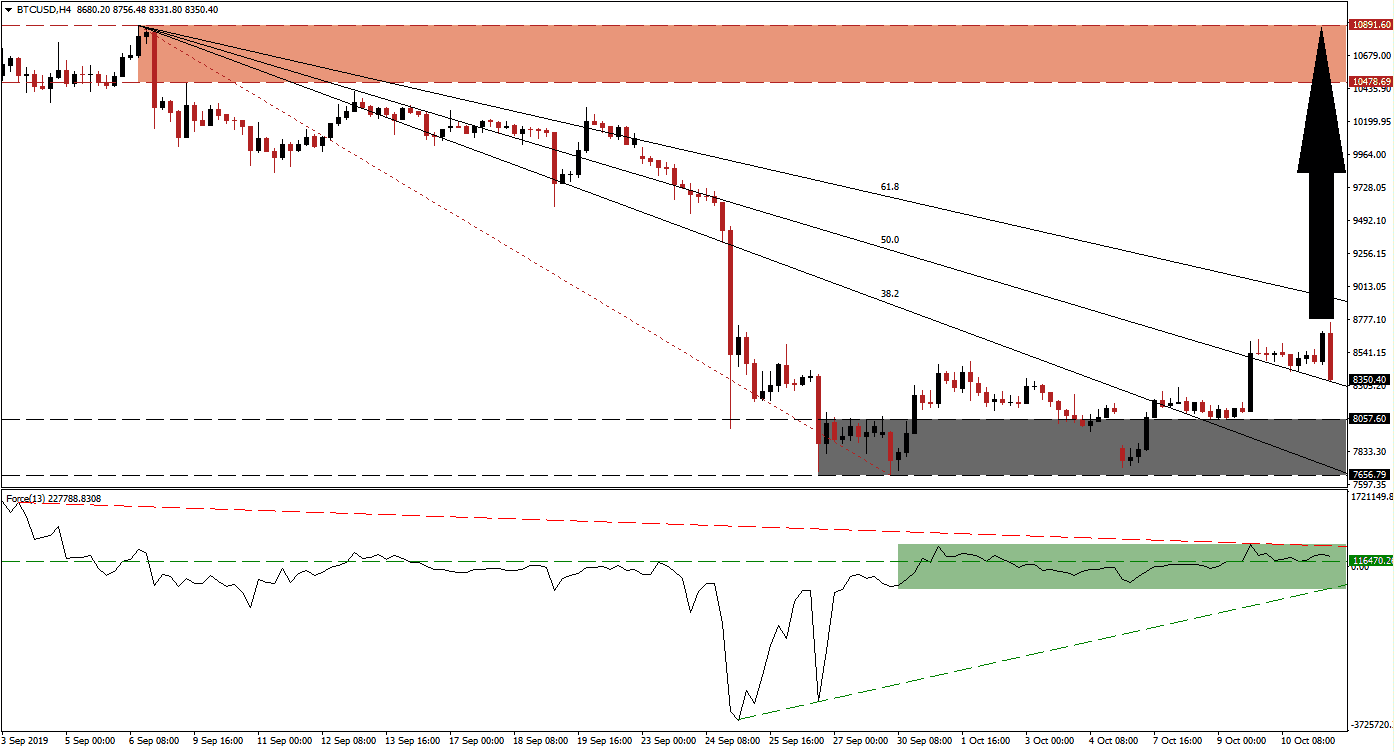

After a breakout sequence which took BTC/USD out of its support zone and above its 38.2 as well as 50.0 Fibonacci Retracement Fan Resistance Levels, turning them into support, price action quickly reversed. There was no immediate reason behind the sudden plunge, nothing unusual in the cryptocurrency sector, but support held and the bullish uptrend remains intact. This cryptocurrency pair is facing a major resistance level in the descending 61.8 Fibonacci Retracement Fan Resistance Level from where a breakout would clear the path to the upside and back above the 10,000 level.

The Force Index, a next generation technical indicator, remained above its horizontal support level and its ascending support level is closing in. The descending resistance level is also approaching and closing the gap the horizontal support level which is expected to pressure the Force Index into either a breakout or a breakdown. This technical indicator remains in positive territory as marked by the green rectangle. The overall rise in bullish momentum is expected to result in a breakout above its descending resistance level which is likely to lead BTC/USD to the upside. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Downside potential in BTC/USD remains limited to its support zone which is located between 7,656.79 and 8,057.60 as marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level is currently passing through this zone with the 50.0 Fibonacci Retracement Fan Support Level nearing the top range of this zone. The series of higher highs and higher lows suggests that more upside is possible and as long as the Force Index remains above its ascending support level, price action should be able to extend further to the upside. One potential catalysts for the sudden sell-off may have been the SEC’s rejection of the Bitwise Bitcoin ETF on the grounds of market manipulation in the cryptocurrency sector.

Forex traders should now carefully monitor price action at the descending 50.0 Fibonacci Retracement Fan Support Level, especially if the current surge in sell orders will push BTC/USD below it. The key level to keep in mind is the intra-day low of 8,065.28 which marks the last higher low before the most recent advance. This level is located just above its support zone and a sustained move below it would invalidate the current uptrend. Should the Force Index push above its descending resistance level, this cryptocurrency pair should be able to complete a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level and accelerate into its resistance zone which is located between 10,478.69 and 10,891.60 as marked by the red rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

BTC/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 8,370.00

Take Profit @ 10,540.00

Stop Loss @ 7,750.00

Upside Potential: 217,000 pips

Downside Risk: 62,000 pips

Risk/Reward Ratio: 3.50

A confirmed breakdown in price action below the 8,065.28 level by a breakdown in the Force Index below its ascending support level could lead to more downside in BTC/USD. This may result in a breakdown below its support zone and close a previous price gap. The next support zone is located between 6,818.05 and 7,308.00 which should be consider a great long-term buying opportunity.

BTC/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 7,600.00

Take Profit @ 7,000.00

Stop Loss @ 7,900.00

Downside Potential: 60,000 pips

Upside Risk: 30,000 pips

Risk/Reward Ratio: 2.00