion I’d be a seller if we get an exhaustive candle in that range. Ultimately, if we simply slice through the uptrend line, then it’s likely that we will continue the overall descending triangle momentum, and the measured move suggests that we could go to the $4800 level given enough time. Obviously, there is a lot of noise between here and there but as we can see, bitcoin looks soft.