Safe haven currencies tend to outperform peers during risk-off trading sessions and as uncertainty surrounding fundamental events is elevated. The Swiss Franc and the Japanese Yen are both considered safe haven currencies, with the Japanese Yen the top choice. As the global economy appears to slide closer to a recession, demand for save haven assets is expected to increase. The CHF/JPY has been under bearish pressures after the Swiss economy showed signs of weakness and the Fibonacci Retracement Fan has kept a lid on any short-term reversals.

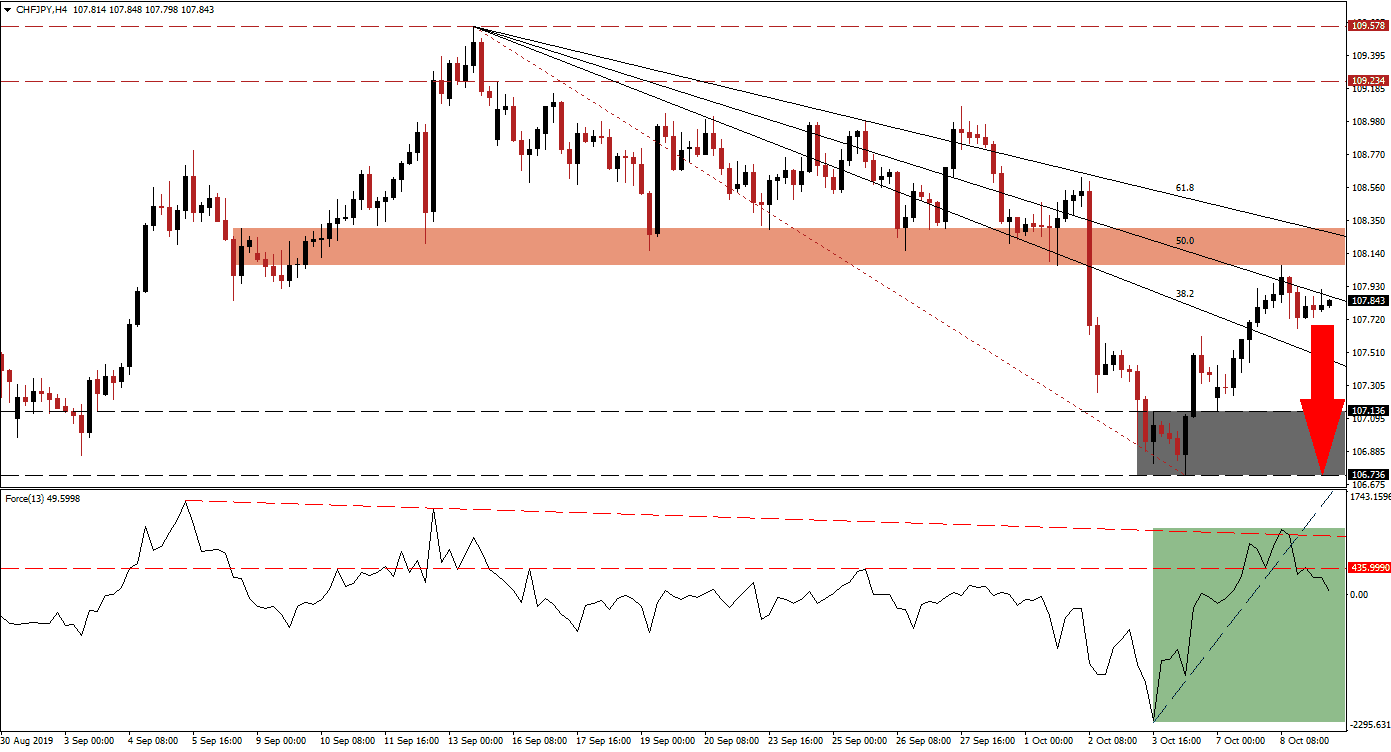

The Force Index, a next generation technical indicator, is now once again pointing towards more downside in this currency pair as price action recovered from its support zone into its descending 50.0 Fibonacci Retracement Fan Resistance Level. Bearish momentum is on the rise which could pressure the CHF/JPY to the downside. A brief spike above its 50.0 Fibonacci Retracement Fan Resistance Level took price action to the bottom range of its short-term resistance zone, before reversing; at the same time the Force Index contracted from its shallow, descending resistance level and below its steep, ascending support level. Bearish pressures resulted in a breakdown of this technical indicator below its horizontal support level, turning it into resistance as marked by the green rectangle. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

More downside should follow the breakdown in the Force Index. The short-term resistance zone, located between 108.065 and 108.300 as marked by the red rectangle, is additionally strengthened by the descending 61.8 Fibonacci Retracement Fan Resistance Level which is currently located inside this zone. While the CHF/JPY may temporarily extend its advance into this zone, a breakout is unlikely given the current fundamental picture which will keep the long-term downtrend alive. Forex traders should monitor the intra-day low of 107.664 which represents the low of the current reversal from the short-term resistance zone, a move below this level is likely to increase selling pressure in this currency pair.

The next support zone is located between 106.736 and 107.139 as marked by the grey rectangle. While the Japanese Yen has strengthened as a risk-off mood started with the fourth-quarter, the Bank of Japan has warned markets that it won’t tolerate the Japanese Yen to drop to levels which will significantly hurt its exporters. The Bank of Japan and the Swiss National Bank are both known to intervene in the markets which limits the breakdown risk in the CHF/JPY below its support zone, unless a major fundamental catalyst emerges. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

CHF/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 107.900

Take Profit @ 106.750

Stop Loss @ 108.350

Downside Potential: 115 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.56

While a breakout above its short-term resistance zone is highly unlikely given the fundamental picture, unexpected events can flare up. A positive fundamental catalyst would be required to break the downtrend in the CHF/JPY, such as a trade deal announced this week between the US and China. The chances of this have been eroded to zero. A potential breakout above its short-term resistance zone as well as above its 61.8 Fibonacci Retracement Fan Resistance Level will clear the path into its next long-term resistance zone which is located between 109.234 and 109.578.

CHF/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 108.650

Take Profit @ 109.400

Stop Loss @ 108.300

Upside Potential: 75 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.14