CAD/CHF: More upside to follow breakout

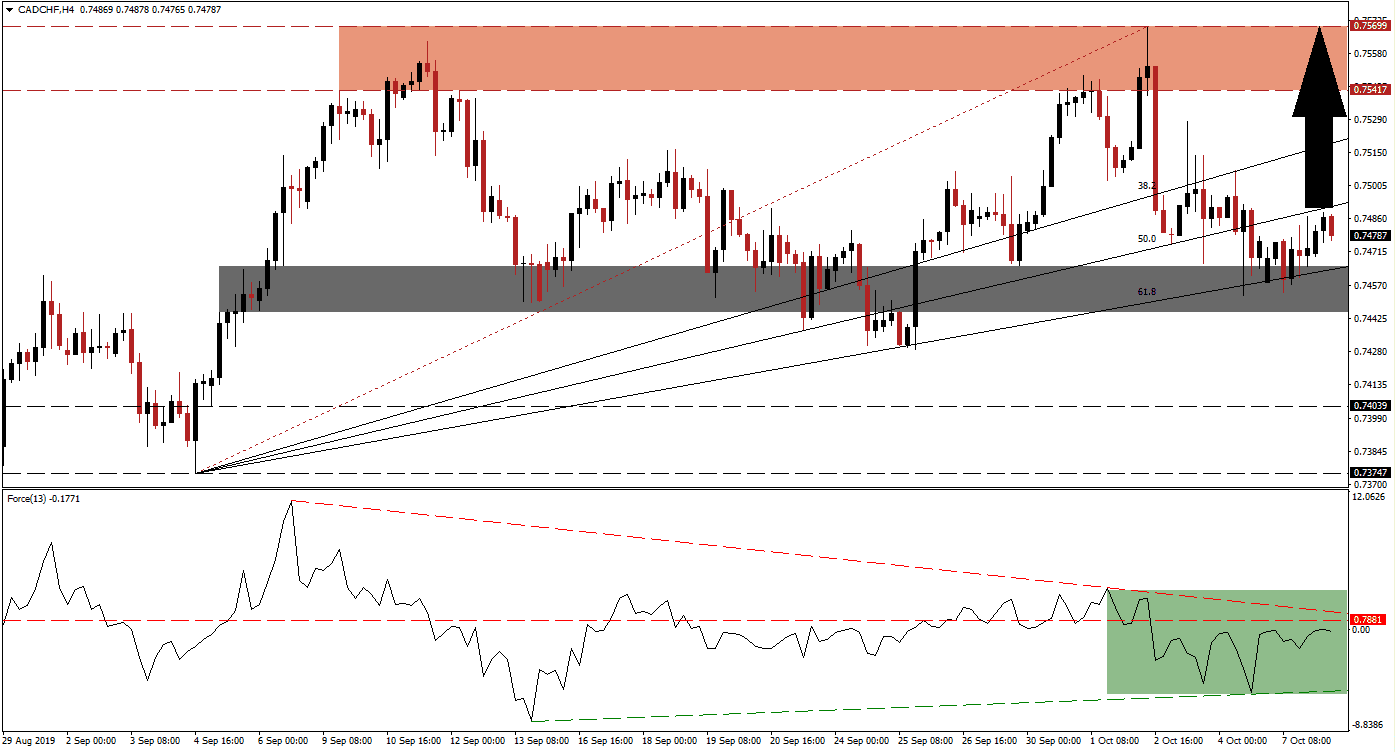

Following yesterday’s Canadian leaders debate in English, the Canadian Dollar was able to drift higher which pushed the CAD/CHF off of its short-term support zone, which is enforced by the 61.8 Fibonacci Retracement Fan Support Level, into its 50.0 Fibonacci Retracement Fan Resistance Level. The ascending 61.8 Fibonacci Retracement Fan Support Level has previously halted a sell-off and gave birth to the most recent advance in price action which resulted in a higher high; this formed the top range of the resistance zone.

The Force Index, a next generation technical indicator, remains in negative territory below its horizontal resistance level. Its descending resistance level is also closing in which increases bearish pressures, but the Force Index remains well above its ascending support level. This is marked by the green rectangle in the chart. A breakout above the double resistance level is likely to materialize as the Swiss Franc is under an increase in selling pressure as a result of today’s risk-on mood; the Swiss Franc is considered a safe haven currency which performs better during risk-off sessions. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Price action may reverse back into its 61.8 Fibonacci Retracement Fan Support Level before attempting a fresh breakout which could also challenge its short-term support zone. This zone is located between 0.74450 and 0.74653 as marked by the grey rectangle. Forex traders should keep an eye out for the intra-day high of 0.74920. This level marks the high of a volatile trading period which dropped the CAD/CHF from above its 50.0 Fibonacci Retracement Fan Support Level to below its 61.8 Fibonacci Retracement Fan Support Level, before reversing and closing just below its 50.0 Fibonacci Retracement Fan Support Level; this turned it into resistance.

This currency pair should be able to accelerate back into its resistance zone which is located between 0.75417 and 0.75699 as marked by the red rectangle. A breakout in the Force Index is required for the CAD/CHF to push further to the upside. Oil prices have supported the Canadian Dollar since the attacks on two key Saudi Arabian oil facilities last month, but election uncertainty has kept bullish momentum in check. The Swiss economy has stuttered after a period of relative strength as compared to other developed economies, this fundamental combination is expected to support price action to the upside over the short-term. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

CAD/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.74750

Take Profit @ 0.75650

Stop Loss @ 0.74450

Upside Potential: 90 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.00

Should double resistance in the Force Index hold, the CAD/CHF may be pressured into a retreat. Forex traders should then monitor the intra-day low of 0.74288 which marks the low of the previous contraction into its 61.8 Fibonacci Retracement Fan Support Level. A breakdown can take this currency pair into its next support zone which is located between 0.73747 and 0.74039. Any move into this zone should be considered a good, long-term buying opportunity.

CAD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.74200

Take Profit @ 0.73800

Stop Loss @ 0.74400

Downside Potential: 40 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.00