ETH/USD: More downside on the horizon

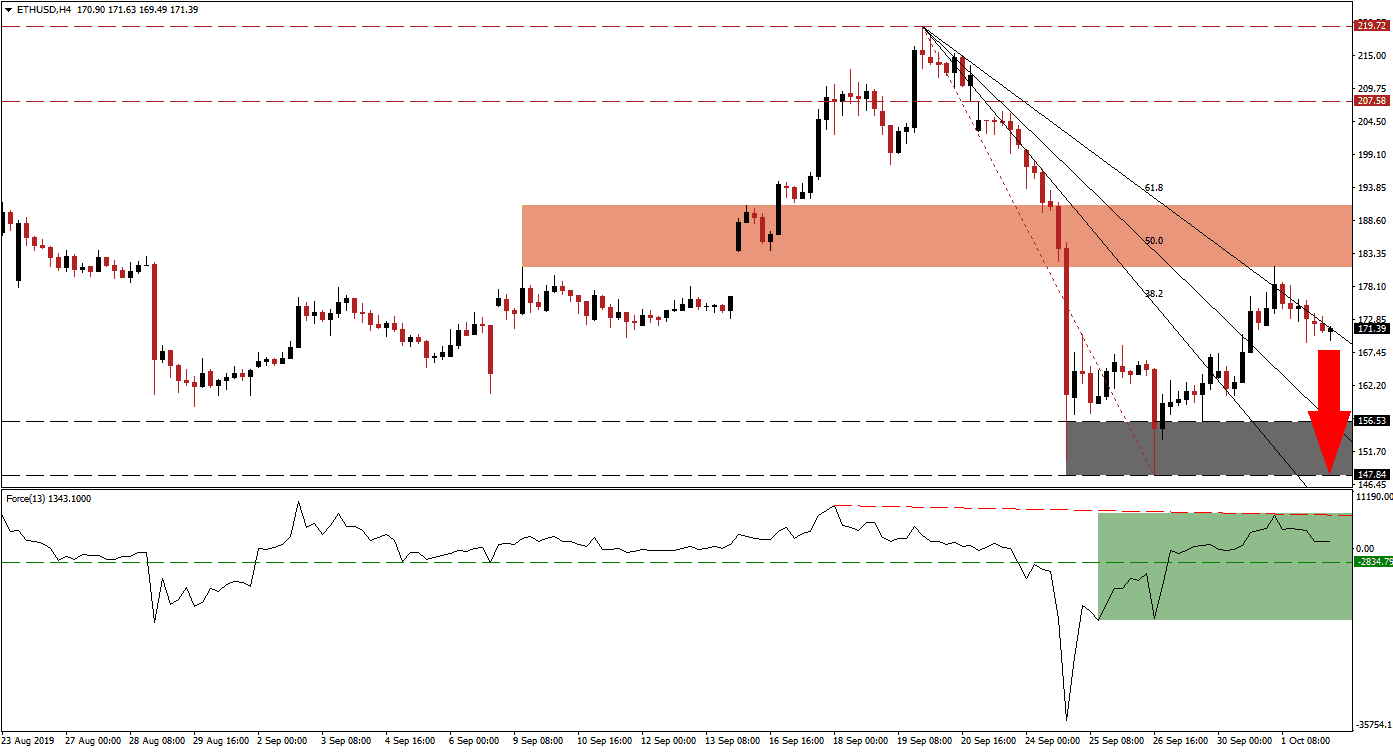

Volatility in cryptocurrency markets has returned, led by Bitcoin’s price plunge following its hashrate flash crash. Ethereum was able to bounce higher after reaching its support zone which led to a breakout through its steep Fibonacci Retracement Fan sequence until ETH/USD reached its 61.8 Fibonacci Retracement Fan Resistance Level. Price action briefly spiked above this level and recorded an intra-day high of 181.20, which took it to the bottom range of its short-term resistance zone, before retracing to the downside along its 61.8 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next generation technical indicator, started to decline which confirms the loss in bullish momentum. A shallow descending resistance level formed as a result which is narrowing the gap to the horizontal support level. The Force Index is currently trading inside this closing gap as marked by the green rectangle. A breakdown below its horizontal support level, turning it into resistance, is expected to lead to a spike in selling pressure which will pressure ETH/USD back into its support zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Following the reversal of the bottom range of its short-term resistance zone, located between 181.15 and 190.97 as marked by the red rectangle, bullish momentum faded quickly. Forex traders should now monitor the intra-day low of 169.14 which marks the low of the current reversal. ETH/USD is trading close to this level and a move below could trigger the next series of sell-orders which can push price action into its 50.0 Fibonacci Retracement Fan Support Level, currently passing through its support zone; the 38.2 Fibonacci Retracement Fan Support Level already move below it.

The next support zone is located between 147.84 and 156.53 as marked by the grey rectangle, it also marks the end point of the current Fibonacci Retracement Fan sequence. Ethereum has been struggling since the Crypto Winter of 2018 as it faces plenty of technological issues while smaller competitors are creating solutions which attract real world applications. This is slowly taking market share away from Ethereum, still the number two cryptocurrency behind Bitcoin measured in market capitalization. A breakdown below its current support zone is not expected unless a fundamental catalyst will drive ETH/USD lower or if Bitcoin will extend its contraction, dragging down most of its peers with it. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

ETH/USD Technical Trading Set-Up - Reversal Extension Scenario

Short Entry @ 172.50

Take Profit @ 148.00

Stop Loss @ 182.00

Downside Potential: 2,450 pips

Upside Risk: 950 pips

Risk/Reward Ratio: 2.58

A reversal in the Force Index and a breakout above its descending resistance level could lead to a price spike in ETH/USD. This can take price action above its short-term resistance zone and into its next long-term resistance zone which is located between 207.58 and 219.72. Given the current fundamental picture in Ethereum, any breakout into this zone should be viewed as a good short selling opportunity as the long-term outlook for ETH/USD remains bearish.

ETH/USD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 195.00

Take Profit @ 212.00

Stop Loss @ 186.75

Upside Potential: 1,700 pips

Downside Risk: 825 pips

Risk/Reward Ratio: 2.06