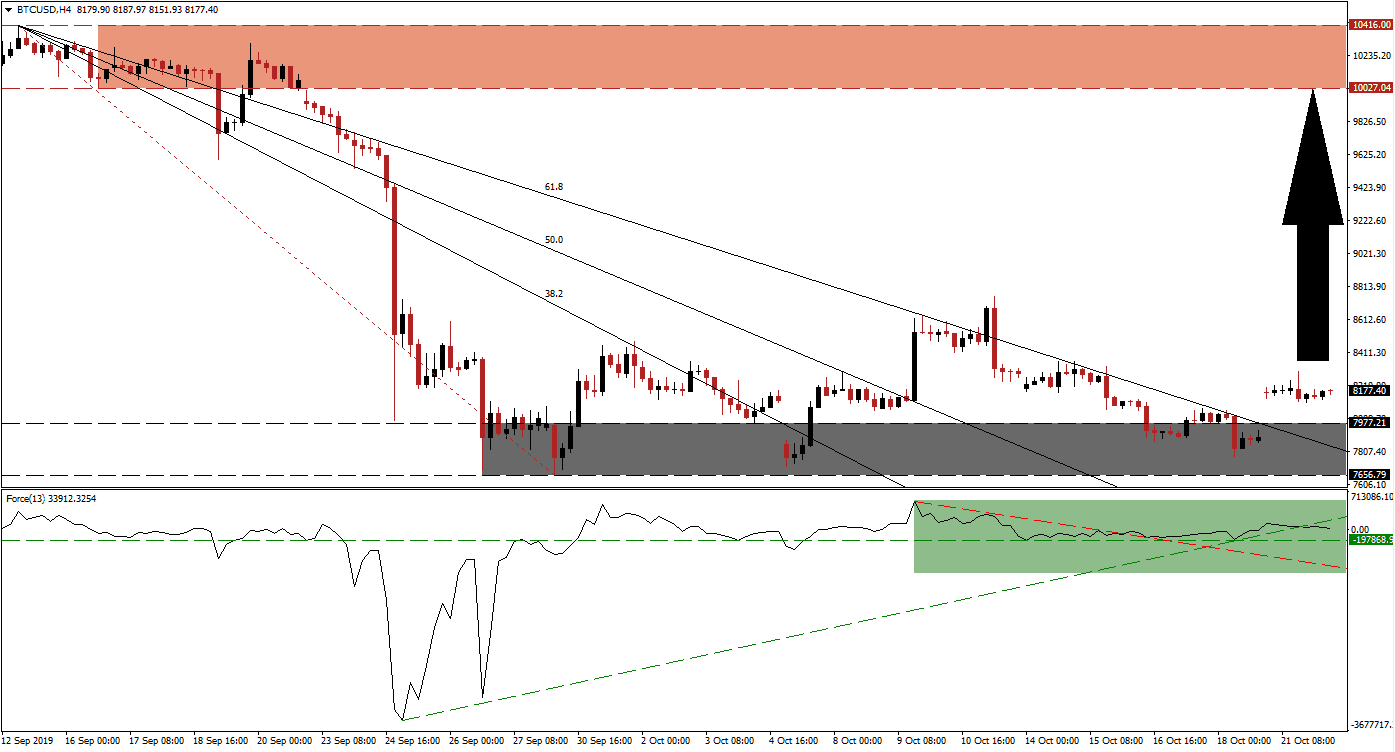

Bearish momentum has been depleted since BTC/USD dropped below the 8K mark. This cryptocurrency pair attempted several breakout above 8K which were all reversed, but each reversal created a higher low which led to a higher high. This bullish development resulted in a price gap to the upside which elevated price action above its support zone as well as above its descending 61.8 Fibonacci Retracement Fan Resistance Level, turning it into support. Given the preceding violent sell-off below 10K, there is no meaningful resistance until the sell-off is retraced.

The Force Index, a next generation technical indicator, initially formed a positive divergence which ended the sell-off in BTC/USD at an intra-day low of 7,656.79; this represent the bottom range of its support zone. A positive divergence forms when price action contracts while the underlying technical indicator rises. After the emergence of the positive divergence, the Force Index advanced and completed a breakout above its horizontal resistance level which turned it into support. A sideways trend emerged which allowed this technical indicator to move above its descending resistance level, but also below its ascending support level as marked by the green rectangle. The Force Index remains in positive conditions above its horizontal support level which indicates that bulls remain in control. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Following the price gap to the upside which lifted price action above its support zone, located between 7,656.79 and 7,977.21 as marked by the grey rectangle, bullish pressures are on the rise. Traders should watch for a breakout in the Force Index above its ascending support level, which temporarily acts as weak resistance; a sustained breakout is likely to increase buying pressure in BTC/USD. Another key level to monitor is the intra-day high of 8,756.48 which marks the high since the sell-off ended and also the last resistance level in the way of price action to advance back into the 10K level.

While a reversal into the top range of the resistance zone cannot be ruled out, it would present traders a great buying opportunity in this cryptocurrency pair. Given the lack of major resistance levels, BTC/USD should have a clear shot into its next resistance zone which is located between 10,027.04 and 10,416.00 as marked by the red rectangle. Further upside is unlikely unless a fresh fundamental catalyst emerges or the 10K level will attract long-term buyers to Bitcoin as scarcity is slowly playing an increasing role with only roughly three million Bitcoin left for mining. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

BTC/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 8,175.00

Take Profit @ 10,160.00

Stop Loss @ 7,750.00

Upside Potential: 198,500 pips

Downside Risk: 42,500 pips

Risk/Reward Ratio: 4.67

In case of a breakdown in the Force Index below its horizontal support level, followed by a breakdown in price action below its 61.8 Fibonacci Retracement Fan Support Level, BTC/USD may be forced into a breakdown below its support zone. This could reignite selling pressure and take this cryptocurrency pair into its next support zone which is located between 6,550.99 and 6,818.05; it would also close a previous price gap to the upside. Any contraction into this zone should be considered an excellent long-term buying opportunity for BTC/USD.

BTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 7,600.00

Take Profit @ 6,820.00

Stop Loss @ 7,950.00

Downside Potential: 78,000 pips

Upside Risk: 35,000 pips

Risk/Reward Ratio: 2.23